Briefing

SWIFT, the global financial messaging network, is developing a blockchain-based shared ledger to facilitate real-time, 24/7 cross-border payments. This initiative represents a significant evolution beyond its traditional messaging infrastructure, positioning SWIFT to support the movement of regulated tokenized value across digital ecosystems. The project, involving over 30 financial institutions from 16 countries, aims to establish a resilient, future-ready global financial infrastructure, extending SWIFT’s core function into digital asset settlement. This strategic move directly addresses the demand for enhanced efficiency, transparency, and security in international transactions, with the ledger designed to process tokenized value and optimize liquidity.

Context

The traditional paradigm of cross-border payments has been characterized by inherent inefficiencies, including protracted settlement times, opaque transaction visibility, and elevated intermediary costs. Legacy systems, often reliant on a fragmented network of correspondent banks and batch processing, introduce friction into the global financial ecosystem. This operational challenge has necessitated a modernization of the underlying infrastructure to support the instantaneous, transparent, and cost-effective movement of value demanded by contemporary global commerce.

Analysis

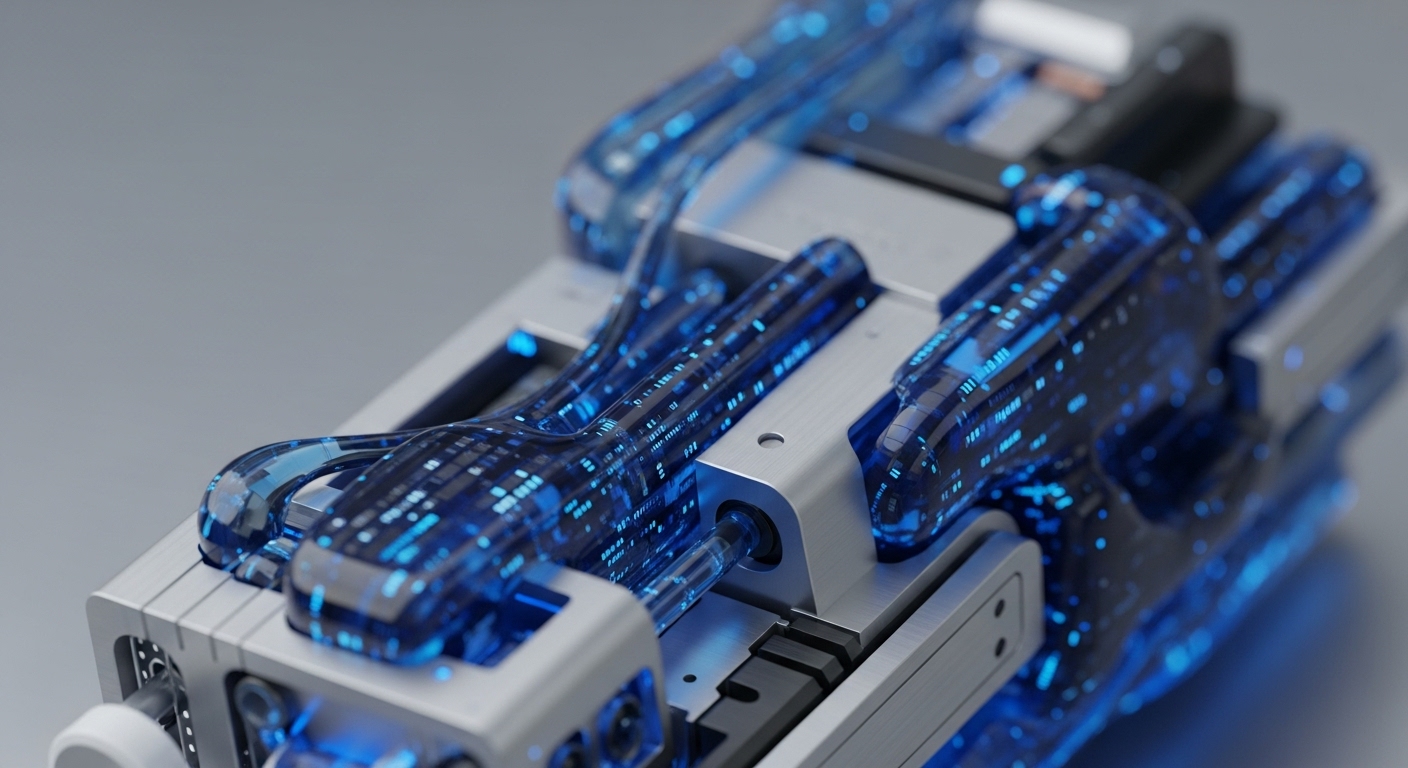

This adoption fundamentally alters the operational mechanics of cross-border payments by introducing a shared, blockchain-based ledger. The ledger will function as a secure, distributed system, recording, sequencing, and validating transactions while enforcing rules through smart contracts. This shifts the payment process from a sequential, message-based system to a synchronized, ledger-based settlement, directly impacting treasury management and global transaction services.

For enterprises and their partners, this means reduced counterparty risk, enhanced intraday liquidity management, and the potential for T+0 settlement. The interoperability design ensures seamless interaction with both existing fiat rails and emerging digital asset networks, creating value by streamlining operational workflows and unlocking new capabilities for tokenized asset transfers across the financial industry.

Parameters

- Organization → SWIFT

- Project Type → Blockchain-based Shared Ledger Development

- Use Case → Real-time, 24/7 Cross-Border Payments and Tokenized Value Transfer

- Collaboration → Over 30 Financial Institutions Across 16 Countries

- Technology Partner → Consensys (for conceptual prototype)

- Stated Objective → Enhance Efficiency, Transparency, and Security in Global Payments

Outlook

The next phase involves rapid completion of the conceptual prototype with Consensys, followed by defining subsequent development stages and implementation timelines with the global banking community. This initiative is poised to establish new industry standards for digital settlement, potentially accelerating institutional adoption of tokenized assets by providing a familiar and trusted infrastructure. Competitors, including commercial blockchain networks, will face pressure to demonstrate comparable levels of global reach, regulatory compliance, and interoperability, as SWIFT leverages its neutral position to define the future architecture of digital finance.