Briefing

Large enterprises are rapidly transitioning to blockchain-based payment systems, signaling a fundamental shift in global financial infrastructure. This adoption is primarily driven by the imperative to overcome the inherent inefficiencies and security vulnerabilities of traditional payment networks, leading to significant operational cost reductions and accelerated transaction finality. The market projects stablecoin usage, a key component of this shift, to reach $2 trillion by 2028, reflecting a substantial increase from its current $250 billion volume and underscoring the scale of this economic transformation.

Context

Prior to this integration, traditional financial transaction systems operated as a complex, multi-intermediary network, characterized by slow settlement times, high cross-border fees, and opaque data trails. These legacy systems were susceptible to data breaches, averaging over $6 million per incident, and relied heavily on manual processes that generated costly errors and frequent chargebacks. Such an antiquated structure hindered the agility required by the modern digital economy, necessitating a transformative operational overhaul.

Analysis

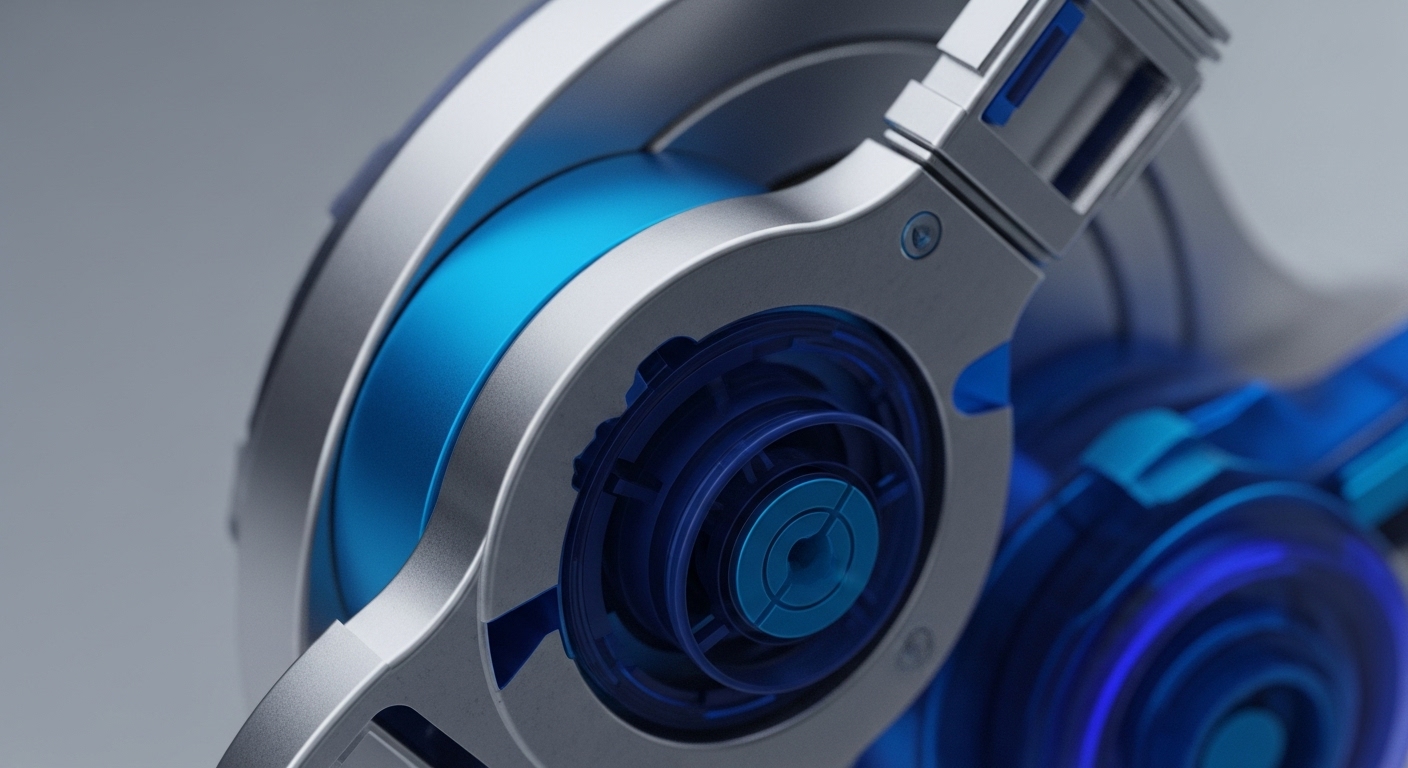

The adoption of blockchain technology fundamentally alters enterprise payment mechanics by establishing a distributed, cryptographically secured ledger that ensures data integrity and transactional transparency. This new infrastructure facilitates near-instantaneous global settlement, moving beyond the 1-5 business day cycles of traditional systems to mere seconds or minutes. Furthermore, the integration of smart contracts enables programmable money, automating complex payment logic and distributing value based on predefined conditions, thereby reducing manual intervention and counterparty risk. This systemic enhancement provides a “golden record” for AI-driven analytics, enabling real-time fraud detection and more precise financial forecasting.

Parameters

- Core Technology → Blockchain Technology

- Primary Use Case → Enterprise Payments

- Key Enabler → Stablecoins (e.g. USDT, USDC)

- Solution Provider Example → NOWPayments (non-custodial payment gateway)

- Transaction Cost Reduction → From 4-6% to 0.1-2% for cross-border fees

- Settlement Speed Improvement → From 1-5 business days to seconds-minutes

- Market Growth Projection → Blockchain technology market to exceed $390 billion by 2030

- Stablecoin Market Projection → $2 trillion by 2028

Outlook

The forward trajectory indicates a continued scaling of blockchain-based payment solutions from pilot programs to full production environments across diverse industries. This widespread integration is poised to establish new industry standards for transactional efficiency, security, and programmability, compelling competitors to accelerate their own digital transformation initiatives or risk significant competitive disadvantage. The evolving regulatory landscape, as evidenced by discussions around stablecoins, will further solidify the operational frameworks for these advanced payment rails.

Verdict

The enterprise-wide pivot to blockchain-based payments represents a critical architectural upgrade, establishing a superior financial operating model essential for competitive advantage and future economic agility.