Briefing

The core insight is that Bitcoin’s network remains structurally strong, contrasting sharply with the recent 30% price correction. This suggests the downturn is a temporary market reset driven by short-term sellers and macroeconomic uncertainty, not a failure of the underlying asset. The single most important data point proving this resilience is the 64% surge in the Hash Rate during the last quarter, confirming sustained miner participation and network security.

Context

The average person is wondering if the sharp price drop below $95,000 signals the end of the bull cycle or a deeper, structural problem with Bitcoin’s utility and security. Is this a temporary dip, or is the foundation of the network cracking?

Analysis

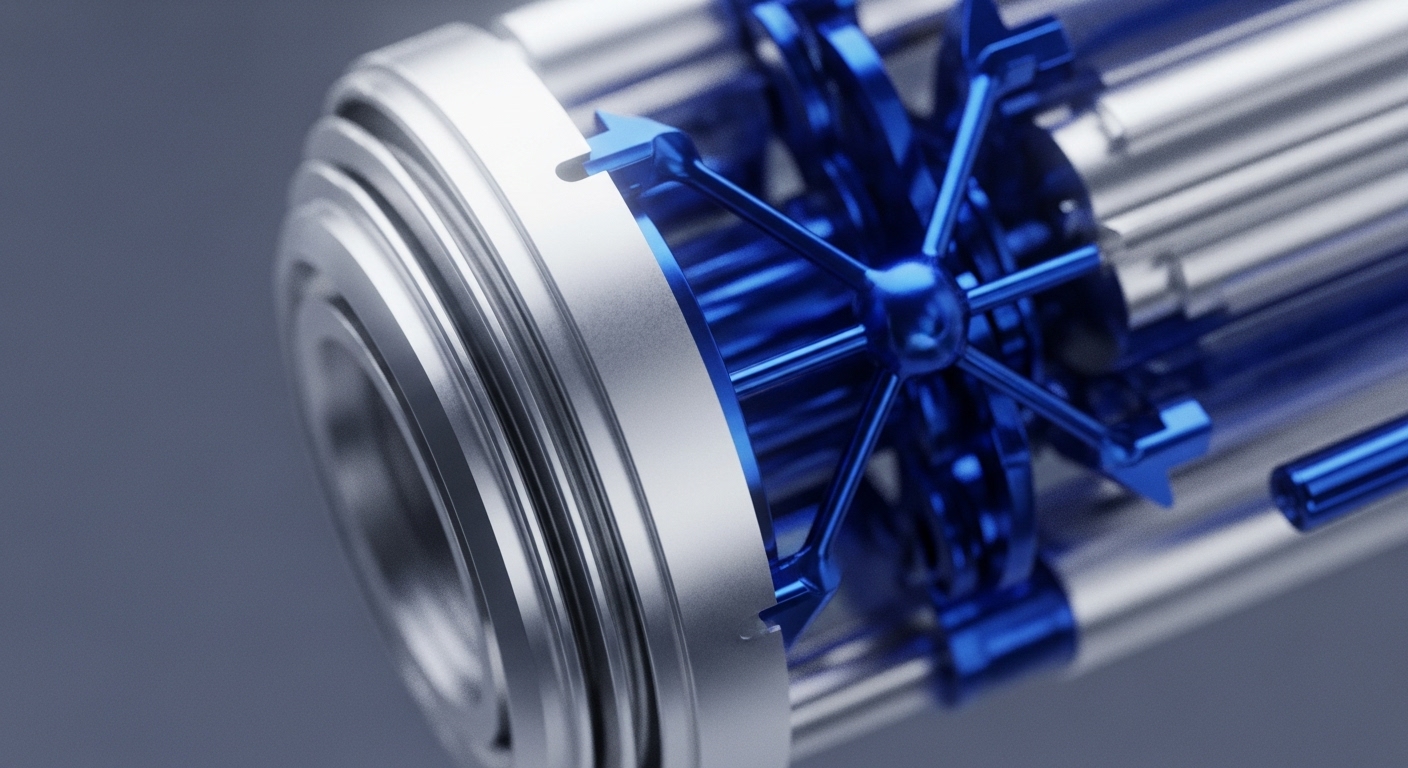

The Hash Rate measures the total computational power securing the network; when it goes up, the network is stronger and more secure. The Transaction Volume measures the value flow, indicating real-world use and adoption. The observed pattern is a massive surge in both metrics → Hash Rate up 64% and volume up 43.8% → while the price simultaneously fell.

This divergence means the builders and users are more committed than ever, even as traders take profits. This structural strength suggests the price correction is purely a market sentiment and leverage flush, not a fundamental issue.

Parameters

- Hash Rate Increase → 64% surge in Q3 2025 to 60.4 Exahash/s. (This is the total computational power securing the network, indicating miner confidence.)

- Transaction Volume Growth → 43.8% increase in Q3 2025 to $155.0 billion. (This measures the value of transactions, indicating rising adoption and utility.)

- Price Correction → Fell to a six-month low below $93,000. (The short-term price action that contrasts with the network health.)

Outlook

This insight suggests the near-term market will likely find a strong structural base near current levels, as the network’s increasing utility and security act as a fundamental floor. A confirming signal to watch for is a stabilization and subsequent rise in the Network Value to Transaction (NVT) ratio, which would confirm that the rising transaction volume is beginning to justify the current market capitalization.

Verdict

The Bitcoin network’s fundamental strength is absorbing the short-term price correction, confirming market resilience.