Briefing

SWIFT, in partnership with over 30 global financial institutions and ConsenSys, has unveiled a new blockchain-based ledger designed to modernize international payments and facilitate the movement of regulated tokenized assets. This strategic pivot extends SWIFT’s traditional messaging role into a direct value transfer facilitator, directly addressing the competitive pressure from stablecoins and eliminating the friction of legacy correspondent banking. The primary consequence is the establishment of a robust, 24/7 financial market infrastructure capable of supporting instantaneous, borderless transactions, with the initiative’s scale demonstrated by the participation of over 30 leading global financial institutions in its development and trials.

Context

The traditional model for cross-border payments and securities settlement is characterized by multi-day settlement cycles (T+2), high intermediary costs, and significant counterparty risk due to the need for pre-funding and non-standardized messaging. This operational challenge forces financial institutions to maintain substantial, inefficient liquidity buffers across various nostro/vostro accounts globally, leading to high capital expenditure and limited operational hours tied to disparate regional banking systems. The lack of a unified, real-time settlement layer has constrained capital efficiency and hampered the growth of instantaneous global commerce.

Analysis

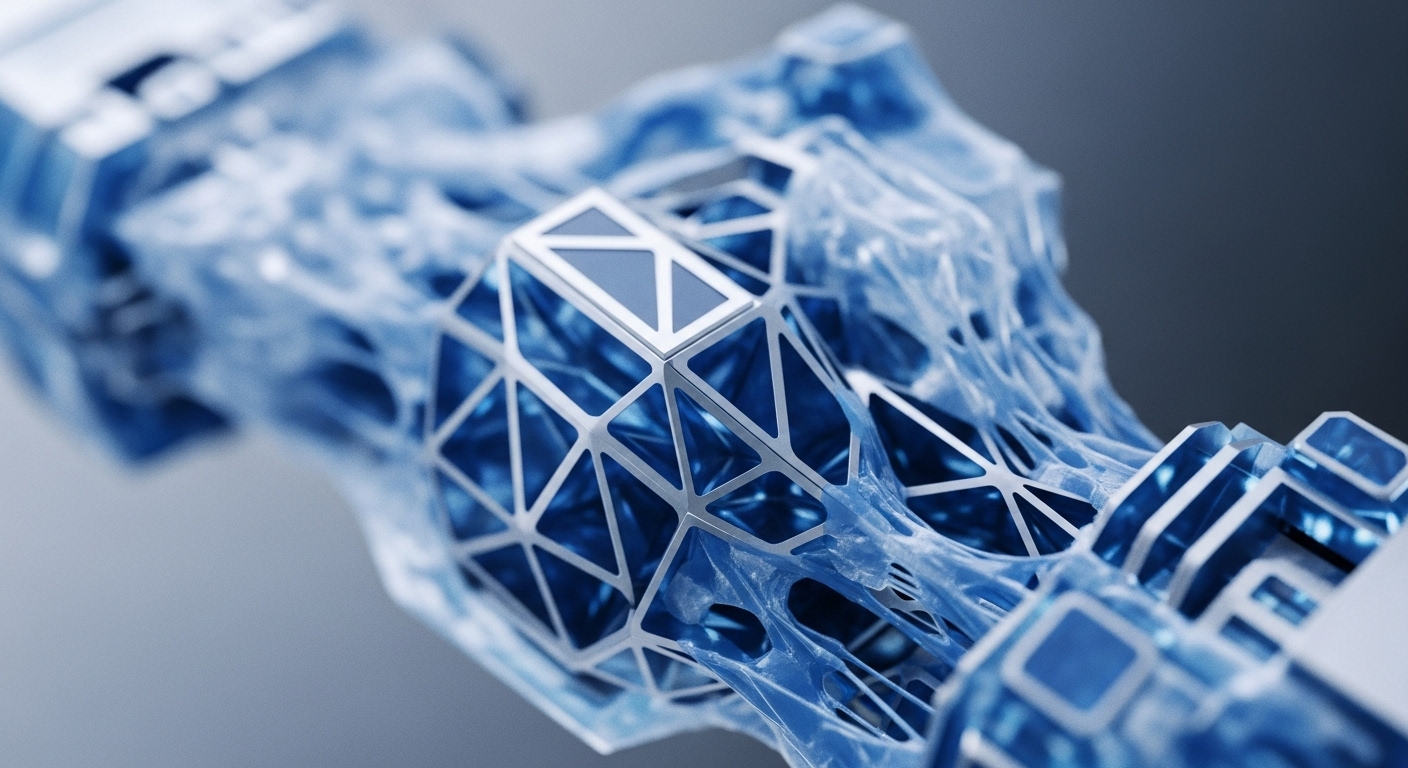

The adoption fundamentally alters the core cross-border payments and securities settlement systems. By deploying a shared digital ledger, the consortium shifts the operational mechanic from sequential, message-based instructions (MT/MX standards) to atomic, simultaneous value transfer and record-keeping. The system utilizes Distributed Ledger Technology (DLT) to sequence, record, and verify tokenized transactions via smart contracts, ensuring immediate, cryptographic finality.

For the enterprise, this cause-and-effect chain delivers immediate capital release by eliminating the need for pre-funding in intermediary banks, translating directly into enhanced capital efficiency. The platform’s ability to handle tokenized assets, such as the demonstrated Eurobond, establishes a single, compliant venue for asset issuance and secondary trading, creating an integrated digital asset lifecycle management system that significantly reduces operational risk and friction for all participating financial partners.

Parameters

- Adopting Entity → SWIFT (Society for Worldwide Interbank Financial Telecommunication)

- Consortium Scale → Over 30 Global Financial Institutions

- Core Technology Partner → ConsenSys

- Underlying Protocol → Ethereum Layer 2 (Linea) for prototyping

- Primary Use Case → 24/7 Cross-Border Payments and Tokenized Securities Settlement

- Demonstrated Asset Class → Tokenized Eurobond

Outlook

The immediate next phase involves expanding the live digital asset trials across North America, Europe, and Asia, moving from testnet demonstrations to production-scale integration with regulated digital assets and tokenized deposits. The second-order effect will compel competing payment networks and custodian banks to rapidly accelerate their own DLT initiatives, as SWIFT’s platform establishes a new baseline for T+0 settlement and capital mobility. This adoption is poised to establish the industry standard for interoperability between traditional financial market infrastructure and the emerging regulated digital asset ecosystem, mandating a systemic re-architecture of treasury and settlement operations across the global banking sector.