Briefing

Insurers globally are strategically integrating artificial intelligence and blockchain technology to fundamentally transform core operational processes. This convergence is leading to significantly faster claims processing, more accurate risk assessments, and enhanced customer trust, ultimately reshaping the industry’s service delivery model. Early adopters are reporting substantial reductions in processing times, shrinking from weeks to minutes, alongside considerable cuts in operating costs.

Context

Traditionally, the insurance industry has contended with inherent inefficiencies characterized by slow claims adjudication, opaque processes, and vulnerability to fraudulent activities. Legacy systems often resulted in prolonged cycle times, high administrative overhead, and a reactive approach to customer service, undermining both operational agility and client satisfaction.

Analysis

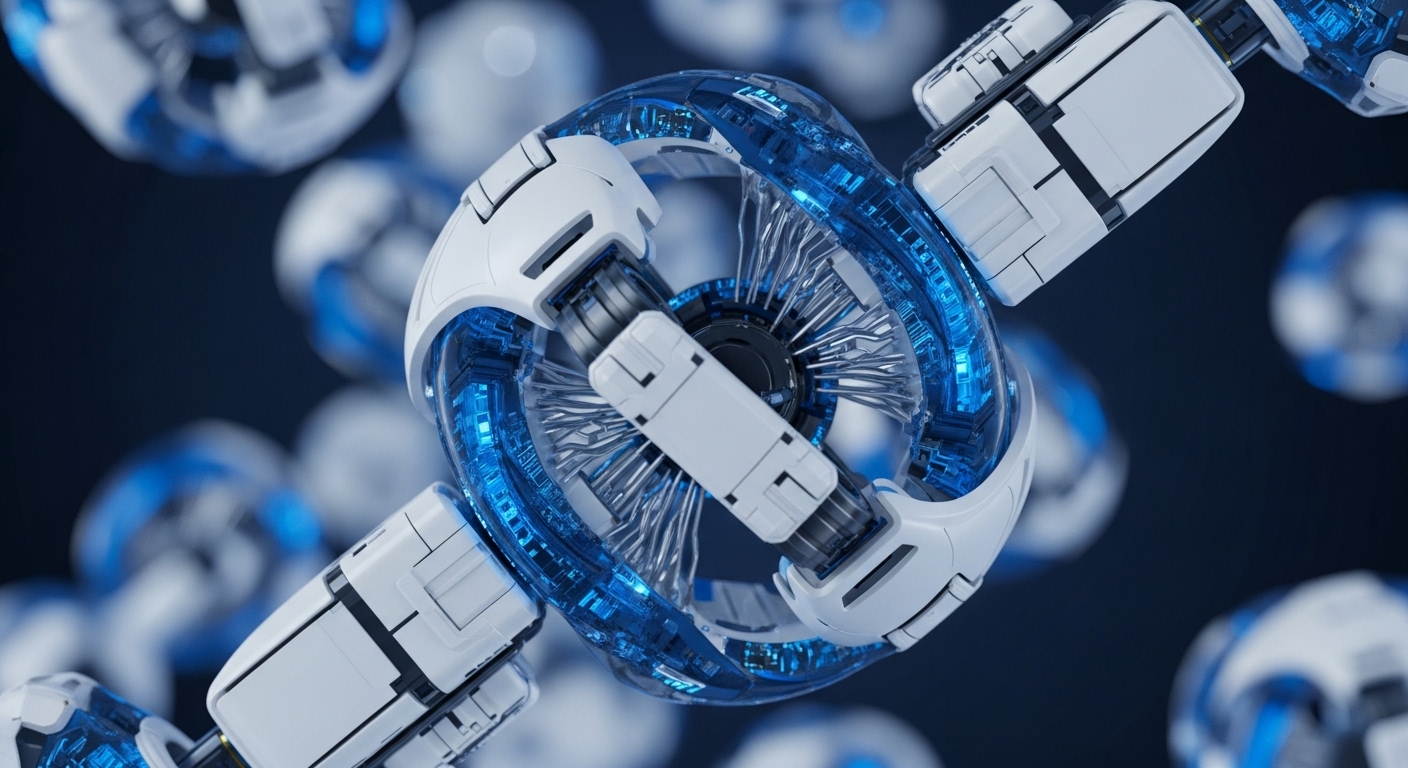

The adoption of blockchain technology, in conjunction with AI, directly impacts the claims management and underwriting systems within the insurance business. Blockchain provides an immutable, transparent ledger for transactions, enabling smart contracts to automate verified payouts for claims and enhancing auditability across the entire process. This systemic alteration streamlines data flows, mitigates counterparty risk by ensuring data integrity, and significantly reduces the potential for fraud through early anomaly detection. The enterprise value is realized through improved operational mechanics, leading to substantial cost savings and a more resilient, trustworthy ecosystem for all stakeholders.

Parameters

- Adopting Sector → Global Insurance Industry

- Key Technologies → Artificial Intelligence, Distributed Ledger Technology

- Core Business Challenge Addressed → Operational Inefficiency and Fraud

- Quantifiable Improvement → Claims Cycle Time Reduction

Outlook

The ongoing integration of AI and blockchain is poised to establish new industry benchmarks for operational efficiency and data security within insurance. The next phase will likely involve the scaling of these pilot programs into full-scale deployments, potentially leading to the development of novel, highly personalized insurance products and a more proactive, data-driven service paradigm. This strategic shift is expected to compel competitors to accelerate their own digital transformation initiatives to maintain market relevance.

Verdict

The pervasive integration of AI and blockchain within the insurance sector represents a decisive strategic pivot, establishing a new operational paradigm defined by unparalleled efficiency, transparency, and trust, fundamentally re-architecting how risk is managed and value is delivered.