Briefing

Paydax Protocol has achieved significant institutional adoption for its decentralized finance (DeFi) platform, which redefines traditional banking services by enabling lending, borrowing, and insurance against both cryptocurrencies and tokenized real-world assets. This strategic shift positions Paydax to capture market share by offering enhanced capital access and operational transparency, directly challenging established financial intermediaries. The platform’s rapidly expanding user base and ongoing presale underscore its potential for substantial growth and market disruption within the digital asset ecosystem.

Context

Prior to the advent of such decentralized solutions, traditional banking systems frequently presented operational challenges characterized by high interest rates, rigid repayment terms, and extensive paperwork, often limiting access to capital for a broad spectrum of borrowers. These legacy processes also suffered from opaque operations and reliance on intermediaries, leading to inefficiencies and exclusion for millions globally. The prevailing model often concentrated control within a few institutions, creating a demand for more equitable and efficient financial frameworks.

Analysis

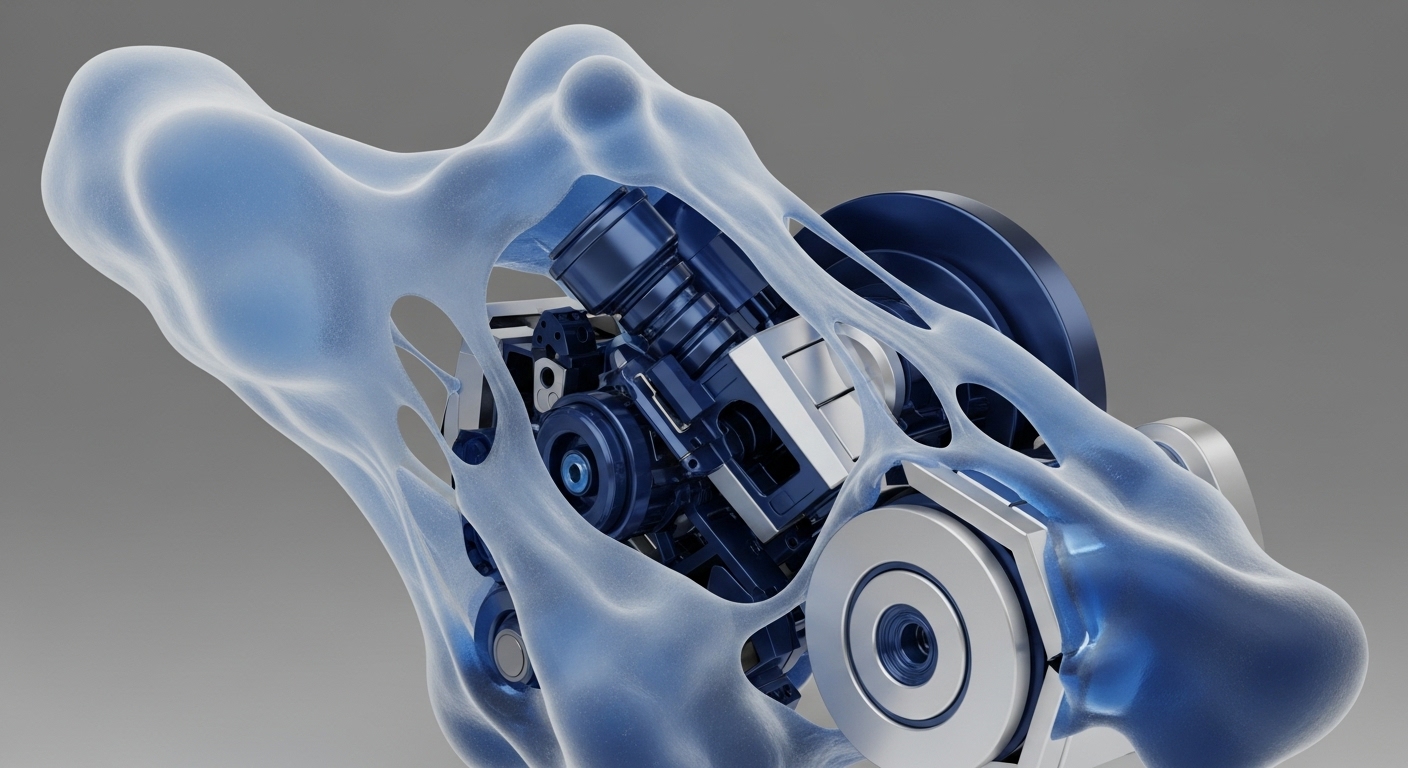

Paydax Protocol’s adoption profoundly alters the operational mechanics of financial intermediation, specifically targeting the lending, borrowing, and insurance sectors. By migrating these functions onto a transparent, decentralized blockchain, the platform eliminates the need for traditional gatekeepers, replacing them with smart contracts that automate transactions and ensure verifiable trust. This integration allows enterprises and individual participants to leverage diverse assets, including authenticated luxury goods or real estate via partnerships with entities like Sotheby’s and Brinks, as collateral for immediate liquidity. The systemic impact extends to reduced counterparty risk, accelerated transaction settlements, and enhanced capital efficiency, fundamentally reshaping how value is accessed and managed across the financial landscape.

Parameters

- Core Platform → Paydax Protocol (PDP)

- Primary Use Case → DeFi Lending, Borrowing, and Insurance

- Collateral Assets → Cryptocurrencies and Tokenized Real-World Assets (RWAs)

- Key Partnerships → Sotheby’s, Christie’s, Brinks (for RWA valuation and security)

- Technology Integrations → Chainlink (for on-chain data oracles), Jumio, Onfido (for KYC verification)

- Security Audits → Assure DeFi, Hacken, Rapid Innovation, Quill Audits

- Yield for Lenders → Up to 15.2% APY

Outlook

The next phase for Paydax Protocol involves continued expansion of its institutional user base and further integration of diverse real-world assets, potentially establishing new industry benchmarks for decentralized finance. This trajectory could compel traditional financial institutions to accelerate their own digital transformation initiatives, fostering a more competitive and innovative financial ecosystem. The protocol’s emphasis on transparency and verifiable security through smart contracts and third-party audits is poised to set a new standard for trust in the evolving digital asset space, potentially driving broader regulatory acceptance and mainstream adoption of DeFi banking models.

Verdict

Paydax Protocol’s institutional traction signifies a decisive shift towards decentralized models that effectively bridge traditional asset classes with blockchain liquidity, fundamentally redefining the architecture of global financial services.