Briefing

The Office of the Comptroller of the Currency (OCC) has issued Interpretive Letter 1186, confirming that national banks may hold de minimis amounts of native crypto-assets to pay blockchain network fees and conduct system testing, a ruling that fundamentally alters the operational feasibility of institutional digital asset platforms. This authorization immediately removes the dependency on third-party fee providers, enabling banks to control the final step of on-chain activity, which is the necessary architectural prerequisite for developing predictable and resilient custody, settlement, and tokenization services. The primary consequence is a substantial reduction in latency and operational friction across all blockchain-enabled workflows, with the ruling explicitly allowing for the holding of limited tokens to test digital-asset platforms before full launch.

Context

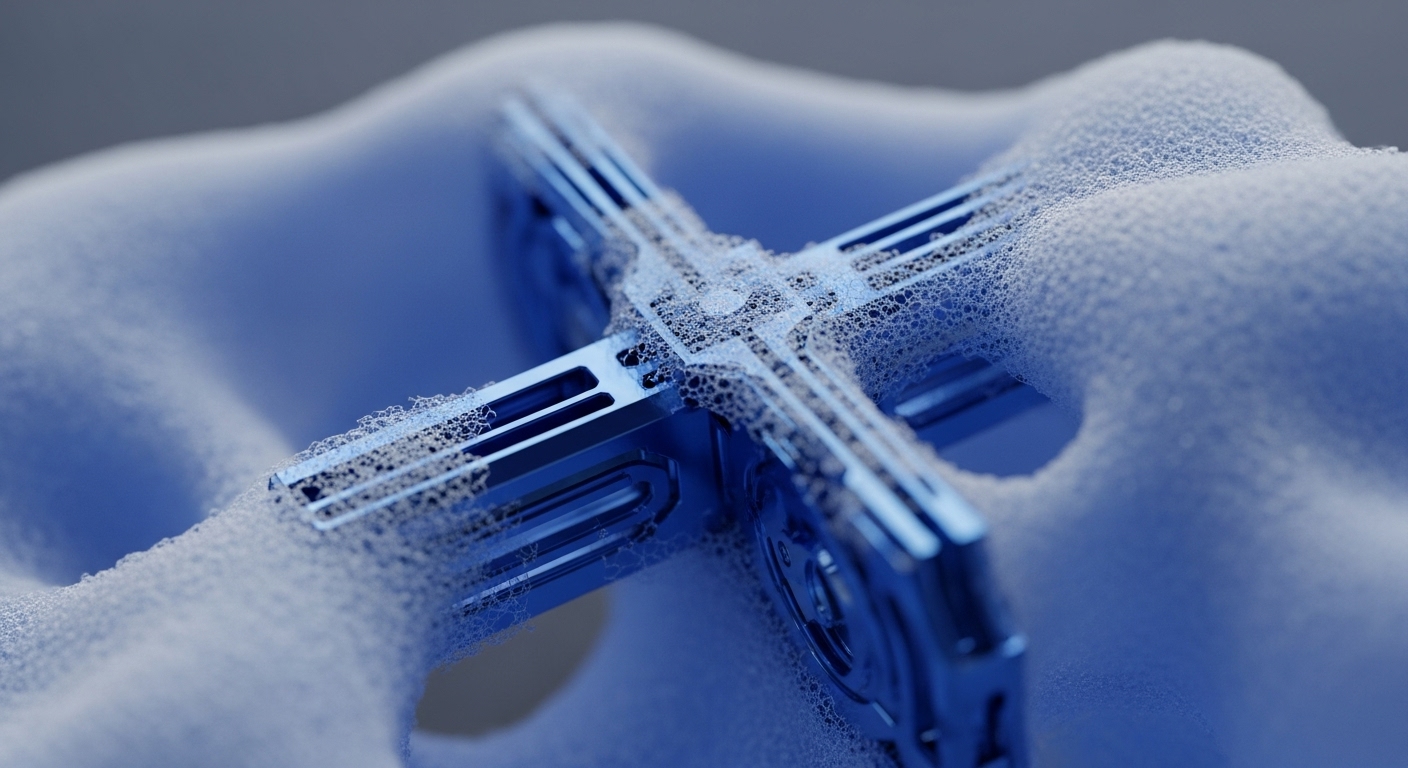

Before this regulatory clarification, national banks developing blockchain solutions faced a significant operational challenge → the inability to natively interact with the network layer. Banks were forced to rely on external fee providers or customer-supplied tokens to cover “gas fees” for transactions, a requirement that introduced substantial cost, third-party risk, and systemic latency into critical processes like custody transfers and settlement. This reliance fragmented the workflow, discouraged thorough system testing, and prevented institutions from achieving the control necessary to integrate blockchain as a core, compliant banking utility.

Analysis

This ruling directly impacts the operational mechanics of the bank’s core settlement and custody systems by allowing for direct, on-chain operations. The ability to hold native tokens for gas fees means the bank can now process transactions, reconcile internal wallets, and support tokenized transfers without relying on external intermediaries, thereby controlling the final step of the on-chain value movement. This control is critical for two reasons → first, it reduces operational friction and latency, enabling programmable payments and tokenized transfers to become predictable and resilient.

Second, it allows for the development of a more robust, internal infrastructure for tokenization and settlement, moving these functions from an outsourced service to an integrated, in-house capability. The result is a more resilient digital asset platform that is compliant with a clear supervisory framework, accelerating the time-to-market for regulated DLT products.

Parameters

- Regulatory Instrument → OCC Interpretive Letter 1186

- Regulated Entities → National Banks

- Permitted Activity → Holding native tokens for gas fees and testing

- Immediate Use Case → Direct On-Chain Operations

- Quantifiable Detail → De Minimis Holdings

- Primary Systems Altered → Custody, Settlement, and Tokenization Infrastructure

Outlook

The OCC’s action establishes a clear supervisory framework, significantly reducing a major point of hesitation for institutions, and is expected to accelerate the development and deployment of regulated DLT products across the US banking sector. The next phase will involve banks rapidly integrating this capability to launch tokenized deposits, digital asset custody, and real-time settlement platforms with enhanced reliability. This regulatory precedent will likely compel international competitors to seek similar clarity, standardizing the operational foundation required for institutional digital asset activity and cementing the convergence of traditional finance with blockchain infrastructure.

Verdict

This regulatory milestone is the critical, foundational authorization that transforms blockchain from an external service into an integrated, core banking utility.