Briefing

Mastercard, in collaboration with R3, has deployed a new tokenized trade finance platform, fundamentally altering the operating model for a consortium of global banks by converting illiquid trade receivables into instantly tradable digital assets. This systemic upgrade directly addresses the $17 trillion global trade finance gap, establishing a new shared ledger for asset ownership and reducing settlement times from multiple days to near-instantaneous T+0 finality. The initiative’s immediate scale is quantified by the target of tokenizing $500 million in trade assets within the platform’s inaugural year.

Context

The traditional trade finance ecosystem is characterized by fragmented, paper-intensive processes and reliance on complex correspondent banking relationships, resulting in significant operational friction and high capital costs. This prevailing inefficiency is rooted in the lack of a unified, trustworthy system for verifying asset ownership and managing the inherent counterparty risk associated with cross-border transactions, leading to extended settlement cycles and the exclusion of small and medium-sized enterprises from necessary liquidity.

Analysis

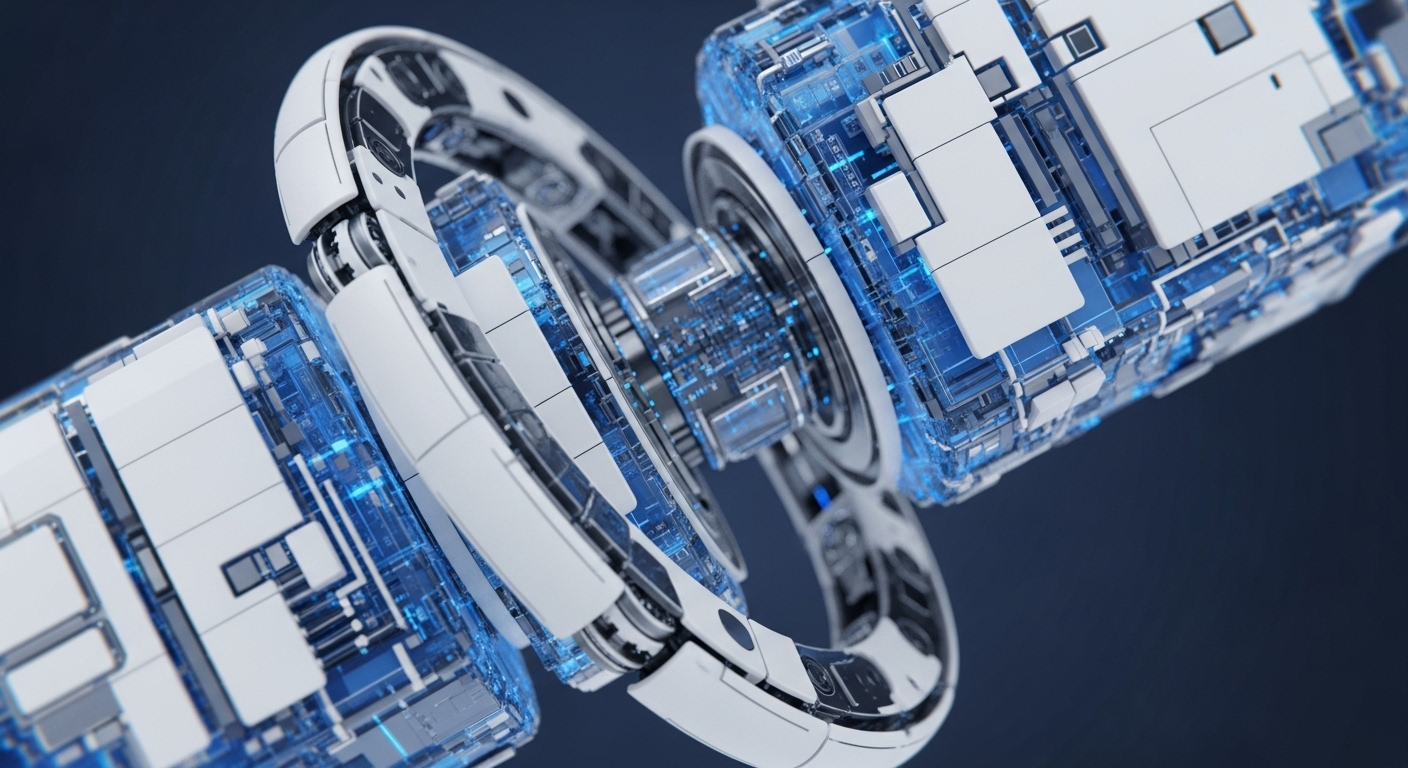

The adoption specifically alters the financial institution’s treasury management and risk mitigation systems by implementing a Corda-based shared ledger as the canonical source of truth for trade assets. This integration allows a trade receivable to be tokenized → a digital twin of the asset → which is then instantly transferable and verifiable among the consortium members, eliminating the need for complex reconciliation. The chain of cause and effect is clear → DLT enables asset fractionalization and atomic settlement, which increases the capital efficiency of the banks and unlocks a new, liquid market for trade assets, ultimately creating value by transforming a static balance sheet item into a dynamic, tradable security.

Parameters

- Core Partner → Mastercard

- DLT Protocol → R3 Corda

- Business Vertical → Trade Finance

- Scale Metric → $500 Million Tokenization Target

- Key Outcome → T+0 Settlement Finality

Outlook

The next phase involves scaling the platform’s consortium membership and integrating its tokenized asset APIs with existing enterprise resource planning (ERP) systems of corporate clients to automate the issuance process. This adoption is set to establish a new industry standard for trade finance, compelling competitor consortia to migrate off legacy bilateral systems and adopt DLT-based shared infrastructure to maintain competitive parity in operational speed and cost.

Verdict

The launch of a tokenized trade finance utility represents a definitive strategic move, proving that DLT is the essential architectural layer for optimizing institutional capital and creating new, high-velocity asset classes.