Briefing

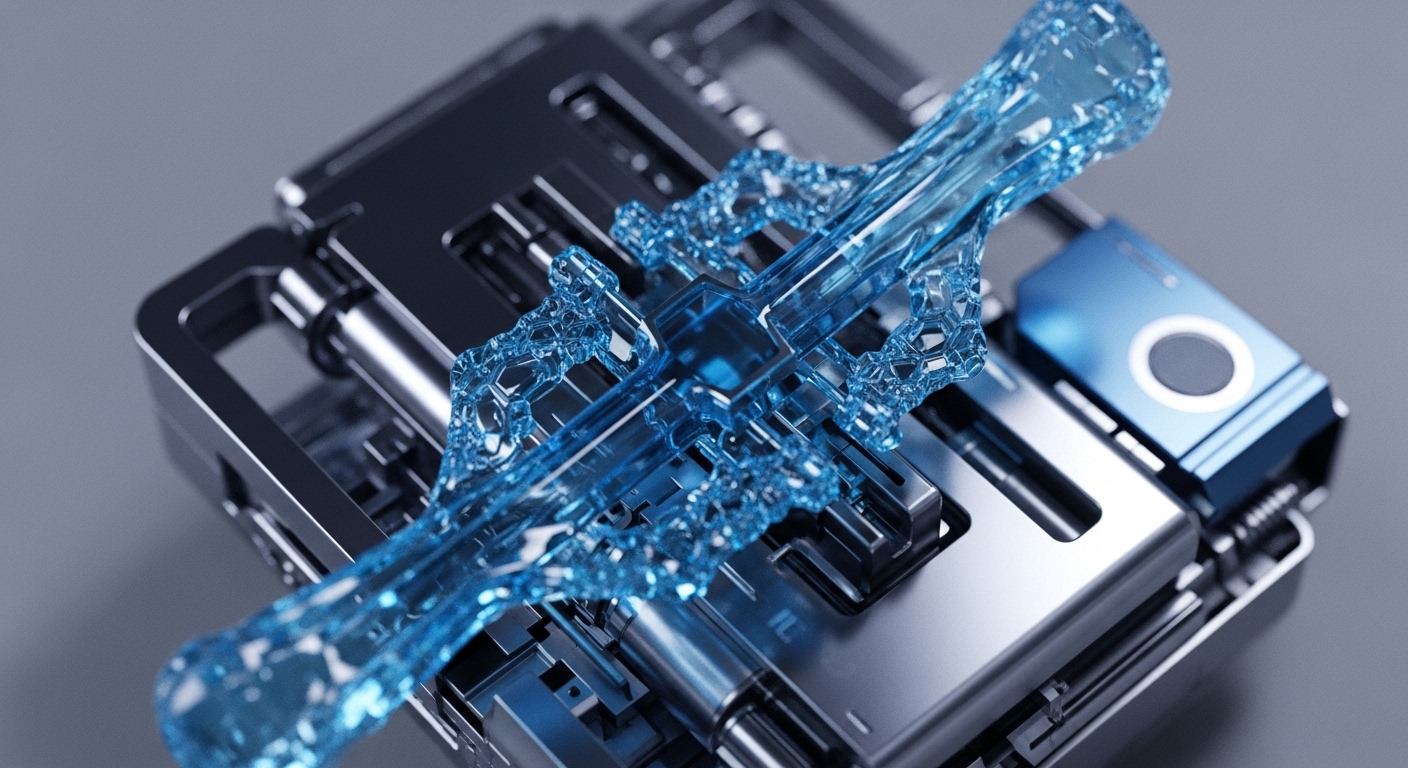

JPMorgan Chase has executed the first tokenization of a Private Equity fund on its proprietary distributed ledger technology (DLT) platform, Kinexys Fund Flow. This adoption fundamentally alters the back-office infrastructure for alternative investments, replacing manual, document-intensive processes with a shared, automated ledger. The primary consequence is the creation of a seamless digital representation of fund ownership, which directly addresses the structural illiquidity of private markets. The initiative is positioned as a prelude to a wider rollout in 2026, which will expand the tokenization framework to include private credit, real estate, and hedge funds.

Context

The alternative investment industry has historically been plagued by operational friction stemming from fragmented recordkeeping, protracted settlement cycles, and opaque capital call processes. Traditional private equity fund administration relies on siloed databases and manual communication between fund managers, administrators, and investors, leading to settlement times measured in days or weeks and a substantial allocation of idle capital. This prevailing operational challenge increases administrative costs and severely limits the ability to trade ownership stakes, thereby suppressing liquidity and market access for smaller institutions and high-net-worth clients.

Analysis

The adoption directly alters the core fund administration and treasury management systems by shifting the record of investor ownership from a traditional book-entry system to a tokenized digital security on the Kinexys DLT. This creates a single, real-time, immutable source of truth for all parties involved, including the fund administrator Citco. The chain of cause and effect is clear → tokenization digitizes investor records, which then enables smart contracts to automate capital activity, such as capital calls and distributions, with programmatic precision.

This systemic upgrade immediately reduces counterparty risk and eliminates the need for manual reconciliation across multiple ledgers, creating value by lowering the Total Cost of Ownership (TCO) for the fund. For the industry, this is significant because it establishes a standardized, institutional-grade digital framework for illiquid assets, paving the way for eventual fractional ownership and a functional secondary market.

Parameters

- Adopting Institution → JPMorgan Chase

- Core Use Case → Private Equity Fund Tokenization

- Technology Platform → Kinexys Fund Flow (Proprietary DLT)

- Key Partner → Citco (Fund Administrator)

- Future Asset Classes → Private Credit, Real Estate, Hedge Funds

- Target Market → Private Banking and Institutional Clients

Outlook

The next phase involves the full commercial launch of the Kinexys Fund Flow platform in 2026, which will broaden the scope of tokenized assets beyond private equity to encompass the entire alternative investment spectrum. This initiative is a competitive signal that will accelerate the industry-wide race among global banks to lead in digital asset infrastructure. The second-order effect is the establishment of a new industry standard for the servicing of alternative assets, forcing competitors to either integrate with the Kinexys framework or rapidly deploy their own proprietary DLT solutions to maintain market share and address client demand for improved capital efficiency.