Briefing

Bank of New York Mellon (BNY Mellon) has released a strategic projection validating a structural shift in institutional finance, forecasting the market for Digital Cash Equivalents → stablecoins, tokenized deposits, and tokenized money market funds (MMFs) → to reach $3.6 trillion by 2030. This adoption signal is driven by the imperative for real-time settlement and enhanced collateral mobility, fundamentally altering how major institutions manage liquidity and counterparty risk. The primary consequence is the displacement of traditional, slow-moving cash management practices with programmable digital assets that enable instant margin posting and continuous operational efficiency. The most critical metric underscoring this transition is the projected $3.6 trillion market size, with stablecoins alone expected to account for $1.5 trillion of that total.

Context

The traditional institutional cash management and collateral posting process is characterized by significant capital inefficiency and systemic friction, often relying on T+2 or T+3 settlement cycles for large-value transfers. This prevailing operational challenge forces institutions to lock up substantial capital as pre-funded collateral or buffer liquidity to mitigate settlement failure risk, especially in derivatives and cross-border transactions. The resulting lack of real-time visibility and high intermediary costs create a persistent drag on capital efficiency, requiring complex, manual reconciliation processes and exposing counterparties to unnecessary risk during multi-day clearing windows.

Analysis

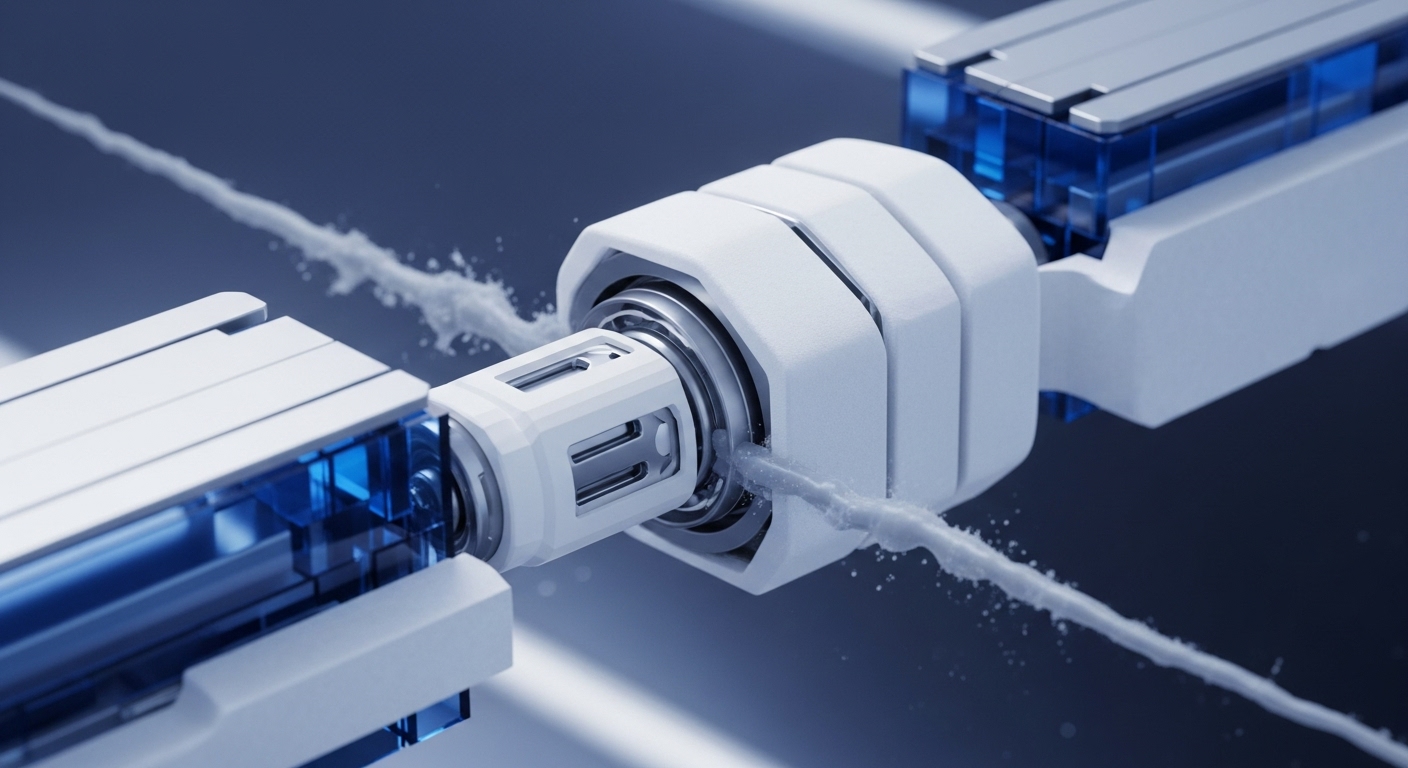

The adoption of tokenized cash directly alters the operational mechanics of treasury management and collateral systems by introducing an instantaneous, atomic settlement layer. Tokenized deposits and MMFs transform traditionally static assets into programmable instruments that can be moved and posted as margin in seconds, not days. The chain of cause and effect is direct → tokenization creates a single, shared ledger of ownership and value, eliminating the need for reconciliation and drastically reducing counterparty risk. For the enterprise, this translates into a superior capital efficiency model, as less liquidity is trapped in the settlement pipeline.

For partners, the shared ledger infrastructure establishes a new, trust-minimized environment for value exchange, enabling new business models such as 24/7, instant derivatives margin calls for pension funds and other institutional actors. This integration is significant because it shifts the financial system from a batch-processed, gross settlement model to a continuous, real-time net settlement framework.

Parameters

- Forecasting Institution → BNY Mellon (Bank of New York Mellon)

- Projected Market Value (2030) → $3.6 Trillion

- Asset Classes → Stablecoins, Tokenized Deposits, Tokenized Money Market Funds

- Primary Use Case → Institutional Cash and Collateral Management

- Key Operational Benefit → Real-Time (T+0) Settlement and Liquidity Control

Outlook

The forward-looking perspective centers on the full integration of these Digital Cash Equivalents into core enterprise resource planning (ERP) and treasury systems, moving beyond bespoke pilot programs. The next phase will be defined by regulatory harmonization, particularly the establishment of clear global standards that support the cross-jurisdictional transfer of these tokenized assets. This structural adoption establishes a new industry standard for institutional liquidity, creating a second-order effect where competitors must rapidly deploy similar tokenization strategies to maintain competitive parity in capital efficiency. The ultimate outcome is the creation of a global, always-on, programmable financial infrastructure that significantly reduces the cost of capital.