Briefing

The convergence of traditional finance and blockchain has entered its execution phase, marked by a decisive shift from proof-of-concept tokenization pilots to scaled, production-ready asset deployment. This adoption is fundamentally redefining capital market infrastructure, moving the industry toward a T+0 settlement environment. The primary consequence is the disintermediation of legacy reconciliation workflows, a strategic advantage evidenced by the fact that 91% of surveyed custodians already report efficiency improvements from offering tokenized assets.

Context

The traditional financial system is burdened by fragmented, multi-day settlement cycles (T+2/T+3), which mandate significant capital lockup and expose institutions to systemic counterparty risk. This prevailing operational challenge stems from siloed record-keeping systems and reliance on manual reconciliation processes across multiple intermediaries, creating friction and elevating the Total Cost of Ownership (TCO) for asset issuance and transfer.

Analysis

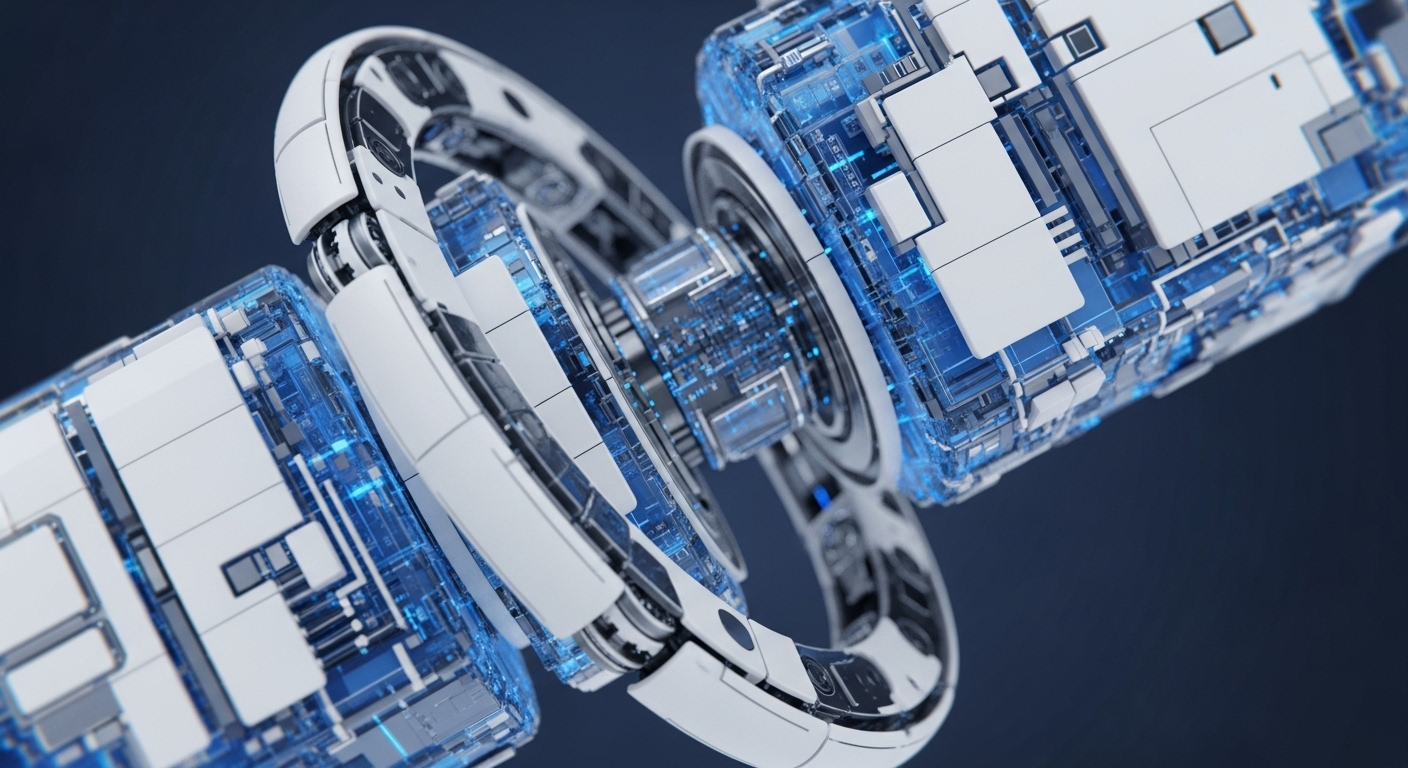

Asset tokenization alters the core operational mechanics of securities issuance and post-trade processing by replacing fragmented databases with a single, shared, immutable ledger. This process converts ownership rights into security tokens, embedding compliance and transfer logic directly into the asset via smart contracts. The chain of cause and effect is direct → a tokenized asset enables atomic settlement, where the exchange of the asset and the payment occurs simultaneously. For the enterprise, this dramatically reduces counterparty risk and frees up capital previously trapped in multi-day settlement windows, which is significant for the industry as it establishes a new standard for instant, transparent, and auditable asset provenance.

Parameters

- Source Entity → Broadridge Financial Solutions

- Adoption Metric → 91% Custodian Efficiency Improvement

- Target Asset Class → Real-World Assets (RWA) and Investment Funds

- Operational Impact → Reduction of Settlement Cycle to Near-Instant (T+0)

- Scale of Survey → 300 Financial Institutions Across North America and Europe

- Core Technology → Distributed Ledger Technology (DLT)

Outlook

The next phase of this strategic rollout involves delivering tokenized products at volume across diverse asset classes, including private equity and real estate, with the same reliability as traditional securities. This commitment will establish new industry standards for liquidity management and fund distribution, forcing slower-moving wealth managers to prioritize tokenization as a core strategy to remain competitive and relevant to high-net-worth investors.

Verdict

Tokenization is the mandatory architectural upgrade for capital markets, providing the definitive pathway to achieving systemic capital efficiency and continuous liquidity.