Briefing

UBS successfully completed a live, end-to-end tokenized fund transaction, executing on-chain subscription and redemption requests for its USD Money Market Investment Fund Token. This adoption immediately validates the Chainlink Digital Transfer Agent (DTA) technical standard as a critical middleware layer for institutional asset servicing, fundamentally shifting fund operations from manual, batch-processed workflows to atomic, real-time smart contract execution. The primary consequence is the creation of product composability, allowing the fund to be integrated directly into other decentralized applications, thereby unlocking new liquidity sources and setting a new benchmark for capital efficiency in the $5.7 trillion money market fund industry.

Context

The traditional fund distribution and asset servicing model is characterized by fragmented, siloed data systems, requiring manual reconciliation and relying on legacy T+2 or T+3 settlement cycles. This prevailing operational challenge introduces significant counterparty risk, locks up trillions in capital due to settlement delays, and severely limits the ability to use fund shares as instantly mobile collateral in other financial instruments. The lack of a unified digital standard for ownership transfer and corporate actions prevents the seamless, automated integration required for modern portfolio construction.

Analysis

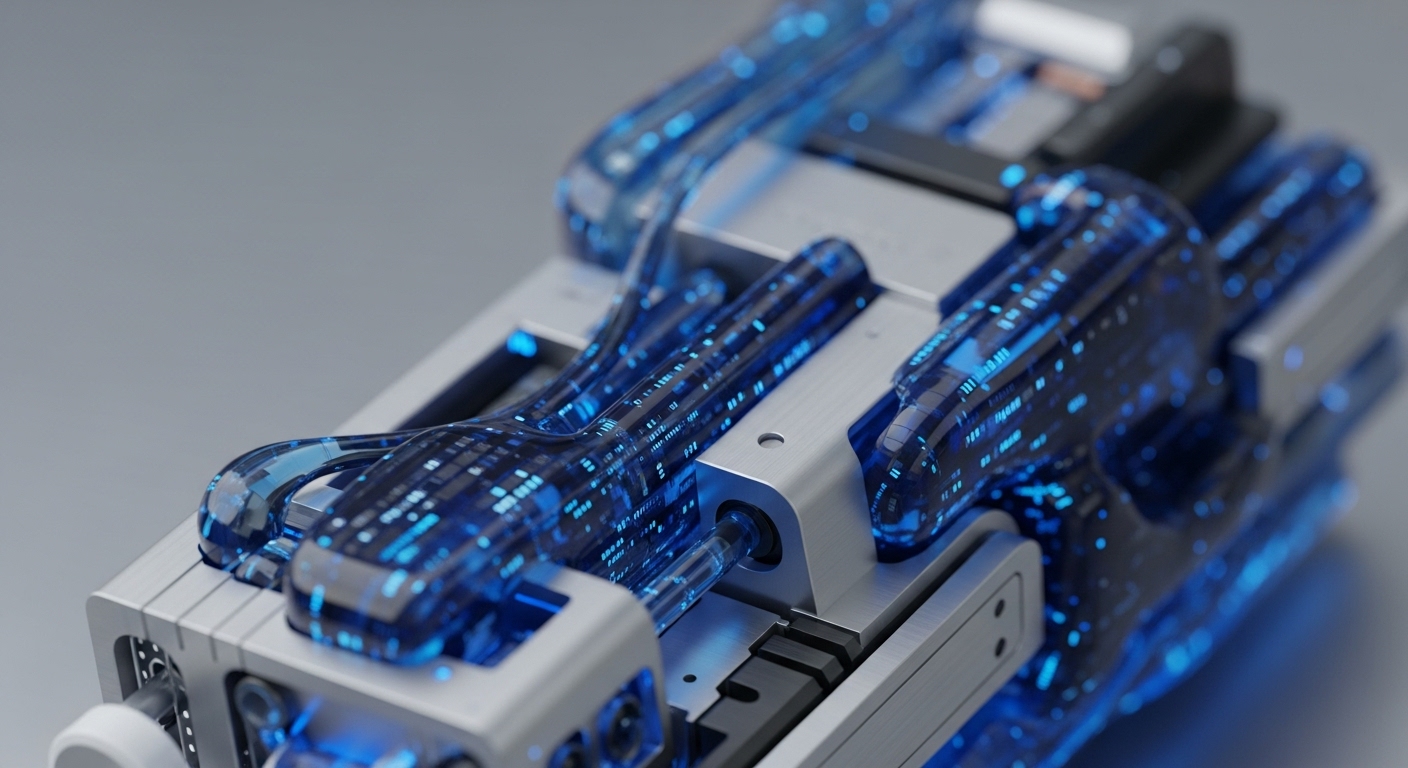

This adoption alters the core operational mechanics of fund transfer agency and treasury management by migrating the subscription and redemption logic onto an Ethereum-based Distributed Ledger Technology (DLT). The Chainlink DTA standard acts as the connective tissue, providing a secure, compliant, and standardized API for external parties → like the on-chain distributor DigiFT → to interact directly with the tokenized fund’s smart contract. The chain of cause and effect is direct → the DTA standard automates the validation of investor status and fund rules before the transaction is executed, eliminating post-trade settlement risk and reducing the administrative burden that currently costs thousands of hours. This shift is significant for the industry because it proves that regulated financial products can be made programmatically composable, enabling the immediate use of tokenized fund shares as collateral across various DLT networks and establishing a foundation for a truly integrated, 24/7 global capital market.

Parameters

- Issuing Institution → UBS

- DLT Protocol → Ethereum

- Technical Standard → Chainlink Digital Transfer Agent (DTA)

- Asset Class → Money Market Fund (UBS USD Money Market Investment Fund Token)

- Use Case → On-chain Subscription and Redemption

- Operational Benefit → Enhanced Fund Operations and Product Composability

Outlook

The successful integration of a standardized DLT agent for fund operations signals the imminent establishment of an industry-wide compliance and interoperability layer for tokenized assets. The next phase will involve expanding the DTA standard to other asset classes, including bonds and structured products, and integrating with other major financial institutions and custodians. This standardization will create network effects, forcing competitors to adopt similar protocols to remain interoperable, ultimately accelerating the shift of global securities onto shared ledger infrastructure and making T+0 settlement the new market baseline.

Verdict

The validation of the Digital Transfer Agent standard by a major global bank is the definitive technical step toward making tokenized funds an operationally seamless, liquid, and composable primitive in the future of institutional finance.