Briefing

Mastercard has formally partnered with R3 to develop a blockchain-powered solution for cross-border payments, a strategic move designed to accelerate global settlements for financial institutions. This initiative directly addresses the inefficiencies inherent in traditional international money movement, aiming to provide a more streamlined and cost-effective alternative. The collaboration integrates R3’s specialized blockchain expertise with Mastercard’s extensive payment network, targeting a significant reduction in transaction times and operational overhead for its member banks.

Context

Prior to this integration, the prevailing operational challenge in cross-border payments involved slow settlement times and high intermediary costs, which burdened financial institutions and their corporate clients. Traditional correspondent banking networks, while established, often introduce friction through multiple intermediaries and disparate systems, leading to delayed fund availability and opaque transaction statuses. This fragmented landscape necessitated a more unified and efficient mechanism for value transfer across borders.

Analysis

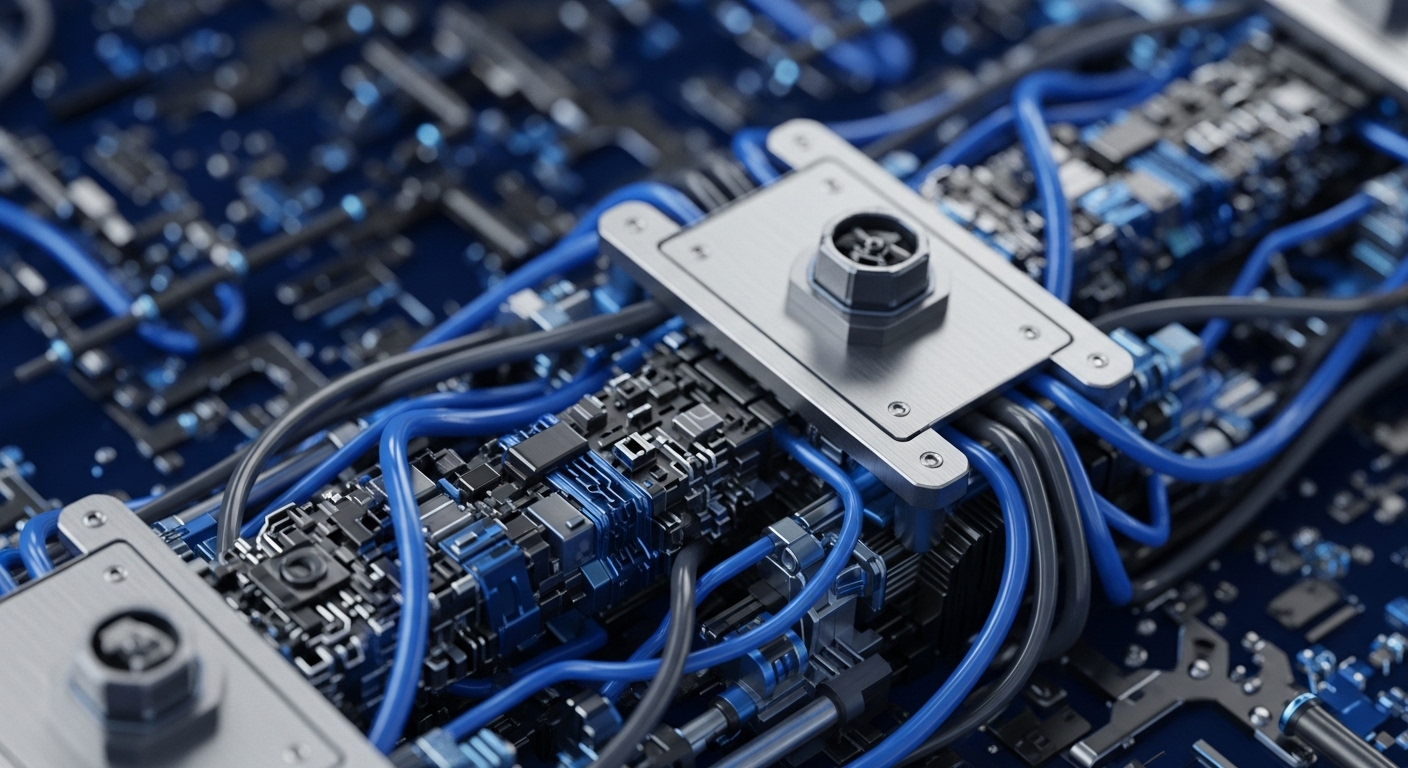

This adoption fundamentally alters the operational mechanics of cross-border B2B payments within Mastercard’s ecosystem. The new system, built on Corda Enterprise, functions as a dedicated settlement layer, enabling direct, secure transfers between participating financial institutions. This architecture bypasses traditional, multi-hop payment routes, thereby reducing counterparty risk and accelerating the finality of transactions.

For the enterprise, this translates into enhanced treasury management capabilities, improved liquidity utilization, and a competitive advantage in offering faster, more transparent international payment services to their clients. The strategic significance for the industry lies in establishing a robust, permissioned blockchain framework that can scale to meet the demands of global financial flows while adhering to regulatory requirements.

Parameters

- Primary Companies → Mastercard, R3

- Blockchain Protocol → Corda Enterprise

- Core Use Case → Cross-border B2B Payments

- Key Objective → Faster Global Settlements

Outlook

The next phase of this project will likely focus on pilot programs with key financial institutions within Mastercard’s network, validating the solution’s scalability and interoperability with existing legacy systems. This initiative has the potential to establish new industry standards for real-time gross settlement in international finance, compelling competitors to evaluate similar DLT-based enhancements. The successful deployment of such a platform could also catalyze the development of new financial products and services, further integrating digital assets into mainstream corporate treasury functions.