Briefing

SharpLink Gaming has initiated the deployment of a $200 million portion of its Ether (ETH) corporate treasury onto ConsenSys’ Linea zkEVM Layer 2 network, fundamentally shifting its financial strategy from passive reserve holding to active, institutional-grade yield generation. This strategic move redefines the firm’s balance sheet as a dynamic, productive asset, utilizing staking and restaking protocols to capture highly competitive, risk-adjusted, ETH-denominated returns, with the initial allocation representing a $200 million commitment over a multi-year period.

Context

Traditional corporate treasury management, even with digital assets, is constrained by a passive holding model where capital reserves remain static, generating minimal yield and failing to keep pace with inflation or alternative growth metrics. This prevailing operational challenge forces enterprises to choose between low-risk, low-return traditional instruments and high-risk, non-compliant DeFi yields, creating a capital efficiency gap that prevents the strategic optimization of substantial digital asset reserves. The need for institutional-grade infrastructure that combines compliance, security, and competitive onchain yield has been the primary impediment to unlocking the full value of corporate digital asset holdings.

Analysis

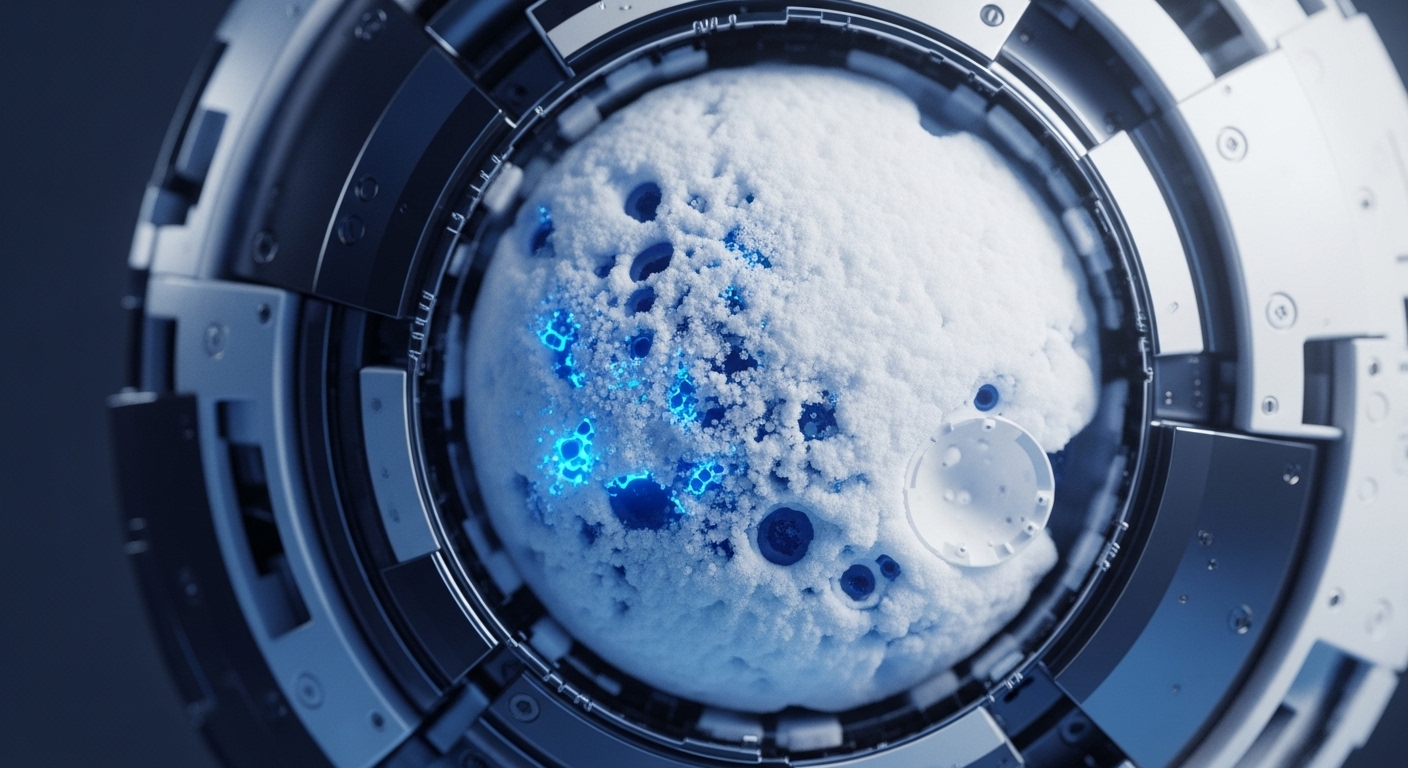

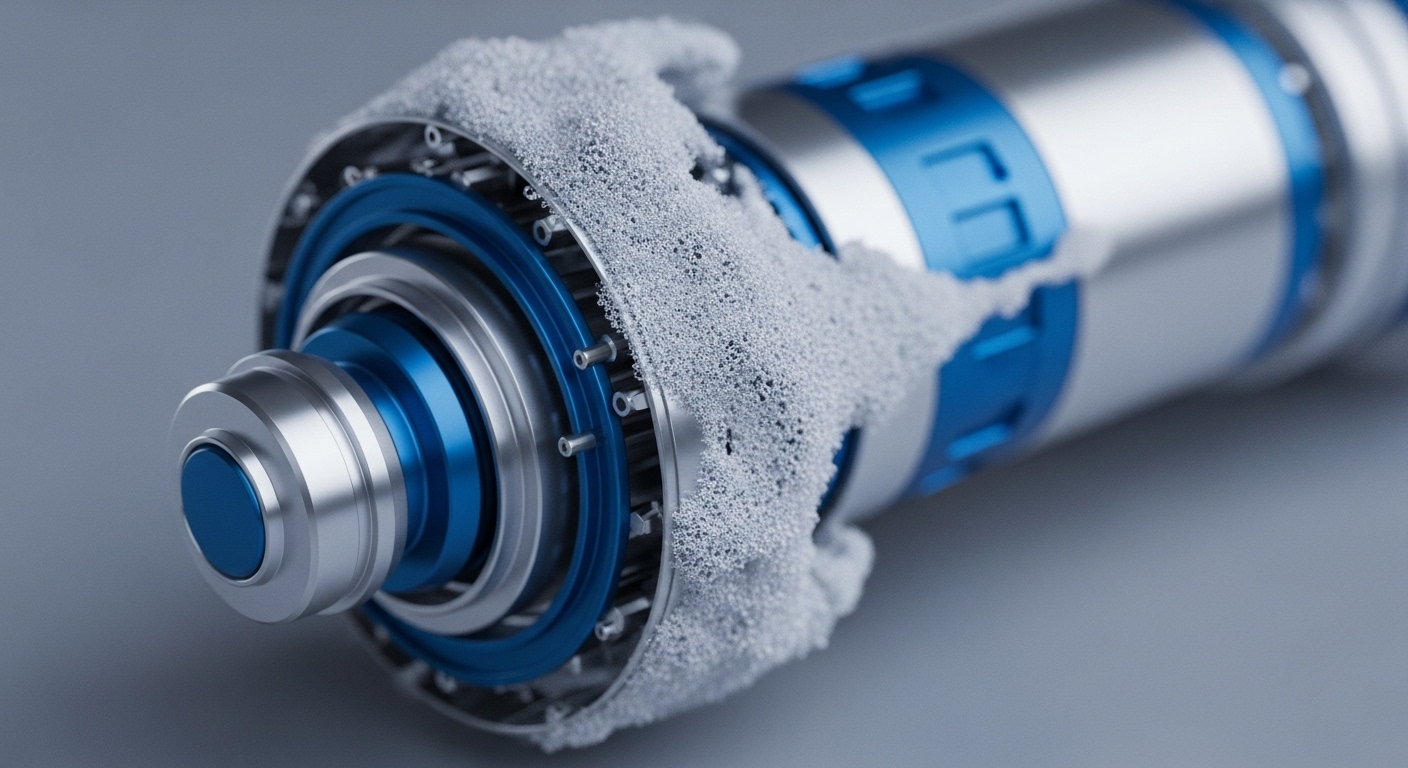

This adoption directly alters the firm’s Digital Asset Treasury (DAT) management system by integrating it with institutional-grade DeFi infrastructure. The chain of effect begins with the secure custody of ETH via Anchorage Digital Bank, which then facilitates deployment onto Linea, a compliant Layer 2 solution. This architecture enables the execution of staking and restaking strategies through providers like ether.fi and EigenCloud. The resulting value creation is multi-faceted → it captures native Ethereum yield, generates restaking rewards for securing emerging AI workloads, and maintains the security and scalability benefits of a Layer 2, effectively transforming a static balance sheet line item into a compounding revenue stream for the enterprise and its stakeholders.

Parameters

- Adopting Company → SharpLink Gaming, Inc. (Nasdaq → SBET)

- Technology Protocol → Ethereum, Linea zkEVM Layer 2

- Use Case → Digital Asset Treasury Yield Optimization

- Scale of Initiative → $200 Million ETH Deployment

- Custody Partner → Anchorage Digital Bank

- Ecosystem Partners → ConsenSys, ether.fi, EigenCloud

Outlook

This integration establishes a new operational standard for public company digital asset treasuries, setting a precedent for compliant, yield-generating corporate finance. The immediate next phase involves the multi-year scaling of the $200 million allocation and the potential tokenization of the firm’s SBET shares on Ethereum. This move exerts competitive pressure on other publicly traded digital asset holders to evolve beyond simple Bitcoin holding, forcing a strategic shift toward active, Ethereum-based capital efficiency models to remain competitive in market capitalization and investor appeal.

Verdict

This deployment validates the institutional-grade maturity of Layer 2 DeFi infrastructure, confirming that compliant, active treasury management is now the necessary strategic imperative for enterprises holding substantial digital assets.