Briefing

Banco Inter, in collaboration with the Central Bank of Brazil (BCB) and the Hong Kong Monetary Authority (HKMA), has successfully executed the first blockchain-based international trade finance settlement, validating a critical cross-chain architecture for global commerce. This initiative’s primary consequence is the creation of a new, inclusive marketplace for small and medium-sized enterprises (SMEs), allowing them to participate in international trade by leveraging instant, automated settlement and reducing the prohibitive costs of legacy correspondent banking. The project’s success was predicated on Chainlink’s interoperability protocol, which securely connected Brazil’s Drex network with Hong Kong’s Ensemble DLT system, orchestrating the simultaneous, atomic exchange of tokenized payments and digital titles.

Context

Traditional international trade settlement is characterized by multi-day delays, high counterparty risk, and a reliance on fragmented, paper-based documentation like Bills of Lading (BLs). The prevailing operational challenge is the lack of simultaneous exchange (Delivery-versus-Payment or DvP) between the physical asset title and the cross-border payment, forcing reliance on trusted, high-cost intermediaries and long reconciliation cycles. This structural inefficiency particularly marginalizes SMEs due to the high capital lockup and complexity required to manage global transactions, hindering their access to international markets.

Analysis

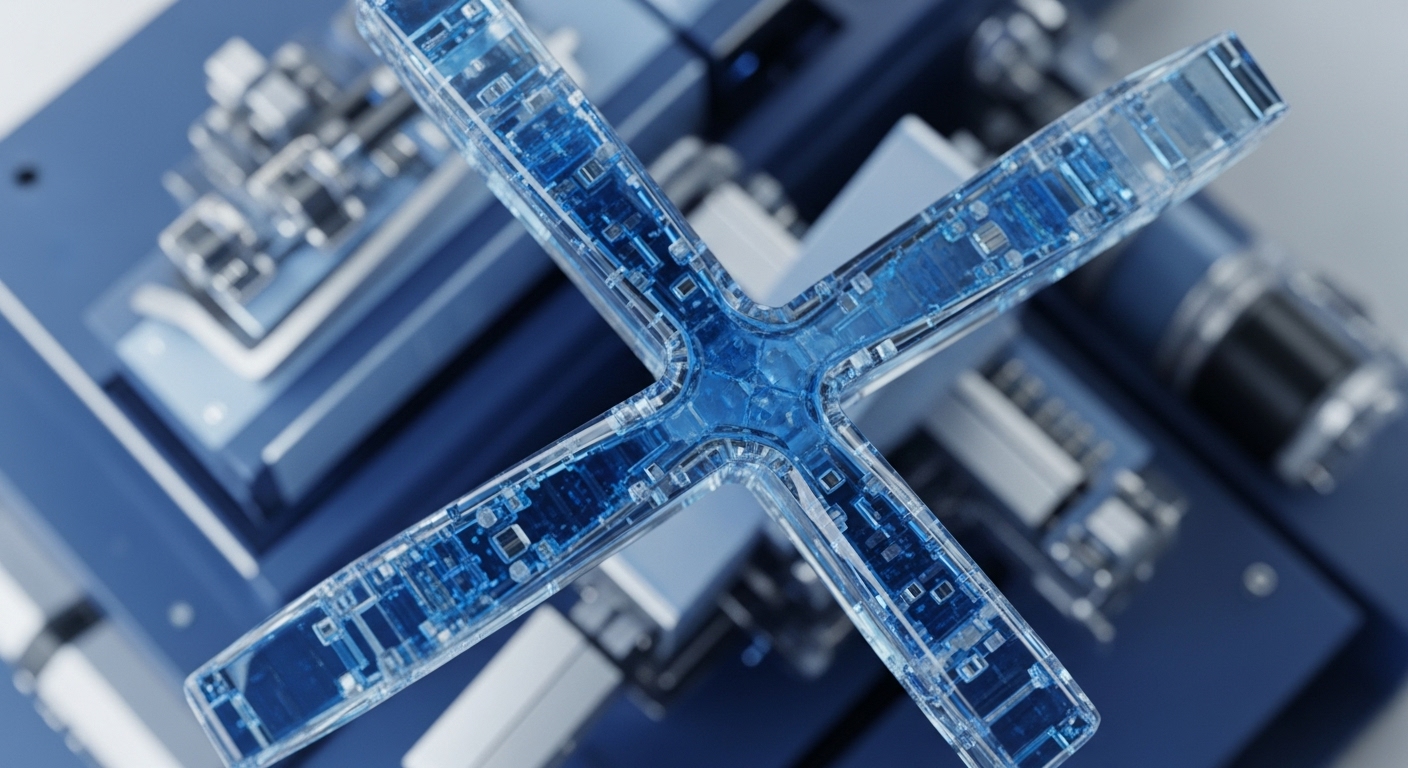

This adoption fundamentally alters the cross-border trade finance system by introducing an atomic Delivery-versus-Payment (DvP) mechanism for tokenized assets. The solution integrates a digital title registry (GSBN’s eBL) with the DLT-based payment rails (Drex and Ensemble) via Chainlink’s interoperability protocol. The cause-and-effect chain is clear → the protocol acts as a secure, decentralized bridge, enabling a smart contract to trigger the release of the tokenized payment only when the digital title transfer is immutably recorded. For the enterprise and its partners, this systemic shift eliminates settlement risk, drastically cuts the capital cycle time from days to minutes, and embeds compliance directly into the transaction logic, setting a new benchmark for secure, instant, and capital-efficient global trade.

Parameters

- Lead Commercial Institution → Banco Inter

- Interoperability Protocol → Chainlink

- DLT Networks Connected → Brazil’s Drex and Hong Kong’s Ensemble

- Use Case Category → Cross-Border Trade Finance Settlement

- Core Operational Mechanism → Atomic Delivery-versus-Payment (DvP)

Outlook

The immediate next phase involves expanding the solution to open account trade and integrating the platform directly with financial institutions via APIs, moving from a proof-of-concept to a production-ready utility. The second-order effect will be the establishment of a new industry standard for cross-chain DvP, pressuring incumbent correspondent banking networks to accelerate their own DLT integrations. This successful pilot validates the hybrid architecture model, proving that regulated central bank DLTs can securely interoperate with external data and payment layers, thereby establishing a blueprint for global financial market infrastructure modernization.

Verdict

This successful, cross-jurisdictional DvP execution marks a definitive strategic shift from DLT experimentation to the creation of a unified, compliant, and production-ready global settlement layer for tokenized commerce.