Briefing

Circle’s Cross-Chain Transfer Protocol (CCTP) has achieved a 640% year-over-year volume increase, signaling its definitive establishment as the preferred interoperability standard for institutional digital dollar flows. This exponential growth, which saw CCTP volume reach $31.3 billion, immediately alters the competitive landscape for stablecoin infrastructure by proving the scalability and security of its native asset transfer mechanism over traditional bridging solutions. The simultaneous enrollment of over 100 major partners, including AWS, BlackRock, and Visa, into the Arc Network public testnet quantifies the initiative’s scale and front-loads the strategic picture ∞ a consolidated, multi-chain settlement layer is now entering the final phase of enterprise integration.

Context

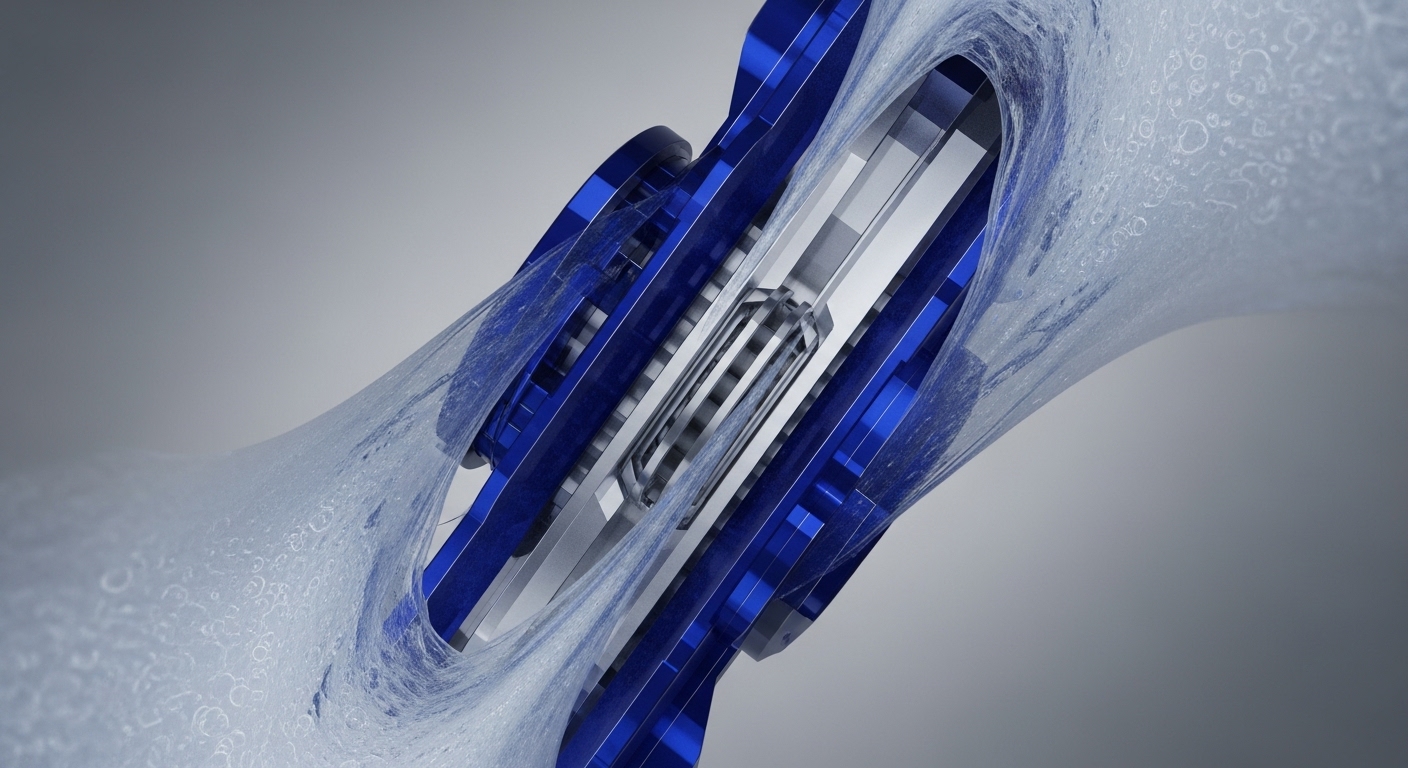

Prior to the maturation of native transfer protocols, institutional adoption of digital dollars was hampered by fragmented liquidity and the security risks inherent in “lock and mint” bridging mechanisms, which introduced unnecessary counterparty risk and operational complexity across disparate blockchain environments. This prevailing challenge created silos of capital, restricting the utility of stablecoins to single-chain ecosystems and preventing the seamless, at-scale movement of digital collateral required for sophisticated capital market operations. The operational inefficiency was a direct constraint on achieving T+0 settlement across multiple ledgers.

Analysis

The adoption of CCTP fundamentally alters the operational mechanics of institutional treasury management and cross-border payments by replacing vulnerable bridging with a secure, native burn-and-mint process. This system ensures that digital dollar assets, specifically USDC, can move across distinct blockchain protocols without the need for a third-party intermediary to custody the locked asset, thereby eliminating a major point of failure and reducing counterparty exposure for the enterprise and its partners. For institutions like Visa and HSBC, CCTP functions as a standardized API for value transfer, plugging directly into existing treasury systems to facilitate instant, compliant settlement and unlocking capital efficiency across global operations. The significance for the industry is the establishment of a robust, compliant, and scalable foundation that enables a multi-chain strategy for tokenized assets.

Parameters

- Core Protocol ∞ Cross-Chain Transfer Protocol (CCTP)

- Primary Asset ∞ USD Coin (USDC)

- Volume Metric ∞ $31.3 Billion (640% YoY Growth)

- Adopting Partners ∞ AWS, BlackRock, HSBC, Mastercard, Standard Chartered, Visa

- Development Platform ∞ Arc Network (Public Testnet)

Outlook

The next phase will involve the transition of the Arc Network from public testnet to a fully permissioned production environment, accelerating the onboarding of the 100+ institutional partners into live operations. This infrastructure will establish a new industry standard for regulated digital asset interoperability, forcing competitors to either adopt similar native transfer mechanisms or risk being marginalized to single-chain solutions. The second-order effect will be the rapid expansion of tokenized real-world assets (RWAs) across multiple chains, leveraging CCTP for instant collateral and payment settlement, fundamentally reshaping global capital markets.

Verdict

The exponential growth and institutional integration of CCTP solidify its position as the foundational, secure, and compliant interoperability layer essential for scaling the tokenized global financial system.