Briefing

Citi has significantly expanded its proprietary tokenized deposit service, onboarding a major institutional client to facilitate real-time, cross-border treasury and collateral management operations. This adoption immediately redefines the bank’s core offering in wholesale funding, shifting from multi-day correspondent banking to instantaneous, T+0 atomic settlement across jurisdictions. The strategic consequence is a direct enhancement of capital efficiency for the enterprise client, as evidenced by a pilot transaction that instantly freed up $100 million in previously trapped liquidity, demonstrating the system’s capacity to optimize billions in institutional working capital.

Context

The prevailing operational challenge in institutional cross-border finance centers on the inherent inefficiency and high cost of the traditional correspondent banking model. This legacy system necessitates pre-funding and maintaining substantial balances in nostro and vostro accounts across multiple jurisdictions, leading to vast amounts of liquidity being perpetually trapped and unavailable for active use. The resulting lack of real-time finality introduces significant counterparty risk and limits the optimization of global treasury functions, forcing corporations to accept multi-day settlement windows for critical payments and collateral movements.

Analysis

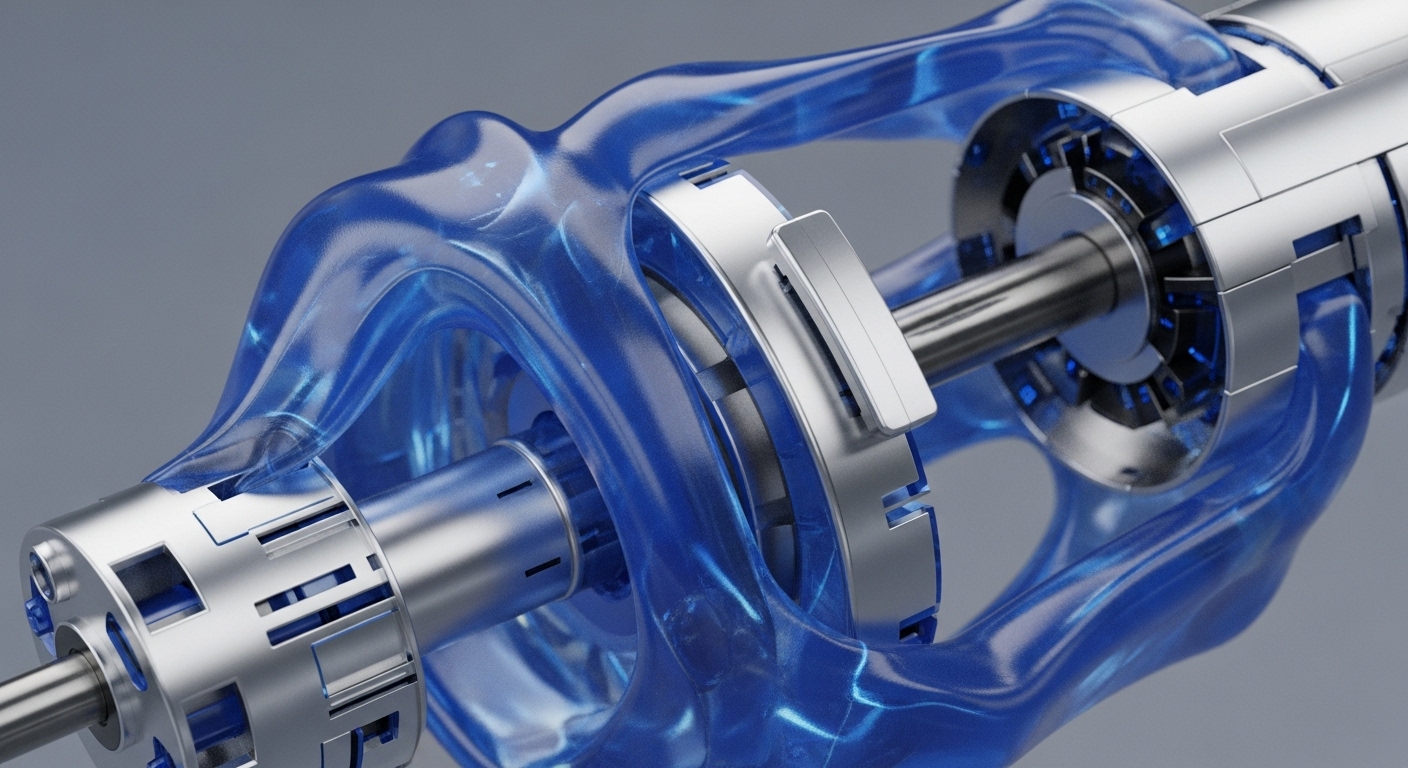

The tokenized deposit integration fundamentally alters the enterprise’s treasury management and cross-border payment mechanics by establishing a secure, shared ledger for liability representation. This DLT-based system replaces the sequential, message-based process of correspondent banking with an atomic settlement layer where the transfer of value (the tokenized deposit) and the record of ownership occur simultaneously. For the enterprise, this means the immediate elimination of settlement risk and the capacity to manage collateral and cash positions 24/7.

The chain of cause and effect is direct → the DLT provides an immutable, single source of truth for the deposit, which in turn enables programmable settlement, drastically reducing operational overhead and transforming previously illiquid balances into dynamic, usable capital for global operations. This is significant for the industry because it provides a regulated, on-balance-sheet digital liability, establishing a compliant blueprint for the future of wholesale banking.

Parameters

- Adopting Financial Institution → Citi

- Digital Asset Type → Tokenized Deposits

- Core Use Case → Institutional Cross-Border Treasury and Collateral Management

- Operational Improvement → T+0 Atomic Settlement

- Pilot Scale Detail → $100 Million Liquidity Freed

- Underlying Technology → Proprietary Institutional DLT Network

Outlook

The next phase of this initiative involves expanding the service to include a broader array of major currency corridors and integrating with third-party institutional trading venues to support tokenized collateral posting. This expansion is positioned to establish a new operational standard for global treasury, compelling competing financial institutions to accelerate their own DLT-based liability tokenization roadmaps to maintain market share. The ultimate second-order effect will be the creation of a hyper-efficient, interconnected institutional settlement network, making the legacy correspondent banking infrastructure strategically obsolete for large-scale, time-sensitive corporate finance operations.