Briefing

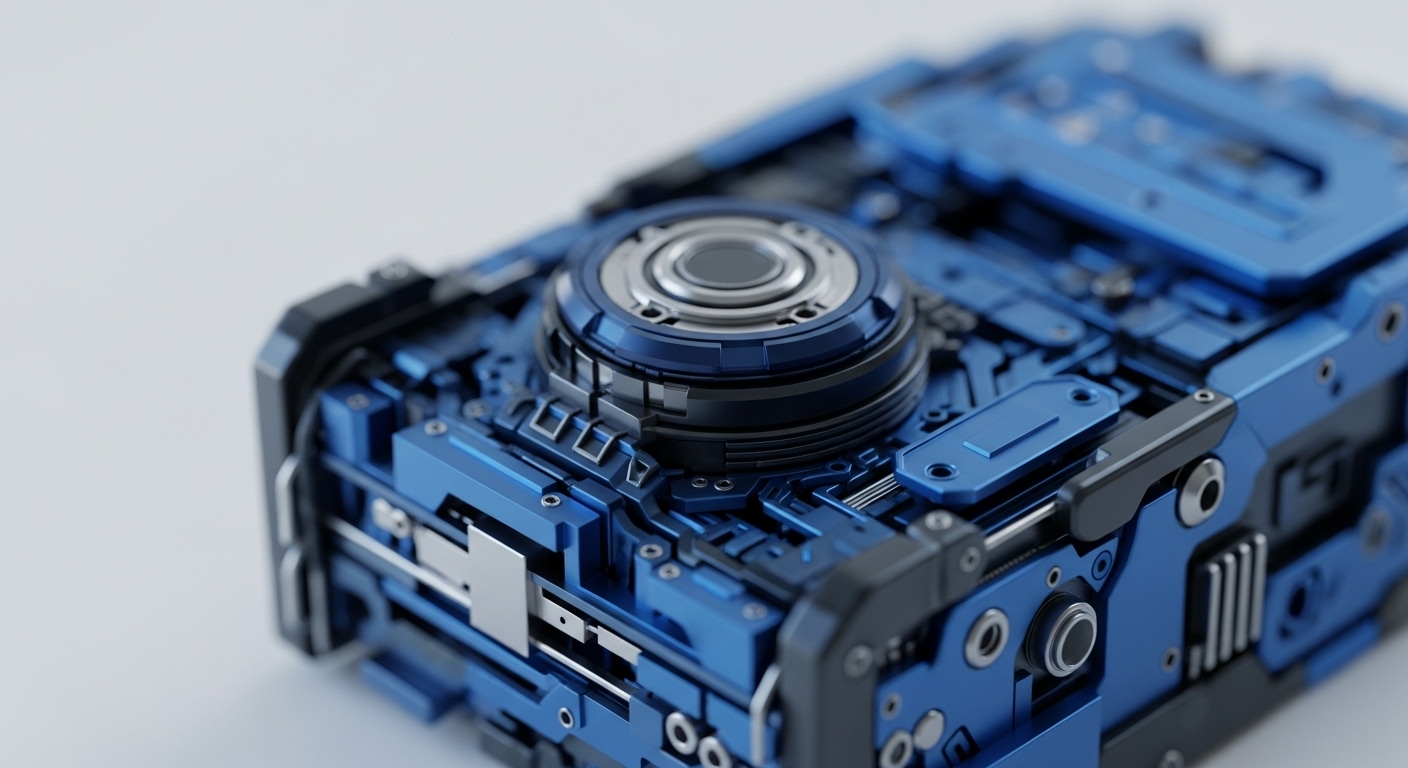

Circle has launched the Arc Layer-1 blockchain, a purpose-built, EVM-compatible network designed to function as an institutional settlement layer for regulated finance. This adoption immediately transforms the stablecoin ecosystem by providing a dedicated, compliant infrastructure that is natively integrated with major financial and technology partners, including BlackRock, Visa, Goldman Sachs, and AWS. The primary consequence is the systemic reduction of settlement latency and counterparty risk in large-value transfers, enabling the company’s $74 billion in USDC to transition from a payment tool to a foundational, programmable asset for institutional treasury and capital markets.

Context

Traditional financial market infrastructure is characterized by siloed systems, multi-day settlement cycles (T+2/T+3), and reliance on a complex, costly network of correspondent banks. This legacy architecture creates significant operational friction, leading to capital lock-up, high cross-border payment fees, and elevated counterparty risk, particularly in high-volume institutional transfers and the issuance of tokenized securities. The prevailing operational challenge is the latency of value transfer, which prevents true 24/7 global liquidity management and capital efficiency.

Analysis

The Arc adoption fundamentally alters the institutional settlement and treasury management system. Arc, as a dedicated Layer-1, functions as a new, high-performance settlement layer where stablecoins (like USDC) are the native gas and transfer mechanism. The chain of effect is → 1) Institutions convert fiat to on-chain stablecoins via Circle’s network; 2) They execute programmable transactions (e.g.

Delivery-versus-Payment for tokenized assets) with instant finality on Arc; 3) The compliant, EVM-compatible architecture allows seamless integration with existing enterprise resource planning (ERP) and treasury management systems. This creates value by eliminating intermediary costs, collapsing settlement time to near-zero, and providing a unified, auditable ledger for all participants, establishing a new industry standard for regulated digital money flows.

Parameters

- Adopting Entity (Lead) → Circle

- Technology Core → Arc (Layer-1 Blockchain)

- Key Institutional Backers → BlackRock, Visa, Goldman Sachs, AWS

- Primary Use Case → Institutional Settlement and Tokenized Assets

- Native Digital Currency → USDC, EURC, USYC1

- Technical Specification → EVM-Compatible, Opt-in Privacy Scheme

Outlook

The next phase involves migrating initial institutional pilots and tokenized asset platforms onto the Arc mainnet, leveraging its compliance-focused features and native integration with the Circle Payments Network. This move is expected to exert competitive pressure on legacy payment processors and banks that have not yet deployed their own dedicated DLT infrastructure. Arc establishes a critical precedent for a “walled garden” approach to regulated decentralized finance, potentially accelerating the standardization of institutional tokenization frameworks and making Layer-1 ownership a strategic imperative for global fintech leaders.