Briefing

Broadridge’s Distributed Ledger Repo (DLR) platform has successfully transitioned from pilot phase to systemic market infrastructure, fundamentally altering the operational mechanics of the global repurchase agreement market. This integration establishes a new paradigm for institutional funding by replacing legacy, batch-processed settlement with atomic, near-real-time transactions, consequently driving significant improvements in capital utilization and counterparty risk management for participating banks and brokers. The platform’s rapid scaling validates the business case for private DLT in core financial services, evidenced by the August 2025 transaction volume surpassing $280 billion in average daily repo transactions, a more than six-fold increase year-over-year.

Context

The traditional repurchase agreement process was characterized by fragmentation and latency, relying on manual reconciliation, multiple intermediaries (tri-party agents), and end-of-day batch settlement cycles (T+1 or T+2). This operational lag necessitated financial institutions to lock up significant amounts of capital as collateral buffers to manage counterparty risk and settlement failure potential, resulting in suboptimal balance sheet utilization and reduced overall market liquidity. The systemic challenge was a lack of a single, shared source of truth for collateral status and ownership, which inhibited the real-time movement and reuse of high-quality liquid assets.

Analysis

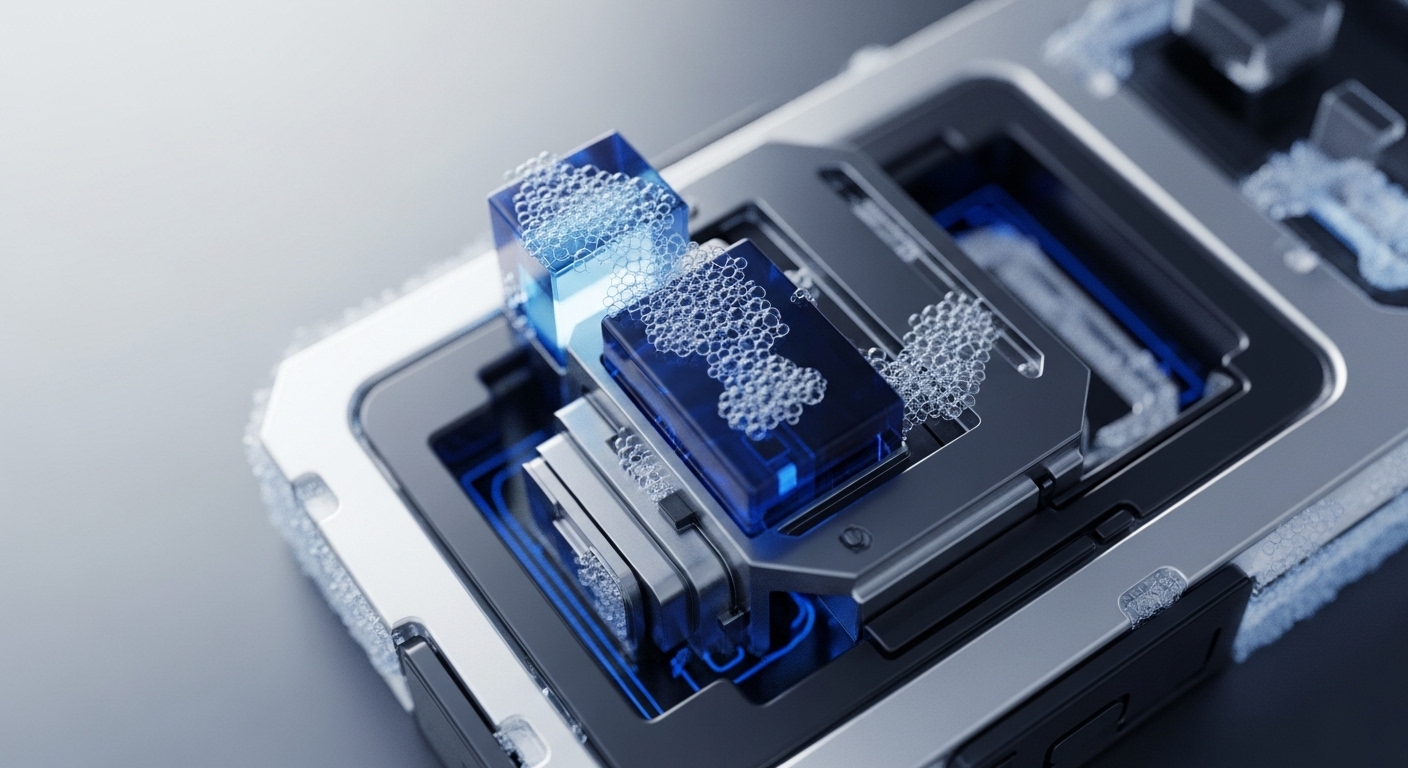

The DLR platform alters the core treasury management and securities settlement systems by introducing a shared, permissioned ledger for the tokenized representation of underlying collateral. This architectural shift enables atomic settlement, where the transfer of cash and the transfer of collateral occur simultaneously (Delivery-versus-Payment, DvP), eliminating principal risk and the need for multi-day settlement cycles. The chain of cause and effect is direct → the platform’s DLT layer provides a unified view of collateral inventory, which reduces operational friction and frees up capital previously trapped in legacy settlement windows.

This real-time collateral mobility allows firms to optimize their funding and financing activities, creating value by lowering the Total Cost of Ownership (TCO) for repo transactions and providing a superior mechanism for intraday liquidity management. The systemic significance is the establishment of a robust, 24/7 digital rail for a foundational element of the global financial system.

Parameters

- Platform Operator → Broadridge Financial Solutions, Inc.

- Core Technology → Distributed Ledger Technology (DLT)

- Financial Instrument → Repurchase Agreements (Repo)

- Adoption Scale Metric → $280 Billion in Average Daily Transactions

- Primary Benefit → Real-Time Atomic Settlement

Outlook

The next phase of this adoption will focus on achieving cross-platform interoperability, connecting the DLR platform with other regulated DLT networks to expand the pool of available collateral and counterparties. This success establishes a high-water mark for the industry, pressuring competitors and traditional market infrastructure providers to accelerate their own DLT roadmaps for core capital markets functions. The long-term effect is the emergence of a new industry standard for securities financing, where T+0 settlement and real-time collateral optimization become the non-negotiable baseline for competitive advantage, driving a fundamental restructuring of balance sheet management across the buy-side and sell-side.

Verdict

This exponential growth in DLT-based repo volume confirms that the convergence of blockchain and traditional finance is now an operational reality, moving from a strategic experiment to essential, mission-critical infrastructure.