Briefing

Hang Seng Bank has successfully completed a critical Phase 2 pilot for tokenized fund settlement under the HKMA’s Project e-HKD+, positioning the institution to lead the regional modernization of capital markets. This adoption immediately validates the commercial viability of using digital money to settle tokenized funds on a public permissioned DLT, directly addressing the multi-day friction inherent in legacy clearing systems. The bank’s unique completion of two distinct pilots → including tokenized fund settlement with partners like Aptos Labs and BCG → underscores its commitment to setting a new benchmark for instant settlement in the Asian financial sector.

Context

The traditional fund settlement process is characterized by multi-day cycles (T+2 or T+3) due to fragmented systems, manual reconciliation, and reliance on central clearing counterparties, which severely constrains capital efficiency and liquidity management. This prevailing operational challenge introduces significant counterparty risk and locks up billions in capital, making the cross-border movement of funds particularly slow and expensive, directly impeding Hong Kong’s ambition as a leading international financial center.

Analysis

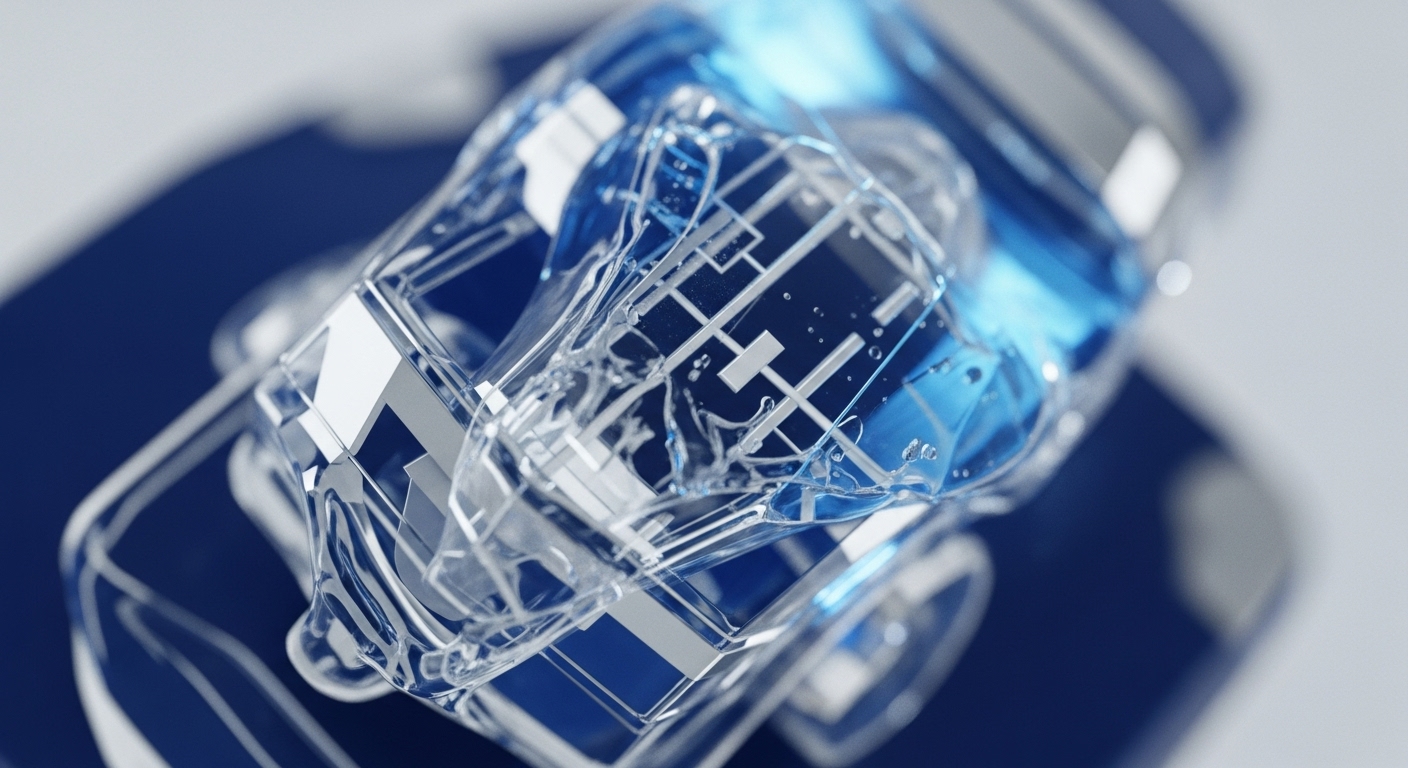

This adoption fundamentally alters the back-office operational mechanics of asset servicing and treasury management by implementing an atomic settlement layer. By representing fund shares as tokens on a public permissioned blockchain, the bank eliminates the need for sequential steps of clearing and settlement, collapsing the cycle to near T+0. The chain of effect is immediate → fund managers gain real-time liquidity, operational risk is minimized via the shared, immutable ledger, and the interoperability with tokenized deposits (e-HKD) creates a compliant, end-to-end digital money ecosystem for the enterprise and its partners, establishing a foundational model for future RWA tokenization.

Parameters

- Adopting Institution → Hang Seng Bank

- Regulatory Framework → HKMA Project e-HKD+ (Phase 2)

- Core Use Case → Tokenized Fund Settlement

- Key Partners → Boston Consulting Group (BCG), Aptos Labs

- Targeted Outcome → Faster settlement and improved operational efficiency

- Technology Rail → Public Permissioned Distributed Ledger Technology (DLT)

Outlook

The successful pilot establishes a proven reference architecture for tokenized fund settlement, accelerating the move from controlled sandbox environments to full-scale production. The next phase will likely involve expanding the asset classes beyond funds to other real-world assets (RWA) and establishing clear interoperability standards between various permissioned DLTs. This initiative pressures competing financial centers to accelerate their own digital money and tokenization strategies, ultimately setting the standard for compliant, instant cross-border financial market infrastructure in the Asia-Pacific region.

Verdict

The bank’s successful pilot validates tokenization as the definitive architectural upgrade for capital markets, translating theoretical DLT benefits into a quantifiable blueprint for instant, compliant institutional settlement.