Briefing

HWAL Inc. has retained Momentum Media Fund to develop the world’s first corporate Bitcoin treasury reserves directly backed by its iconic music catalog, establishing a novel financial primitive that converges digital assets with intellectual property. This move fundamentally shifts the media company’s balance sheet strategy, translating traditionally illiquid IP rights into a secure, yield-generating reserve asset, thereby optimizing corporate liquidity and reducing reliance on conventional debt instruments. The initiative is positioned within a broader music publishing market projected to reach $10.21 billion by 2030, setting a precedent for the tokenization of creative assets across the entire entertainment vertical.

Context

The traditional media and entertainment sector faces significant operational challenges related to asset valuation, capital formation, and IP monetization. Intellectual property, such as music catalogs, is inherently illiquid, requiring complex, time-consuming, and costly securitization processes to unlock value, often involving multiple intermediaries and lengthy settlement periods. This prevailing operational challenge results in underutilized balance sheet assets and a reliance on dilutive equity or high-friction debt markets for capital, which this blockchain-based treasury model is designed to circumvent.

Analysis

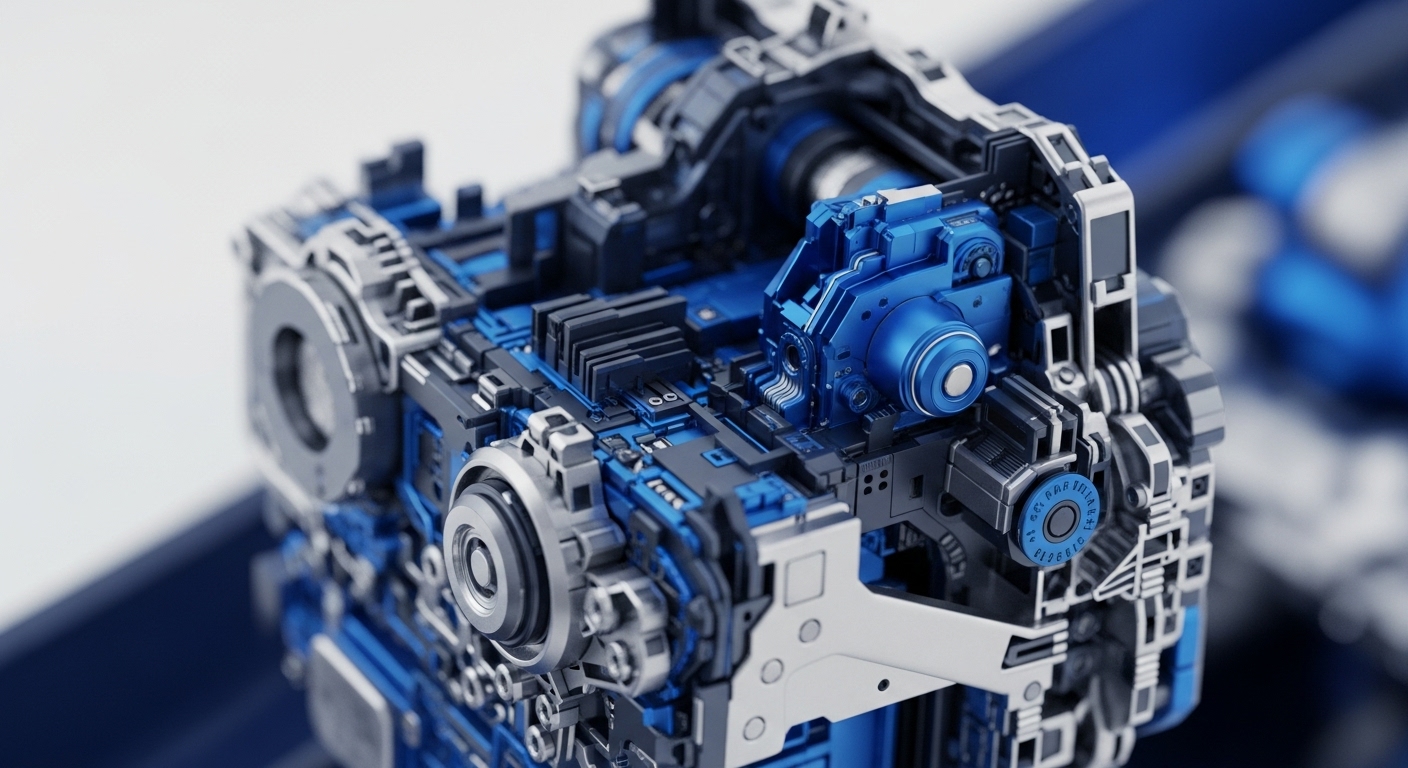

This adoption directly alters the enterprise’s treasury management and capital markets system by creating a digital twin of the music catalog, tokenizing its future royalty streams as an on-chain, auditable asset. The chain of cause and effect begins with the tokenized IP serving as high-quality collateral to justify the holding of a strategic Bitcoin reserve. This architecture provides immediate liquidity and fungibility to the IP, which can then be used to generate yield or be transferred instantly. For partners and the industry, this creates a new, standardized mechanism for valuing and transacting in creative assets, transforming a traditionally opaque and fragmented asset class into a transparent, programmatic digital security, which is significant for establishing a new framework for IP-backed financing.

Parameters

- Adopting Entity → HWAL Inc. (formerly Hollywall Entertainment, Inc.)

- Advisory Partner → Momentum Media Fund

- Core Asset Tokenized → Iconic Music Catalog Intellectual Property

- Reserve Asset → Bitcoin (BTC)

- Industry Vertical Impacted → Media, Entertainment, and Corporate Treasury

- Projected Sector Value → $10.21 Billion (Music Publishing by 2030)

Outlook

The immediate next phase involves the technical conversion of the music catalog’s economic rights into a compliant, on-chain digital security, followed by the formal inscription of the Bitcoin reserve. This successful integration will establish a critical new standard for corporate treasury, forcing competitors in the media and entertainment space to re-evaluate their own illiquid IP holdings. The second-order effect will be the emergence of a new asset class → IP-backed digital securities → that attracts institutional capital seeking high-yield, non-correlated assets, thereby accelerating the convergence of creative finance and digital asset markets.

Verdict

The tokenization of a major music catalog to back a corporate Bitcoin reserve is a decisive, high-signal integration that validates the strategic utility of blockchain technology as a fundamental capital formation layer.