Briefing

The Bitcoin mining sector is grappling with its most severe profitability crisis in history, as declining Bitcoin prices and rising operational costs squeeze margins for even efficient operators. This significant shift means miners are earning less per unit of computing power, pushing many to the brink of unprofitability and forcing a strategic pivot towards debt reduction and diversification into artificial intelligence services. The hash price plummeted from approximately $55 to a “structural minimum” of $35 per petahash per second daily, while the median operational cost remains around $44 per petahash per second.

Context

Before this recent downturn, many in the crypto space wondered about the long-term viability of Bitcoin mining, especially with the upcoming halving event. The average person might have assumed mining was consistently lucrative, given Bitcoin’s past price surges. However, beneath the surface, a fierce competition for block rewards and the constant need for capital investment created an underlying tension, questioning how miners would adapt to evolving market conditions and increasing operational pressures.

Analysis

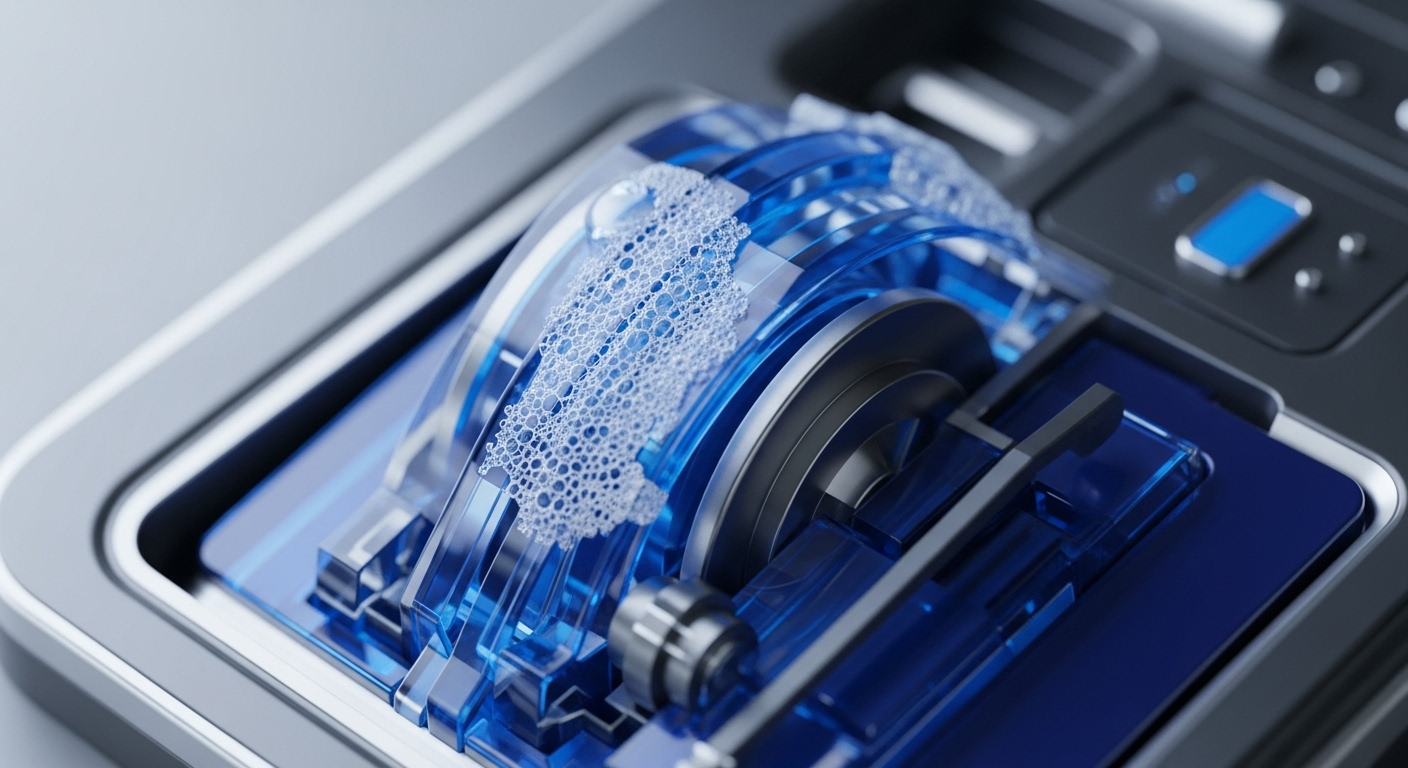

This profitability crisis in Bitcoin mining is a direct consequence of a double squeeze → declining Bitcoin prices reducing revenue, combined with increasing network competition and operational expenses. Think of it like a small business facing a drop in sales while its rent and utility bills keep climbing. Miners earn Bitcoin for validating transactions, and when Bitcoin’s value falls, so does their primary income. At the same time, more miners joining the network means the “difficulty” of finding a block increases, requiring more powerful and energy-intensive machines.

This dynamic has pushed the “hash price” → the revenue per unit of mining power → below the median cost of operating. The stress from declining profitability is now systemic, moving beyond theoretical concerns, and forcing miners to either become more efficient, secure new funding, or explore alternative revenue streams like providing computing power for AI.

Parameters

- Hash Price Decline → Hash price fell from approximately $55 to $35 per PH/s per day.

- Median Cost of Hash → The median operational cost for public miners is about $44 per PH/s.

- Equipment Payback Period → The time to recoup investment for new mining installations now exceeds 1,000 days.

- Upcoming Halving → Approximately 850 days remain until the next halving, which will reduce the block reward from 3.125 BTC to 1.5625 BTC.

- Q3 Financing → Miners raised $3.5 billion through convertible bonds and $1.4 billion in equity during the third quarter.

- New Financing Trend → Miners are now securing more expensive senior secured bonds with yields around 7%.

Outlook

Looking ahead, the industry is clearly entering a phase of restructuring. Investors should watch closely to see if miners’ aggressive pivot into AI and high-performance computing can generate enough revenue to offset the ongoing hash price collapse and the burden of increased debt. The key indicator will be the financial reports from major mining companies, specifically their ability to demonstrate profitable diversification and sustainable operations beyond just Bitcoin rewards.

Verdict

Bitcoin miners are facing a systemic profitability challenge, compelling a significant industry shift towards debt reduction and AI diversification for survival.