Briefing

HSBC is making a major strategic move by expanding its Tokenized Deposit Service (TDS) to corporate clients in the United States and the United Arab Emirates, signaling the institutional shift toward regulated, on-balance-sheet digital money for wholesale payments. This adoption fundamentally alters the corporate treasury model by replacing legacy correspondent banking with a proprietary Distributed Ledger Technology (DLT) rail, directly addressing the multi-day settlement latency inherent in traditional systems. The initiative’s primary consequence is the enablement of real-time, 24/7/365 cross-border fund transfers, which is a critical step toward unlocking billions in currently idle corporate working capital.

Context

The prevailing challenge in global corporate finance has been the reliance on a decades-old correspondent banking network, which mandates that multinational corporations pre-fund accounts in various jurisdictions to cover payment obligations. This operational necessity ties up significant capital, subjects treasurers to restrictive cut-off times, and introduces uncertainty due to multi-day settlement lags and opaque intermediary fees. The resulting friction in liquidity management and capital efficiency represents a systemic inefficiency that the financial industry has sought to resolve.

Analysis

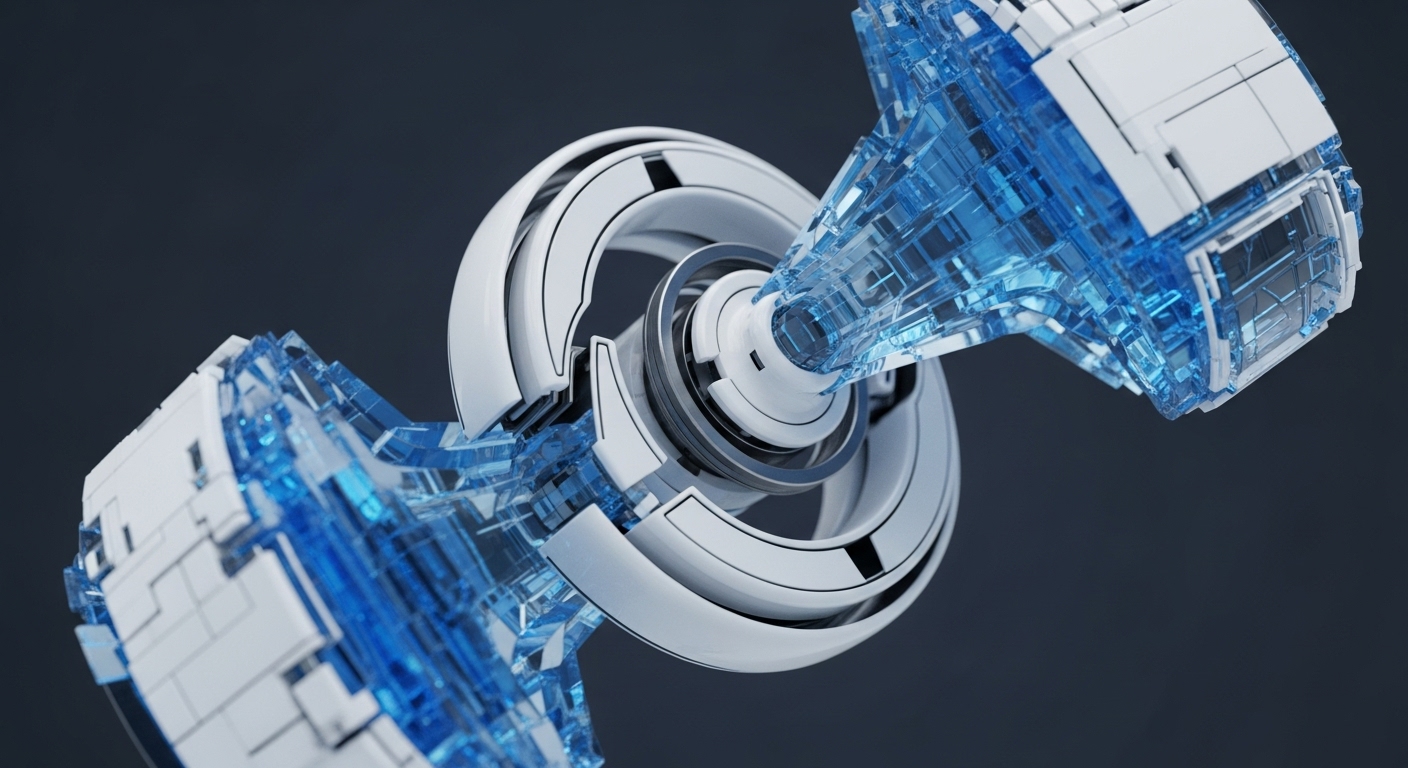

The adoption of TDS directly alters the treasury management and cross-border payments systems by tokenizing traditional fiat deposits into digital representations on the bank’s proprietary DLT. The chain of cause and effect is straightforward → by converting a deposit into a token, the bank creates a digital liability that can be moved and settled instantly, 24/7, between authorized corporate wallets. This eliminates the need for slow, multi-hop SWIFT transfers and the corresponding pre-funding requirement, thereby reducing counterparty risk and freeing up capital. The significance for the industry is the establishment of a compliant, regulated, and on-balance-sheet alternative to unregulated stablecoins, positioning the bank as the primary provider of digital cash infrastructure for its largest corporate clients.

Parameters

- Adopting Institution → HSBC Holdings Plc.

- Service Name → Tokenized Deposit Service (TDS)

- Core Technology → Proprietary Distributed Ledger Technology (DLT)

- Target Markets → United States (U.S.) and United Arab Emirates (UAE)

- Launch Timeline → First Half of 2026 (H1 2026)

- Asset Class → Tokenized Deposits (On-Balance-Sheet Digital Cash)

Outlook

The next phase of this rollout will involve integrating the TDS framework directly into corporate ERP and treasury management systems via APIs, enabling automated, programmable payments at scale. This move will exert significant pressure on competitor banks to accelerate their own deposit token and wholesale CBDC (Central Bank Digital Currency) initiatives to retain corporate treasury mandates. The TDS model is poised to establish a new industry standard for regulated digital cash settlement, forcing a systemic upgrade of global financial infrastructure that prioritizes capital efficiency and continuous operation.