Briefing

Robinhood’s launch of tokenized versions of over 200 U.S. stocks and ETFs fundamentally repositions the firm from a traditional brokerage to a vertically integrated digital asset platform. This move immediately addresses the systemic friction of legacy securities settlement by enabling near-instant, 24/7 trading and custody on a proprietary Ethereum Layer 2. The primary consequence is the creation of a highly capital-efficient, globally accessible product line that directly challenges the operating models of incumbent financial institutions. This initiative quantifies its scale by immediately onboarding over 200 U.S. stocks and ETFs, positioning the tokenized stock market for exponential growth.

Context

Traditional equity markets operate under severe operational constraints, primarily characterized by T+2 settlement cycles and restricted exchange hours, which collectively result in significant counterparty risk and locked capital. This prevailing challenge created a structural inefficiency, particularly for cross-border investors seeking fractional or immediate access to U.S. securities, necessitating complex and costly intermediary layers for clearing and custody.

Analysis

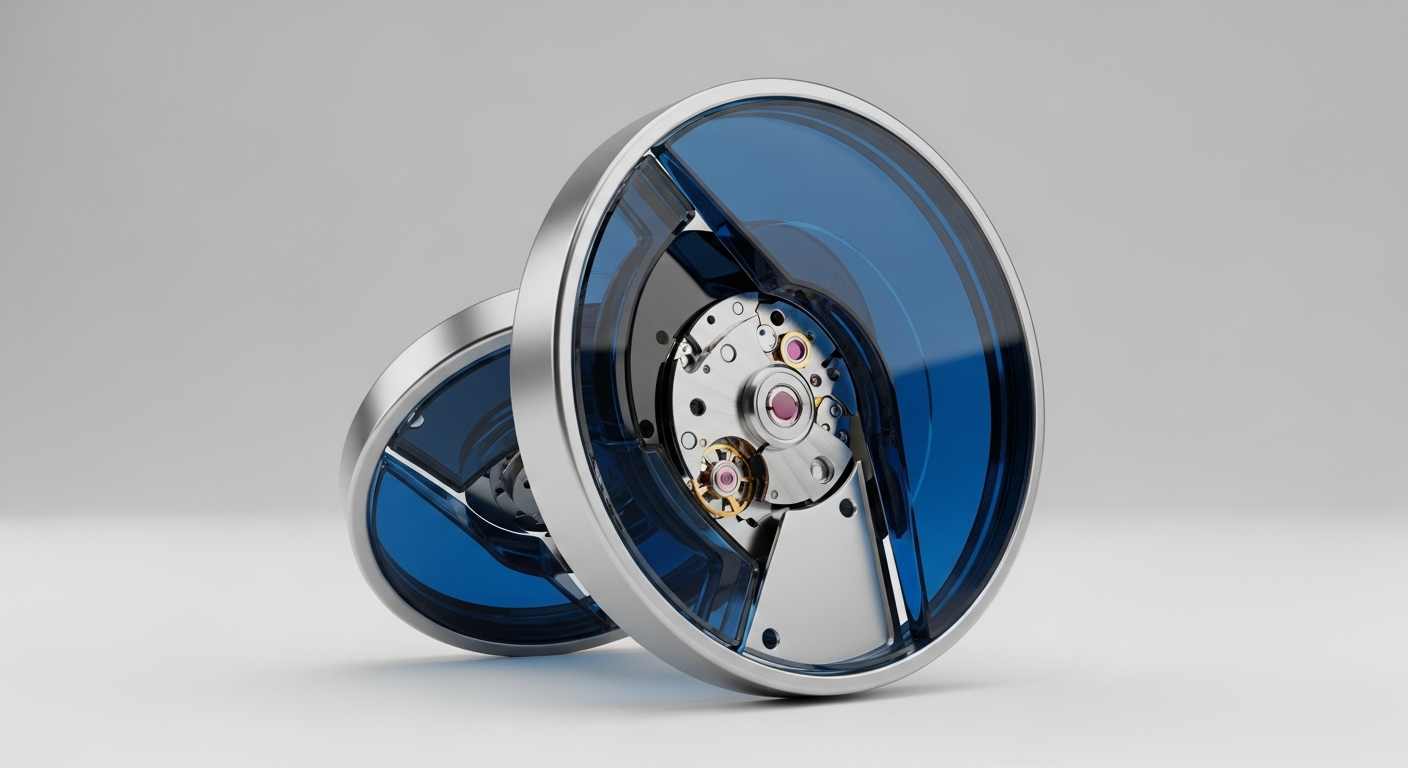

The adoption profoundly alters the enterprise’s Securities Issuance and Settlement system. By migrating the beneficial ownership record to the Robinhood Chain DLT, the platform creates a digital twin of the underlying security. This chain of cause and effect enables T+0 settlement, as the transfer of the token on-chain is simultaneously the transfer of ownership, thereby eliminating the need for post-trade reconciliation and drastically reducing operational float. For the enterprise and its partners, this transition creates value through reduced operational costs, enhanced collateral mobility, and the ability to offer novel, programmable financial products, establishing a new industry benchmark for digital capital market infrastructure.

Parameters

- Issuing Entity → Robinhood

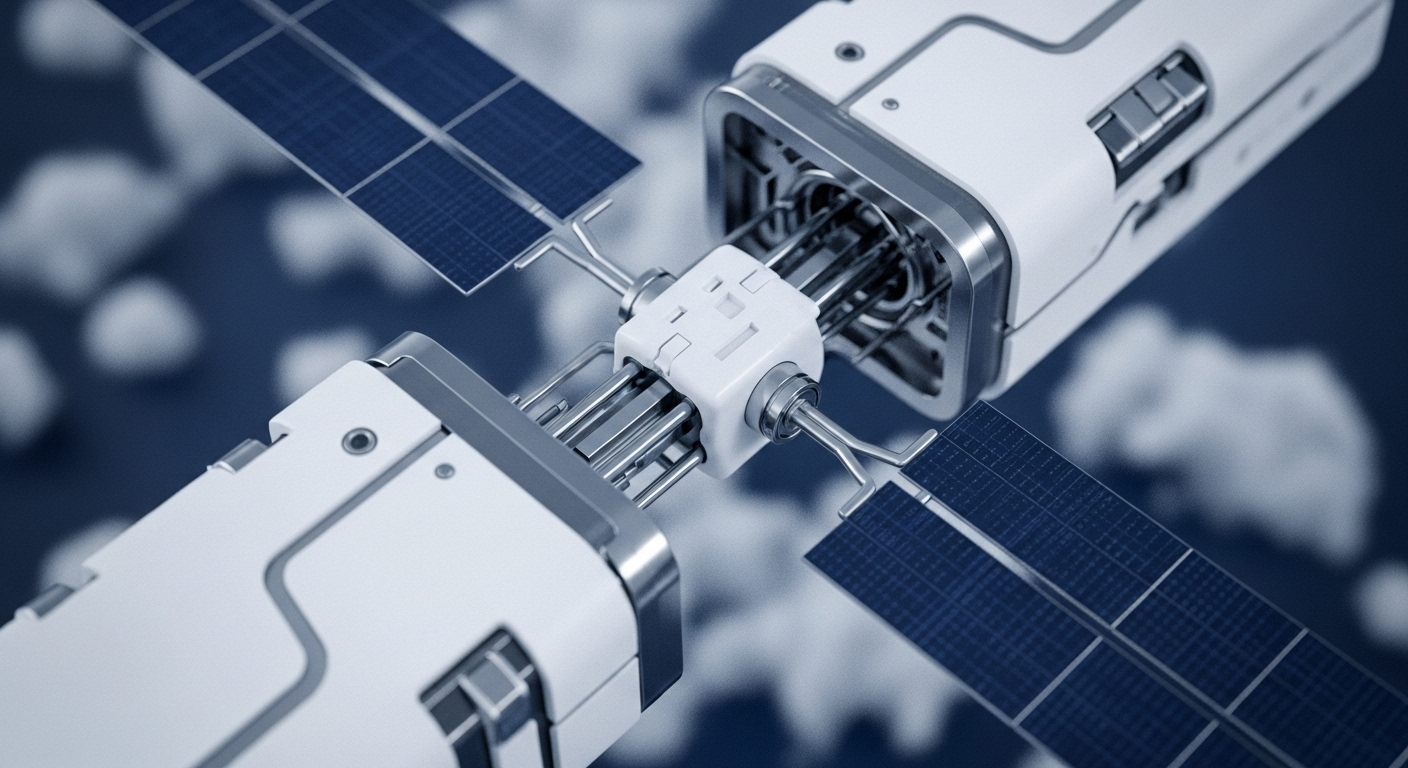

- Technology Stack → Arbitrum, Robinhood Chain (Ethereum Layer 2)

- Asset Class → U.S. Stocks and ETFs

- Scale Metric → Over 200 Tokenized Assets

- Target Market → Global Retail and Institutional Investors

Outlook

The next phase of this rollout involves the full migration to the proprietary Robinhood Chain, which is optimized for regulatory compliance and RWA tokenization at scale. This move is a strategic declaration that will force competing brokerages to accelerate their DLT adoption roadmaps to remain competitive on settlement speed and product availability. This tokenization architecture is poised to establish a new global standard for equity market access, accelerating the projected multi-trillion-dollar growth of the Real-World Asset tokenization sector.

Verdict

Robinhood’s vertical integration of tokenized equities validates DLT as the superior, irreversible infrastructure for modernizing global capital markets and achieving maximum capital efficiency.