Briefing

Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho Bank have launched a joint pilot program to issue yen and dollar stablecoins for corporate settlements, fundamentally restructuring Japan’s cross-border payment architecture. This initiative, built on MUFG’s Progmat Coin infrastructure, directly addresses the friction and capital inefficiency inherent in correspondent banking by creating a regulated, on-chain settlement layer. The pilot commences with Mitsubishi Corporation, a global enterprise with over 240 subsidiaries, which will use the tokenized assets for internal dividend transfers and client transactions, demonstrating the potential to modernize liquidity management for the consortium’s network of over 300,000 corporate clients.

Context

Traditional corporate cross-border payments and inter-subsidiary settlements are encumbered by slow, multi-day settlement cycles (T+2 or longer), high intermediary fees, and the necessity of pre-funding large fiat balances in various foreign accounts. This legacy system forces global enterprises to tie up significant working capital in idle reserves, which reduces capital efficiency and introduces counterparty risk across multiple correspondent banks. The prevailing operational challenge is the systemic delay and cost associated with achieving finality of payment, particularly for high-volume, low-value transactions and time-sensitive dividend distributions.

Analysis

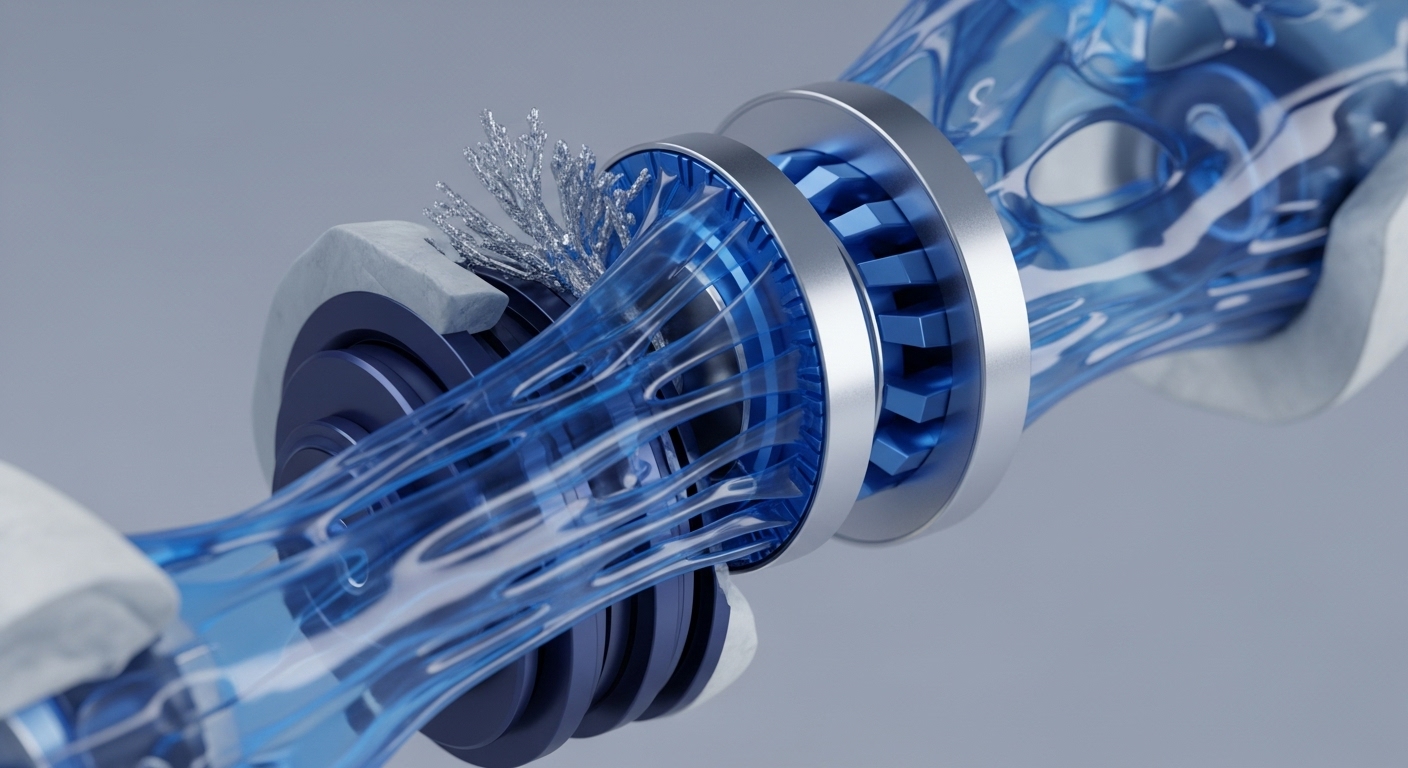

This adoption alters the core treasury management and cross-border payments systems for the participating banks and their corporate clients. By issuing fiat-backed tokens → digital representations of deposits → on the Progmat Coin infrastructure, the consortium transforms the settlement mechanism from a sequential, batch-processed system into an atomic, 24/7 process. The integration provides the enterprise with immediate, on-chain liquidity in both yen and dollar denominations, enabling instant Delivery-versus-Payment (DvP) settlement for digital assets and real-time reconciliation of international payments.

This systemic shift reduces the need for large, pre-funded nostro/vostro accounts, directly unlocking working capital and minimizing foreign exchange exposure by providing native currency circulation within a regulated, domestic banking framework. The tokenized rail functions as a shared, trusted ledger for value transfer, increasing operational precision and lowering the Total Cost of Ownership (TCO) for global corporate finance operations.

Parameters

- Issuing Consortium → Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corp (SMBC), Mizuho Bank

- Initial Corporate Pilot → Mitsubishi Corporation

- Target Use Case → Corporate Settlements, Cross-Border Payments, Dividend Transfers

- Underlying Infrastructure → Progmat Coin (Developed by MUFG)

- Projected Client Reach → Over 300,000 Corporate Clients

Outlook

The next phase involves scaling the pilot across Mitsubishi Corporation’s global subsidiaries and expanding the stablecoin offering to the broader corporate client base. This coordinated effort by Japan’s largest banks establishes a new domestic standard for programmable money, positioning them as first-movers in a regulated, on-chain settlement market. This move will exert competitive pressure on global correspondent banks and fintechs, forcing them to accelerate their own digital asset strategies or risk losing market share in the high-value corporate payments corridor. The successful deployment will validate the model of bank-issued, regulated digital currency as the institutional default for wholesale finance.