Briefing

DAMAC Group, a major property developer, has executed a $1 billion agreement with the MANTRA platform to tokenize a significant portion of its real estate portfolio, fundamentally transforming its capital structure and investor relations model. This strategic move is designed to dismantle the high-friction barriers of traditional real estate investment by converting illiquid property equity into fractional, tradable digital securities, thereby enabling 24/7 global secondary market access and broadening the investor base beyond accredited institutions. The initiative’s primary consequence is the creation of a new, highly liquid capital formation channel, directly challenging traditional real estate fund structures and positioning the company at the forefront of the digital asset economy, a shift quantified by the $1 billion initial valuation of the tokenized assets.

Context

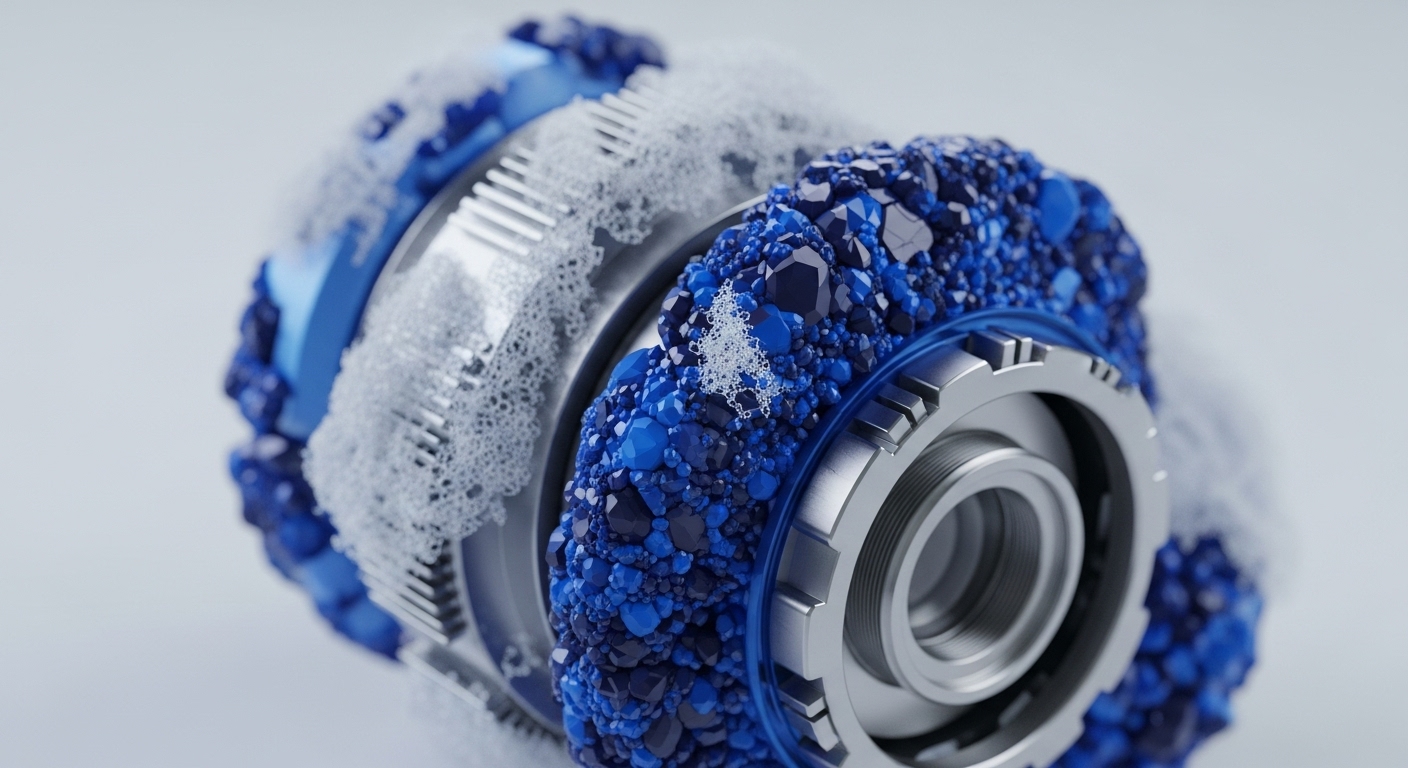

Traditional commercial real estate investment is characterized by extreme illiquidity, opaque valuation processes, and high transactional friction due to multi-day settlement cycles and reliance on costly intermediaries like brokers, custodians, and title companies. The prevailing operational challenge for developers was the protracted capital lock-up and the inability to efficiently fractionalize high-value assets, which severely restricted the pool of potential investors to large, institutional funds and ultra-high-net-worth individuals, limiting the capital velocity required for rapid development cycles.

Analysis

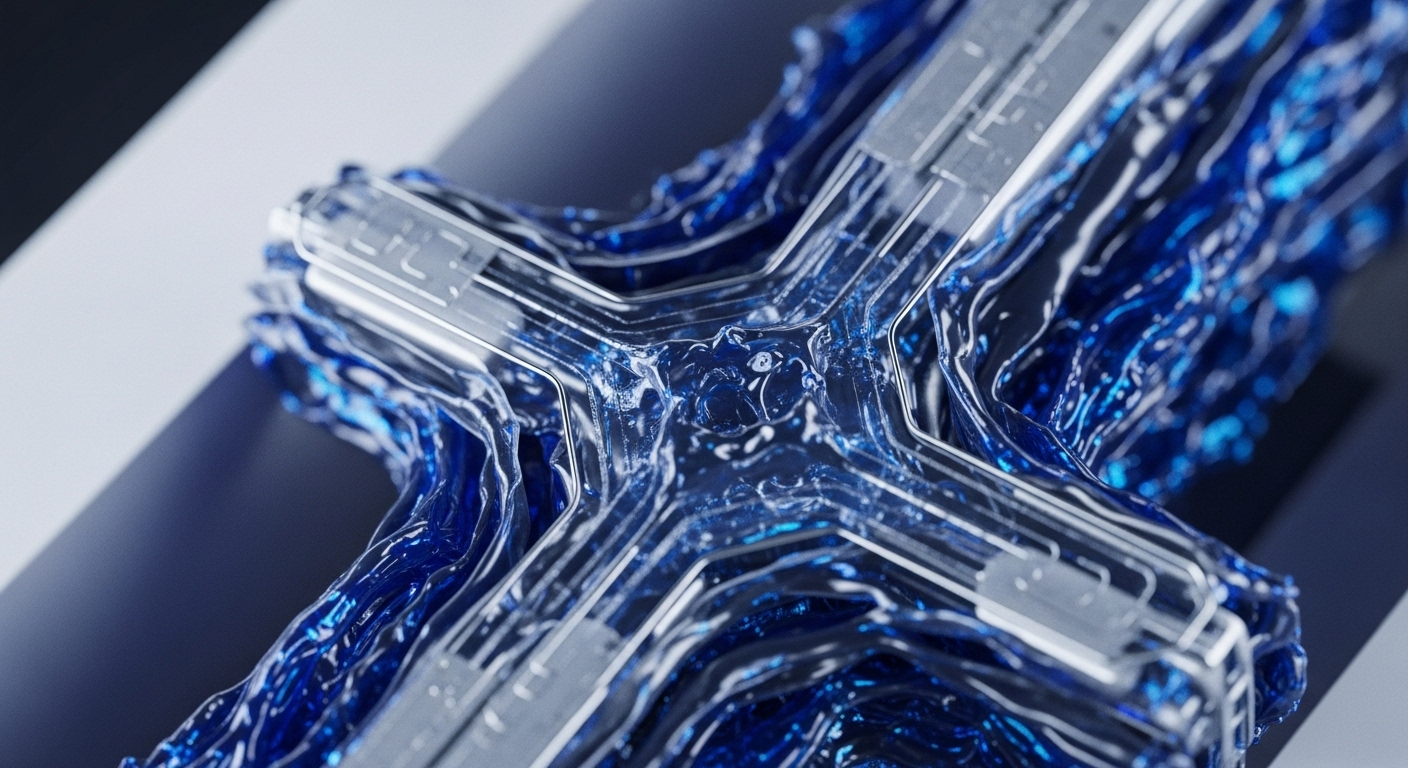

This integration directly alters the enterprise’s Capital Formation and Treasury Management systems. The tokenization process converts the property’s legal ownership into a set of compliant, programmable digital securities (tokens) on the MANTRA DLT platform. The chain of cause and effect is systemic → The token acts as a “digital twin” of the real-world asset, automating corporate actions (e.g. rental income distribution) via smart contracts, which reduces back-office overhead.

For the enterprise, this means T+0 settlement for fractional shares, eliminating counterparty risk associated with traditional escrow and clearing. For partners and investors, the tokens create an instant, permissioned secondary market, which is a critical mechanism for price discovery and liquidity premium generation that was previously unavailable in private real estate.

Parameters

- Adopting Entity → DAMAC Group (Property Developer)

- Integration Partner → MANTRA (DLT Platform)

- Asset Class → Commercial Real Estate

- Initial Scale Metric → $1 Billion in Tokenized Assets

- Core Use Case → Fractional Ownership and Liquidity Enhancement

Outlook

The forward-looking perspective indicates a rapid expansion beyond the initial $1 billion tranche, establishing a new operational standard for real estate capital markets in the MENA region. The second-order effect will be competitive pressure on rival developers to adopt similar tokenization strategies to avoid being capital-disadvantaged by DAMAC’s superior liquidity and broader investor reach. This model is expected to pioneer a new standard for the compliant issuance of Real World Assets (RWA) that is immediately liquid, accelerating the convergence of global private equity and institutional-grade DLT infrastructure.

Verdict

This $1 billion tokenization initiative validates that blockchain technology is now the primary, strategic infrastructure for unlocking liquidity in the world’s most capital-intensive, illiquid asset classes.