Briefing

The Monetary Authority of Singapore (MAS) has initiated critical DLT workstreams with the Deutsche Bundesbank, Bank of England, and Bank of Thailand to modernize cross-border settlement and foreign exchange (FX) infrastructure. This collaboration fundamentally shifts the global payment paradigm by focusing on developing common standards for tokenized transactions and achieving synchronized FX settlement. The strategic objective is the institutional adoption of Payment versus Payment (PvP) or atomic transactions, a mechanism explicitly designed to eliminate Herstatt risk, the primary systemic default risk in the multi-trillion-dollar FX market.

Context

Traditional cross-border transactions and FX settlements are plagued by multi-day settlement cycles (T+2 or longer), high intermediary costs, and the persistent exposure to Herstatt risk, where one party delivers the currency but the counterparty defaults before delivering the equivalent. The prevailing operational challenge is the lack of a real-time, shared ledger infrastructure that can guarantee the simultaneous, atomic exchange of two different assets, necessitating pre-funding and complex risk management protocols across multiple jurisdictions.

Analysis

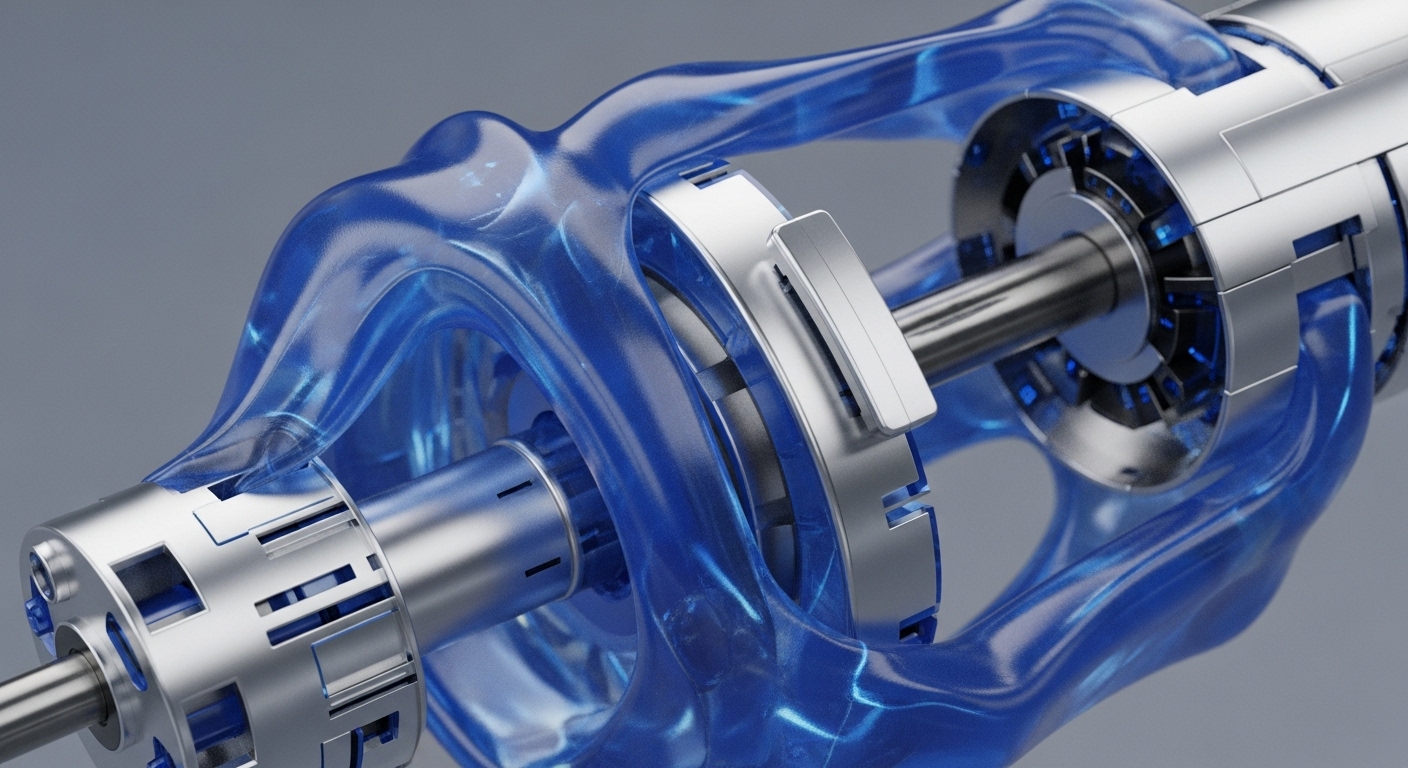

This DLT integration directly alters the cross-border payments and securities settlement systems by establishing an interoperable, shared ledger infrastructure between central bank real-time gross settlement (RTGS) systems and DLT platforms. The chain of cause and effect begins with the standardization of tokenized digital liabilities (digital representations of central bank money), which enables the creation of atomic, PvP transactions. For the enterprise and its partners, this transition translates directly into a massive reduction in counterparty risk, a significant decrease in capital held for pre-funding (intraday liquidity management), and a dramatic acceleration of cross-border value transfer, transforming a multi-day process into a near-instantaneous, risk-free settlement. This is a foundational move to de-risk and optimize global capital flows.

Parameters

- Lead Regulators → Monetary Authority of Singapore, Deutsche Bundesbank

- Core Use Case → Cross-Border Digital Asset and FX Settlement

- Risk Mitigated → Herstatt Risk (Settlement Default)

- Key Mechanism → Payment versus Payment (PvP) Atomic Transactions

- Interoperability Focus → RTGS Systems and DLT Infrastructures

Outlook

The immediate next phase involves drawing lessons from these exploratory workstreams to inform the next steps in facilitating central bank money settlement for wholesale DLT transactions. This multilateral effort is positioned to establish the foundational technical and legal standards for the future of tokenized finance, creating a blueprint for other central banks and financial market infrastructures (FMIs). The second-order effect will be the competitive pressure on commercial banks and payment providers to adopt these new, risk-minimized rails or risk obsolescence in the high-value cross-border market.

Verdict

The collaboration between these major central banks is the definitive signal that DLT-based, atomic settlement is moving from theoretical pilot to the mandated, de-risked standard for global wholesale finance.