Briefing

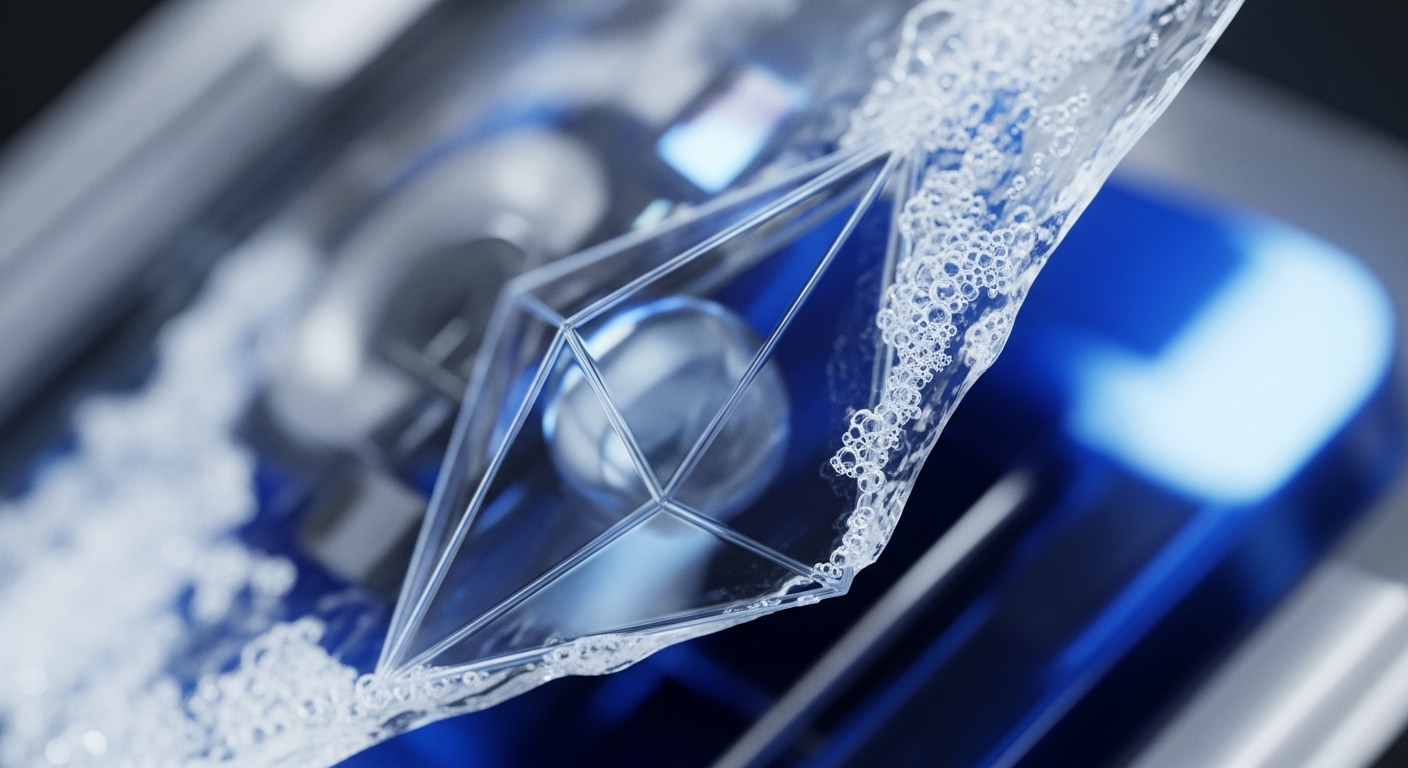

BTCS Inc. a publicly traded blockchain firm, is significantly scaling its digital asset treasury by initiating a $2 billion capital raise through share sales, primarily aimed at accumulating Ethereum. This move strategically positions the company to leverage digital assets for enhanced balance sheet strength and operational flexibility, underscoring a proactive approach to modern corporate finance. The initiative builds upon its existing substantial holdings of 70,028 ETH, valued at approximately $275 million, signaling a deep commitment to an Ethereum-centric treasury strategy.

Context

Traditional corporate treasury management often grapples with inflationary pressures and limited yield opportunities within conventional financial instruments, leading to a gradual erosion of purchasing power. This environment necessitates innovative strategies beyond static cash reserves or low-return bonds. The prevailing operational challenge involves optimizing capital allocation to maintain value and support growth, particularly when competing with market giants that possess vast resources.

Analysis

This adoption fundamentally alters BTCS Inc.’s treasury management system by integrating Ethereum as a core balance sheet asset. The capital raise directly funds the acquisition of digital assets, shifting capital allocation from traditional reserves into a high-growth, inflation-resistant asset class. This strategy provides a mechanism for value preservation and potential appreciation, creating a more dynamic and resilient financial framework.

The enterprise benefits from enhanced liquidity and a diversified asset base, offering a strategic advantage in capital deployment and operational funding. This initiative establishes a precedent for public companies to actively leverage blockchain assets for long-term financial health.

Parameters

- Company → BTCS Inc.

- Blockchain Protocol → Ethereum (ETH)

- Capital Raise Target → $2 Billion

- Current ETH Holdings → 70,028 ETH

- Regulatory Filing → S-3 Registration Statement

Outlook

The forward trajectory for BTCS Inc. involves the systematic deployment of raised capital to further expand its Ethereum holdings, potentially influencing other publicly traded entities to re-evaluate their treasury strategies. This could establish new industry benchmarks for digital asset integration within corporate finance, fostering a competitive landscape where balance sheet optimization through blockchain assets becomes a standard practice. The initiative paves the way for a broader acceptance of Ethereum as a strategic reserve asset.

Verdict

BTCS Inc.’s aggressive pursuit of a $2 billion Ethereum treasury expansion decisively validates digital assets as a foundational component of modern corporate financial strategy, setting a clear precedent for enterprise-grade blockchain integration.

Signal Acquired from → Bitcoinist.com