Briefing

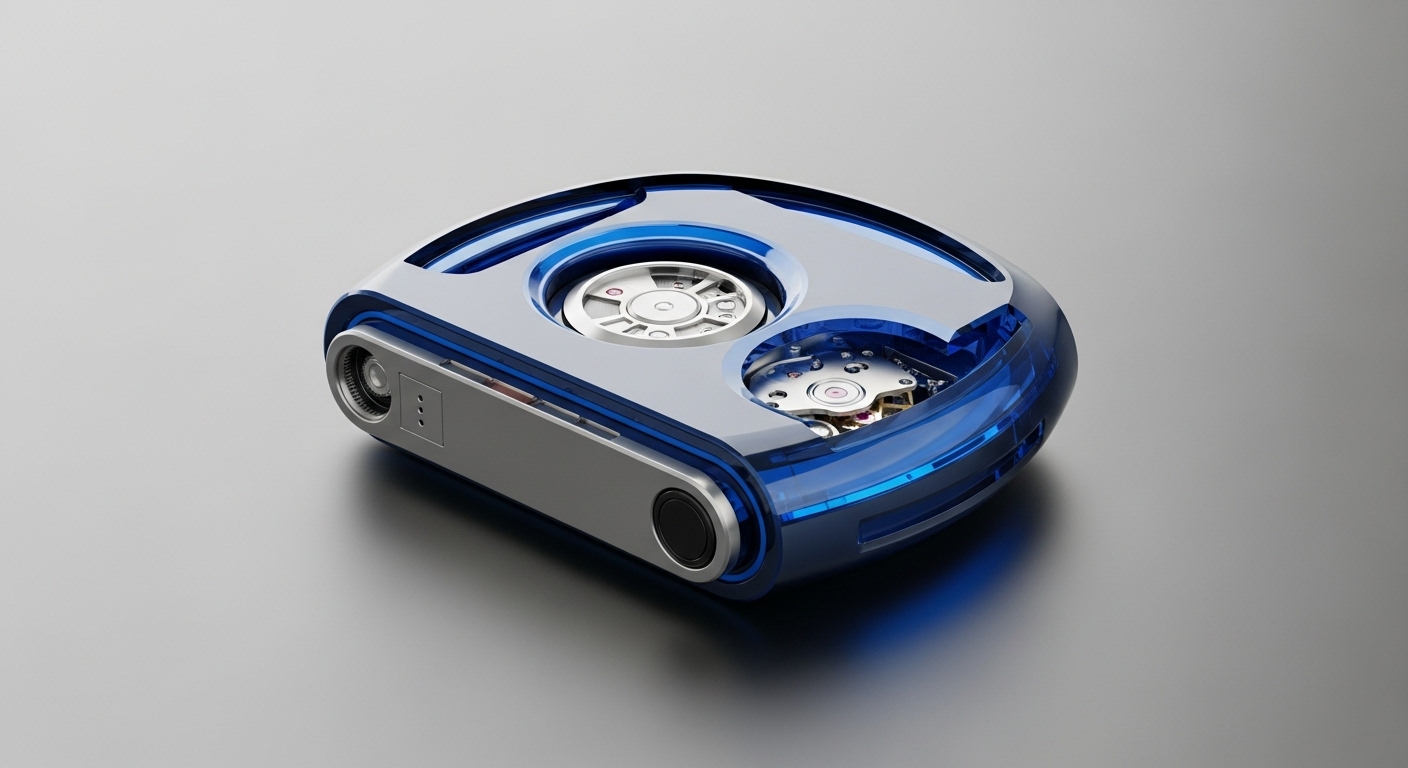

HSBC has strategically expanded its Tokenised Deposit Service (TDS) to facilitate real-time, 24/7 cross-border transactions for corporate clients, fundamentally transforming traditional payment and treasury operations. This blockchain-based solution directly addresses inefficiencies in global financial flows, offering enhanced liquidity management and programmable payment capabilities. The initial successful USD cross-border transaction between Hong Kong and Singapore, executed for Ant International, quantifies the immediate operational impact and sets a precedent for accelerated global deployment.

Context

Historically, international payments have been characterized by slow settlement times, opaque processes, and high intermediary costs, creating significant friction in corporate treasury management. Traditional batch processing and reliance on correspondent banking networks imposed operational cut-off times and time-zone barriers, limiting real-time liquidity management and increasing counterparty risk. This prevailing operational challenge necessitated a transformative approach to achieve instantaneous, verifiable value transfer across diverse geographical markets.

Analysis

The adoption of HSBC’s Tokenised Deposit Service directly alters the operational mechanics of corporate treasury and cross-border payments. Leveraging Distributed Ledger Technology (DLT), traditional fiat deposits are digitally tokenized, enabling instantaneous, customizable cash movements directly from clients’ enterprise systems. This systemic integration streamlines existing treasury operations by eliminating cut-off times and geographical constraints, fostering atomic settlement for tokenized assets. The chain of cause and effect for enterprises and their partners includes a substantial reduction in operational overhead, optimized liquidity management through real-time access to funds, and the capacity to embed conditional payments, which is significant for industries requiring precise, automated financial execution across complex value chains.

Parameters

- Initiating Institution → HSBC

- Key Partner → Ant International

- Core Technology → Distributed Ledger Technology (DLT)

- Service Offering → Tokenised Deposit Service (TDS)

- Initial Transaction Currencies → USD, GBP, EUR

- Initial Cross-Border Corridor → Hong Kong to Singapore

Outlook

The forward-looking perspective for HSBC’s Tokenised Deposit Service involves a planned expansion across key markets, including the UK and Luxembourg, signifying a strategic commitment to global scalability. This initiative is poised to establish new industry standards for real-time, programmable cross-border payments, potentially spurring competitors to accelerate their own DLT-based payment infrastructure developments. The continued integration of TDS with enterprise DLT systems suggests a future where a substantial portion of institutional payment flows will operate on a next-generation blockchain infrastructure, driving further innovation in digital money.