Briefing

Citibank and Swift have successfully completed a pilot program for Payment-versus-Payment (PvP) settlement between fiat and digital currencies. This landmark achievement significantly advances the integration of traditional finance with distributed ledger technology, demonstrating a pathway to eliminate settlement risk in cross-currency transactions. The pilot showcased the feasibility of using existing Swift infrastructure, augmented with institutional-grade blockchain connectors and smart contracts, to achieve synchronized settlement, proving a critical step towards more efficient and secure global financial operations.

Context

Before this development, a common question in the market revolved around the practical challenges of integrating the speed and efficiency of digital assets with the established security and regulatory frameworks of traditional finance. Many wondered if distributed ledger technology could truly scale and offer the necessary safeguards for institutional-grade cross-currency settlements, particularly given the inherent differences in how fiat and digital currencies are transacted. The core concern was how to bridge these two worlds securely and efficiently.

Analysis

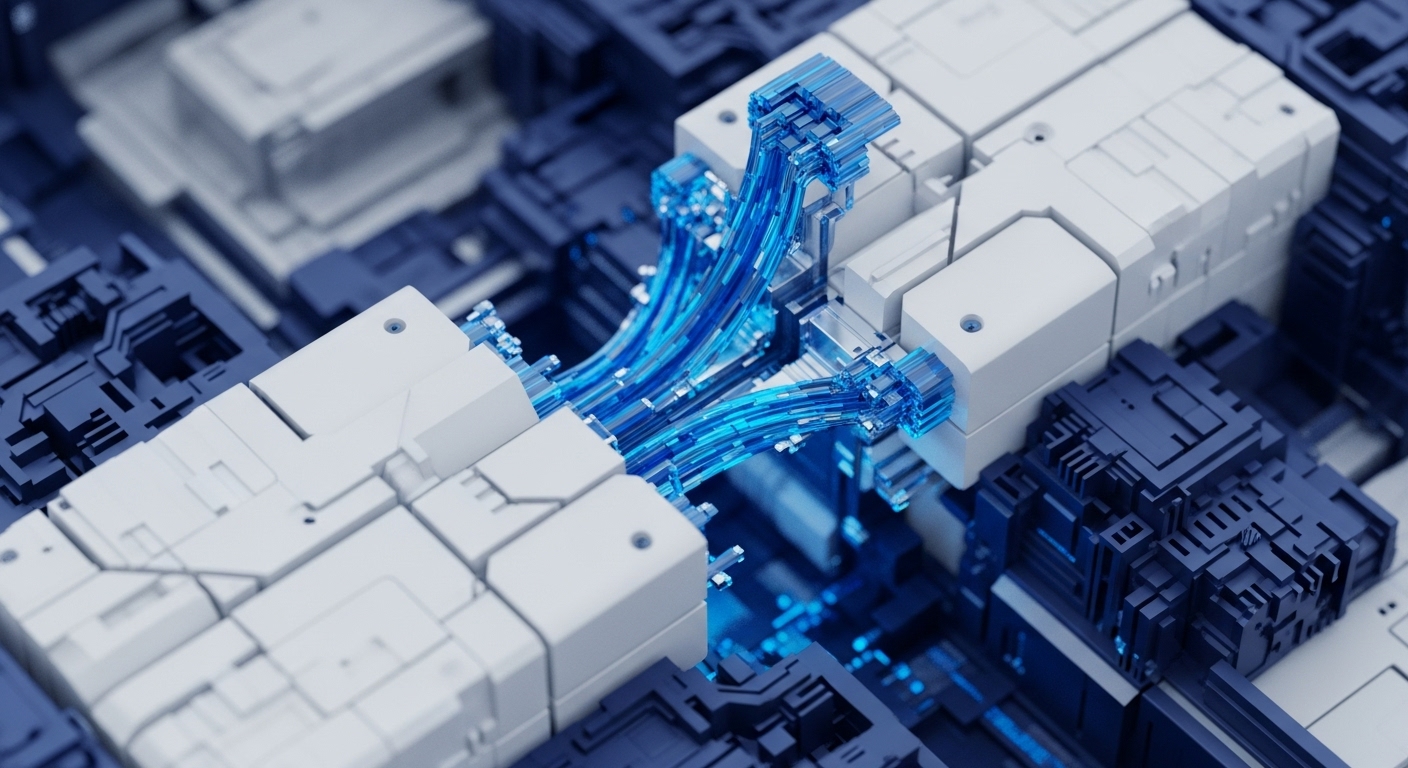

This pilot happened because the global financial system needs more efficient and secure ways to settle transactions between fiat and digital currencies, overcoming the limitations of current foreign exchange messaging standards. The core dynamic involves leveraging Swift’s established network and enhancing it with blockchain technology. Think of it like upgrading a reliable highway system by adding dedicated, high-speed express lanes for digital vehicles, all while using the existing road signs and traffic controllers.

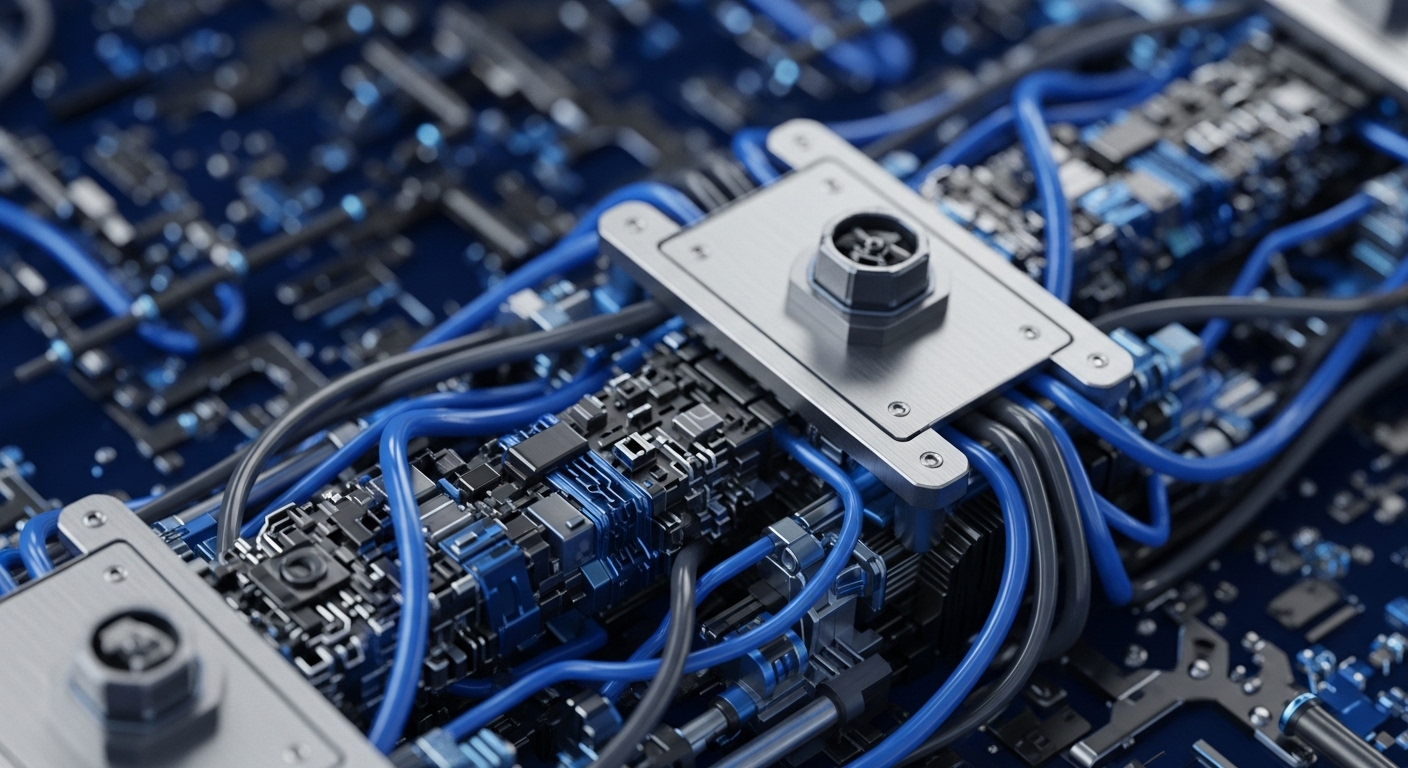

By integrating institutional-grade blockchain connectors, orchestrators, and smart contracts, the pilot demonstrated that traditional and digital systems can communicate and settle transactions simultaneously, effectively eliminating the risk that one party delivers their currency without receiving the other. This successful interoperability reduces counterparty risk and paves the way for broader institutional adoption of digital assets.

Parameters

- Pilot Participants → Citibank and Swift collaborated on this groundbreaking trial.

- Settlement Method → The pilot utilized a Payment-versus-Payment (PvP) workflow, ensuring simultaneous exchange of currencies.

- Currencies Involved → The trial successfully settled payments between fiat currencies and digital currencies, using a test version of USDC on the Ethereum Sepolia testnet to simulate real-world conditions.

- Key Achievement → The initiative proved the feasibility of interoperability between traditional financial systems and distributed ledger networks, significantly reducing settlement risk.

Outlook

This successful pilot signals a significant shift towards greater institutional engagement with digital assets. Investors should watch for further developments in hybrid models that blend traditional financial infrastructure with blockchain technology. Key indicators will include additional pilot programs by major financial institutions, potential regulatory responses to these new settlement capabilities, and the broader adoption of similar solutions for cross-border payments. These steps will indicate whether this trend of seamless integration continues to accelerate, potentially unlocking new financial products and services.

Briefing

Citibank and Swift have successfully completed a pilot program for Payment-versus-Payment (PvP) settlement between fiat and digital currencies. This landmark achievement significantly advances the integration of traditional finance with distributed ledger technology, demonstrating a pathway to eliminate settlement risk in cross-currency transactions. The pilot showcased the feasibility of using existing Swift infrastructure, augmented with institutional-grade blockchain connectors and smart contracts, to achieve synchronized settlement, proving a critical step towards more efficient and secure global financial operations.

Context

Before this development, a common question in the market revolved around the practical challenges of integrating the speed and efficiency of digital assets with the established security and regulatory frameworks of traditional finance. Many wondered if distributed ledger technology could truly scale and offer the necessary safeguards for institutional-grade cross-currency settlements, particularly given the inherent differences in how fiat and digital currencies are transacted. The core concern was how to bridge these two worlds securely and efficiently.

Analysis

This pilot happened because the global financial system needs more efficient and secure ways to settle transactions between fiat and digital currencies, overcoming the limitations of current foreign exchange messaging standards. The core dynamic involves leveraging Swift’s established network and enhancing it with blockchain technology. Think of it like upgrading a reliable highway system by adding dedicated, high-speed express lanes for digital vehicles, all while using the existing road signs and traffic controllers.

By integrating institutional-grade blockchain connectors, orchestrators, and smart contracts, the pilot demonstrated that traditional and digital systems can communicate and settle transactions simultaneously, effectively eliminating the risk that one party delivers their currency without receiving the other. This successful interoperability reduces counterparty risk and paves the way for broader institutional adoption of digital assets.

Parameters

- Pilot Participants → Citibank and Swift collaborated on this groundbreaking trial.

- Settlement Method → The pilot utilized a Payment-versus-Payment (PvP) workflow, ensuring simultaneous exchange of currencies.

- Currencies Involved → The trial successfully settled payments between fiat currencies and digital currencies, using a test version of USDC on the Ethereum Sepolia testnet to simulate real-world conditions.

- Key Achievement → The initiative proved the feasibility of interoperability between traditional financial systems and distributed ledger networks, significantly reducing settlement risk.

Outlook

This successful pilot signals a significant shift towards greater institutional engagement with digital assets. Investors should watch for further developments in hybrid models that blend traditional financial infrastructure with blockchain technology. Key indicators will include additional pilot programs by major financial institutions, potential regulatory responses to these new settlement capabilities, and the broader adoption of similar solutions for cross-border payments. These steps will indicate whether this trend of seamless integration continues to accelerate, potentially unlocking new financial products and services.