Briefing

HSBC’s expansion of its Tokenised Deposit Service (TDS) to cross-border transactions fundamentally alters the global corporate payments landscape by replacing traditional correspondent banking with a private, DLT-based rail. This initiative directly addresses the core inefficiency of cut-off times and time-zone barriers, allowing multinational clients to execute payments and manage liquidity instantly and around the clock. The service’s first USD cross-border transaction was completed between Hong Kong and Singapore, demonstrating a production-scale model for always-on, real-time treasury optimization.

Context

Traditional cross-border payments rely on a fragmented correspondent banking network, resulting in multi-day settlement times, high intermediary costs, and operational friction due to global time-zone differences and bank cut-off windows. This legacy system forces corporate treasurers to pre-fund accounts and maintain excess liquidity across various jurisdictions, creating significant capital inefficiency and increasing counterparty risk. The prevailing challenge is the lack of a unified, real-time, 24/7 settlement layer for fiat currency movements.

Analysis

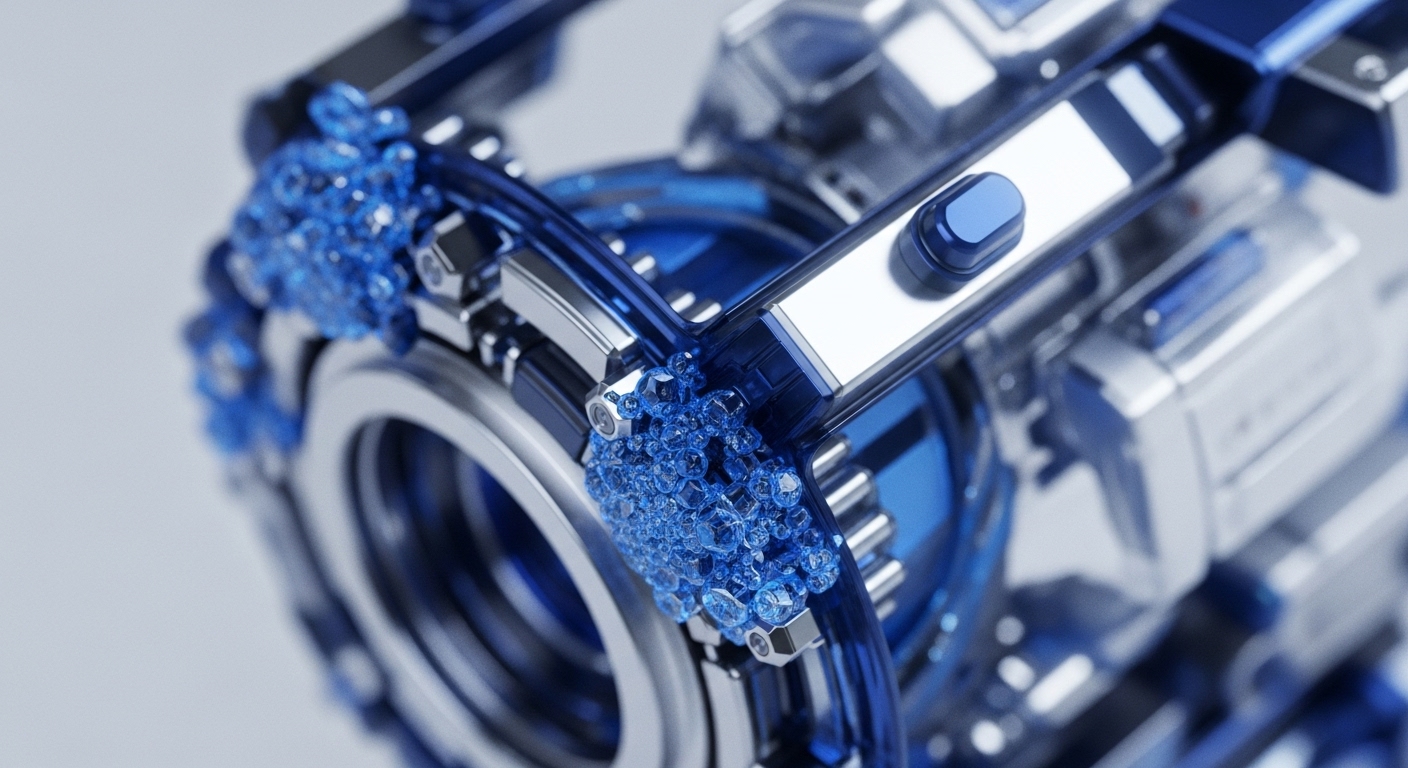

The TDS integration transforms the treasury management system by tokenizing traditional fiat deposits into digital tokens on a private Distributed Ledger Technology (DLT) network. This architectural shift enables atomic settlement, where the transfer of value (the token) is instantaneous and final, eliminating the settlement risk inherent in the T+2 or T+3 cycle of legacy rails. For the enterprise, this translates directly to superior capital efficiency, as cash previously locked in transit or pre-funded accounts can be deployed immediately. The DLT platform integrates with existing corporate Enterprise Resource Planning (ERP) and treasury systems via APIs, allowing clients to initiate programmable payments directly from their own systems, which is the key to automating and future-proofing the treasury function.

Parameters

- Financial Institution → HSBC

- Client Pioneer → Ant International

- Technology Protocol → Distributed Ledger Technology (DLT)

- Core Asset Tokenized → Fiat Deposits (USD, HKD, GBP, EUR)

- Initial Cross-Border Corridor → Hong Kong to Singapore

- Key Operational Metric → Instant 24/7 Settlement

Outlook

The next phase involves scaling the TDS across HSBC’s key markets in Asia and Europe, with a strategic focus on integrating programmability features that allow for conditional payments to be embedded in the token transfer. This move is expected to establish a new benchmark for global transaction banking, compelling competitors to accelerate their own tokenized deposit and cross-border DLT solutions to remain relevant in the high-value corporate payments space. The long-term trajectory is the convergence of this DLT rail with other tokenized assets, creating a unified ecosystem for atomic Delivery Versus Payment (DvP) settlement.

Verdict

The production expansion of tokenized deposit services validates DLT as the foundational, high-velocity settlement layer required for modern, capital-efficient global corporate treasury operations.