Briefing

HSBC has successfully executed its first institutional trades of tokenized physical gold, leveraging its proprietary Distributed Ledger Technology (DLT) to create a digital twin of the asset. This integration fundamentally re-architects the wholesale precious metals market by replacing legacy, bilateral settlement with atomic, on-chain finality, thereby unlocking significant capital previously trapped in multi-day settlement cycles and reducing systemic counterparty risk. The platform, which is integrated with the HSBC Evolve trading system, is positioned to scale the tokenized Real-World Asset (RWA) market, signaling a critical shift from pilot to scaled production for institutional digital assets.

Context

Traditional precious metals trading relies on an opaque, fragmented network of custodians and brokers, resulting in settlement times of T+2 or longer, which mandates significant capital reserves to cover potential counterparty default during the settlement window. This latency is a direct drag on capital efficiency for institutional participants. Furthermore, the physical custody and reconciliation process for gold bullion introduces considerable administrative overhead and audit complexity, bogging down the historically significant London gold market.

Analysis

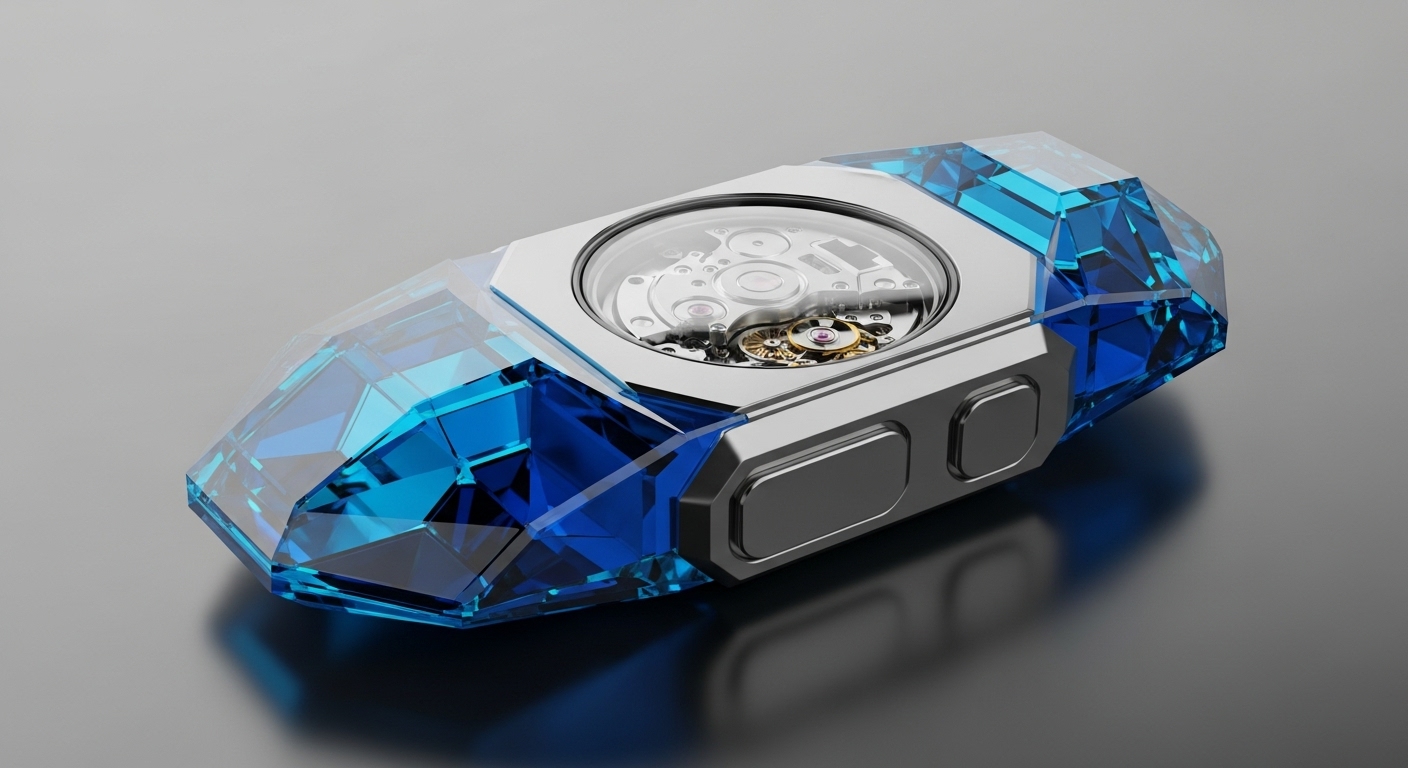

This adoption directly alters the asset issuance and post-trade settlement system for precious metals. The gold is tokenized into a digital representation on the DLT, creating a digital twin that is indivisible from its underlying asset and its legal claim. The cause-and-effect chain is clear → The token’s smart contract automates the Delivery vs. Payment (DvP) process, enabling atomic settlement, which improves the post-trade market infrastructure.

This eliminates the need for gross capital pre-funding to cover settlement risk, immediately freeing up billions in institutional liquidity. For the enterprise, this establishes a new, high-margin, 24/7 trading revenue stream and positions the bank as the foundational infrastructure provider for a modernized global asset class.

Parameters

- Lead Institution → HSBC

- DLT Platform → Proprietary DLT (Integrated with HSBC Evolve and Orion)

- Asset Class → Tokenized Gold (Loco London Gold)

- Key Operational Metric → Improved Post-Trade Infrastructure

- Token Granularity → One token equals 0.001 troy ounce

Outlook

The immediate next phase involves expanding the tokenization framework to include other high-value commodities and foreign exchange, leveraging the existing DLT infrastructure. This success validates the institutional, private DLT model for RWA tokenization, pressuring competing global banks to accelerate their own proprietary digital asset strategies or risk losing market share in the lucrative custody and settlement sectors. This initiative sets a new operational standard for capital efficiency in wholesale commodity trading, shifting the industry benchmark from multi-day to instantaneous settlement.