Briefing

Visa Inc. is significantly scaling its stablecoin pre-funding pilot for cross-border payments, utilizing fiat-backed digital currencies to modernize its Visa Direct service. This strategic adoption immediately re-architects the firm’s treasury operations and those of its financial institution partners by eliminating the necessity of pre-depositing dormant capital in foreign bank accounts, directly addressing the systemic inefficiency of “trapped cash” in the correspondent banking model. The initiative is already demonstrating substantial traction, with the monthly stablecoin settlement volume now operating at an annualized run rate surpassing $2.5 billion.

Context

The prevailing operational challenge in global payments is the requirement for financial institutions and large enterprises to maintain significant, non-yielding balances (nostro/vostro accounts) across numerous foreign jurisdictions to ensure sufficient liquidity for cross-border transactions. This traditional pre-funding mechanism results in substantial capital lockup, high operational costs associated with managing fragmented fiat reserves, and settlement times that are restricted to banking hours and multiple business days. This structural inefficiency forces treasurers to manage a complex web of intermediary relationships, which directly impacts the enterprise’s overall working capital efficiency and cost of capital.

Analysis

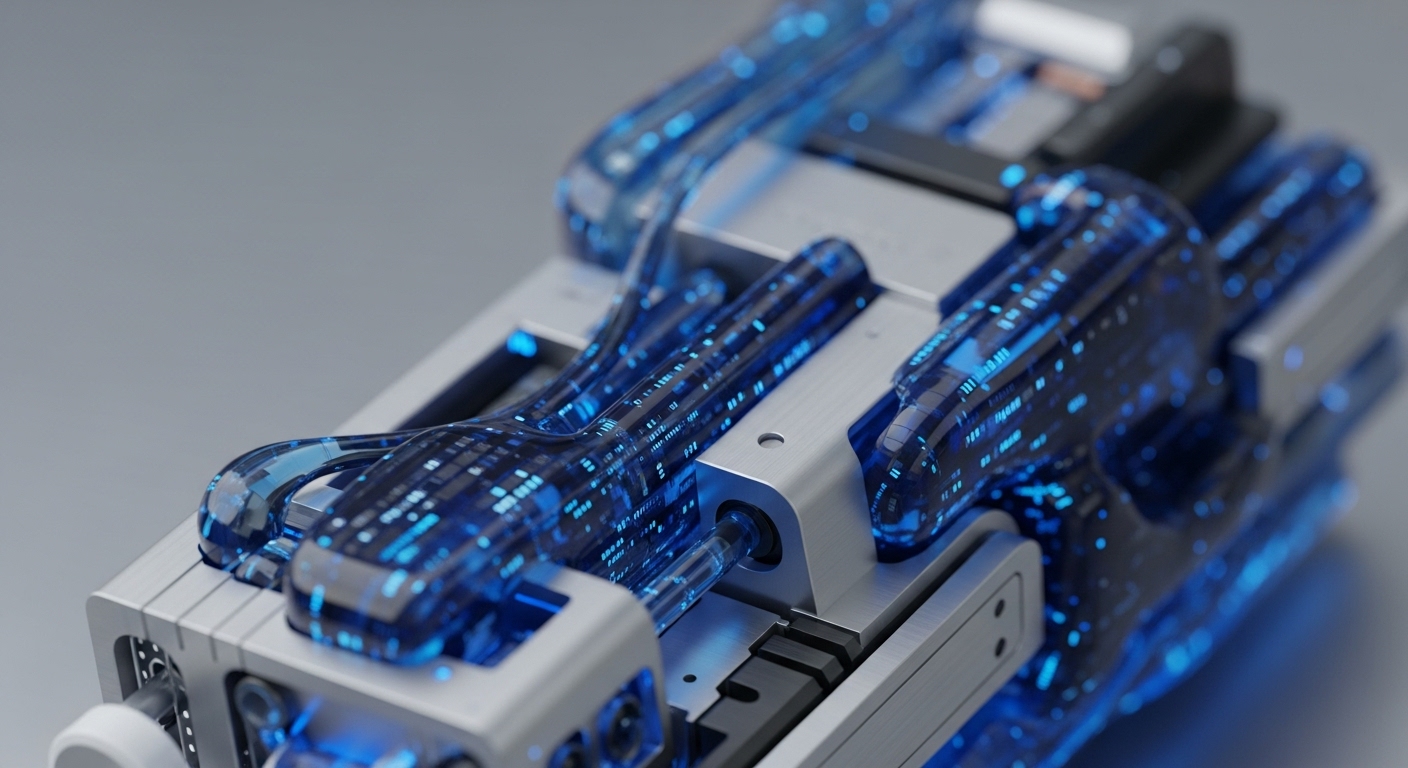

This integration fundamentally alters the cross-border treasury management system by introducing stablecoins as a high-velocity, digital cash equivalent for pre-funding. Instead of sending fiat over slow, multi-day wire transfers to local accounts, Visa and its partners use stablecoins like USDC and EURC on public blockchains, including Solana and Ethereum, to move liquidity instantly and compliantly. The chain of cause and effect is clear → the stablecoin functions as a programmable settlement layer, enabling near-instantaneous, 24/7 movement of funds between a sender’s treasury and the Visa network’s treasury.

This real-time liquidity transfer minimizes counterparty risk and converts previously trapped, idle capital into active, manageable working capital, providing a material uplift in capital efficiency for the enterprise and its partners. The use of a public ledger for the asset transfer ensures an auditable, transparent, and globally interoperable rail that seamlessly plugs into the existing VisaNet authorization layer.

Parameters

- Core Adopter → Visa Inc.

- Blockchain Protocols → Solana, Ethereum

- Digital Assets → USDC, EURC (Circle)

- Primary Use Case → Cross-Border Liquidity and Settlement Pre-Funding

- Quantified Scale → $2.5 Billion Annualized Monthly Settlement Volume

Outlook

The next phase of this project involves expanding the pilot to a full rollout, integrating more banks and remittance providers globally, and potentially supporting additional regulated stablecoins. This initiative is positioned to establish a new industry standard for B2B and remittance payments, creating competitive pressure on legacy correspondent banking networks and accelerating the adoption of tokenized deposits by other major financial institutions. Early adopters will gain a structural advantage in speed and cost control, while the model validates the public blockchain as a robust, compliant settlement infrastructure for global financial services.