Briefing

State Street, a major global custodian and asset manager, has executed its first transaction on J.P. Morgan’s Digital Debt Service, purchasing a $100 million tokenized commercial paper issuance from Oversea-Chinese Banking Corporation (OCBC). This action is a pivotal step in the institutional adoption of Distributed Ledger Technology (DLT), fundamentally transforming the fixed income value chain by demonstrating an end-to-end digital investment cycle. The primary consequence is the systemic shift from legacy T+2 settlement to near-instant, T+0 finality, which directly unlocks capital efficiency and mitigates operational risk across the asset class, evidenced by the $100 million value of the inaugural tokenized issuance.

Context

The traditional fixed income market operates on a fragmented, multi-intermediary model that mandates a T+2 settlement timeline for most securities. This delay locks up capital for 48 hours, creating significant liquidity drag, increasing counterparty risk, and requiring complex, costly reconciliation processes. The reliance on legacy clearing and settlement infrastructure introduces systemic friction, preventing the efficient, 24/7 movement of institutional capital necessary for modern treasury management.

Analysis

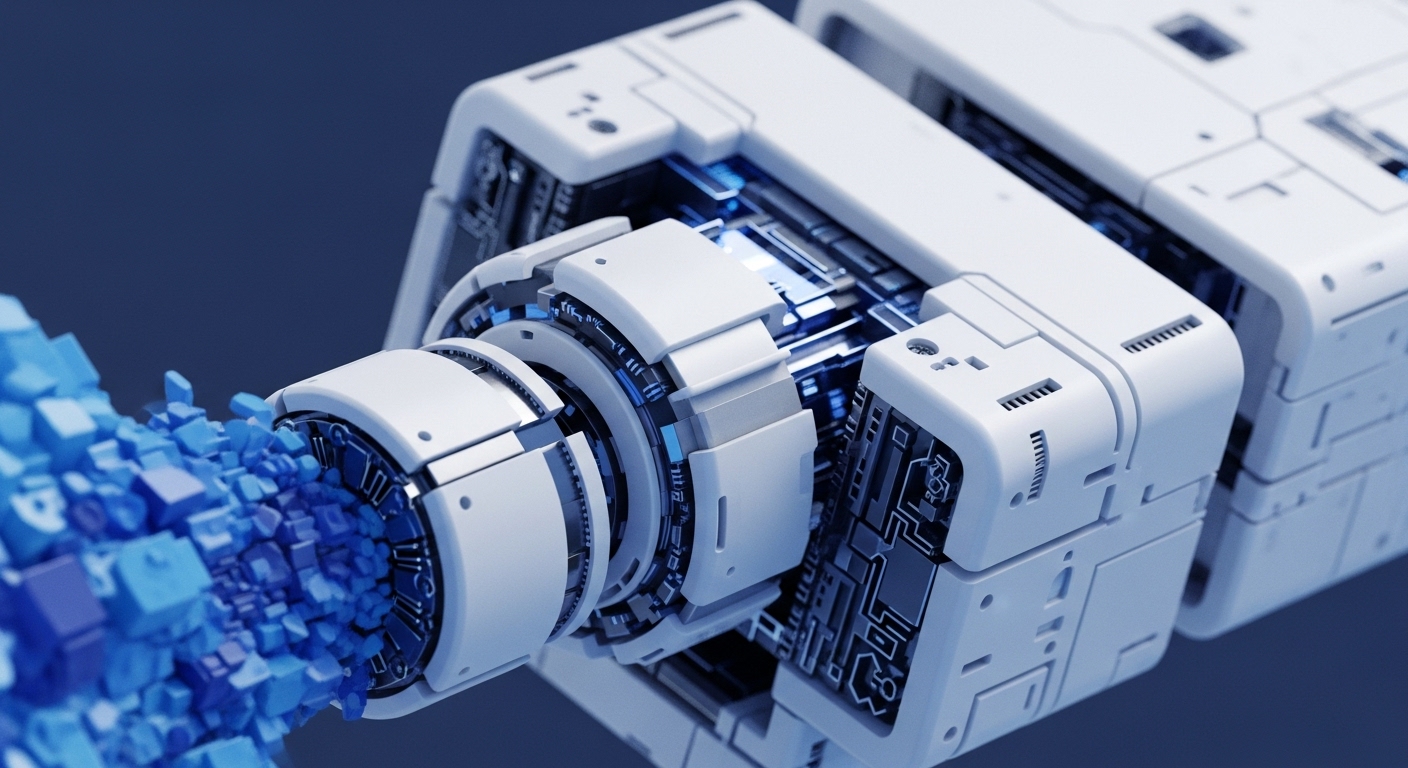

This integration alters the fundamental mechanics of treasury management and asset custody. By participating in the Digital Debt Service, State Street leverages the Kinexys DLT platform as a shared, immutable settlement layer. The tokenized commercial paper represents a digital twin of the asset, while a digital wallet manages the on-chain transfer of value and ownership.

The cause-and-effect chain is direct → smart contracts automate the entire corporate action lifecycle, from issuance to redemption and interest payments, eliminating manual intervention. This systemic change bypasses traditional central securities depositories (CSDs), reducing transaction costs and providing immediate, atomic Delivery versus Payment (DvP), which is critical for scaling institutional digital finance.

Parameters

- Custodian/Asset Manager → State Street

- DLT Platform → Kinexys (J.P. Morgan Onyx)

- Asset Class → Commercial Paper

- Transaction Value → $100 Million

- Settlement Improvement → T+0 Finality

- Issuer → Oversea-Chinese Banking Corporation (OCBC)

Outlook

The immediate outlook involves expanding the variety of assets tokenized on this platform, moving beyond commercial paper to include money market funds and other illiquid private assets for use as collateral. This pilot establishes a critical industry standard for atomic DvP and is expected to exert competitive pressure on rival custodians and market infrastructure providers to develop interoperable DLT-based services. The second-order effect will be the convergence of custody and settlement into a single, real-time function, fundamentally reshaping the operating model for global financial market infrastructure.