Briefing

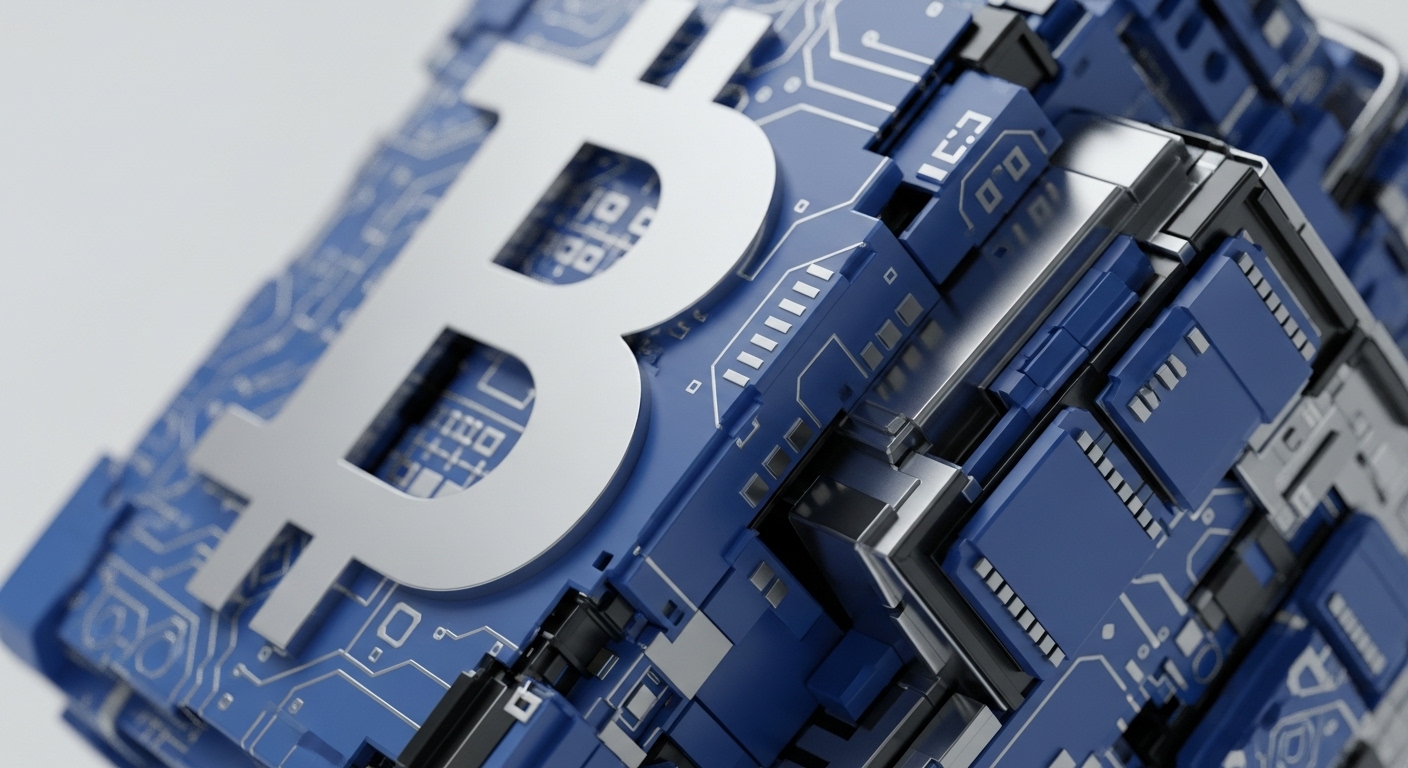

The crypto market experienced a significant event with over $1.8 billion in liquidations, largely impacting Bitcoin and Ethereum. This “flush-out” of overleveraged positions led to Bitcoin falling below $112,000 and Ethereum below $4,150, as excessive leverage, particularly in altcoins, triggered a cascading effect. This marked one of the year’s largest long liquidation events, with more than 370,000 traders affected.

Context

Before this news, many in the market were likely wondering if the recent gains were sustainable or if the market was becoming too speculative. There was a common anticipation of a “big breakout,” which often leads traders to take on more risk through leveraged positions. This setup created a vulnerable environment where a minor price shift could trigger a broader market reaction.

Analysis

This market event happened because many traders used borrowed money, known as leverage, to amplify their bets, particularly on altcoins. When prices started to dip, these highly leveraged “long” positions → bets that prices would go up → were forcibly closed by exchanges because traders could no longer cover their potential losses. Think of it like a game of musical chairs → when the music stops (prices drop), those without enough capital to maintain their leveraged positions are forced out, creating a domino effect that pushes prices down further.

This process, known as a liquidation cascade, accounted for the $1.8 billion wipeout. Analysts suggest these are primarily technical market adjustments rather than a fundamental shift in the long-term outlook.

Parameters

- Total Liquidations → $1.8 billion → This is the total value of leveraged positions forcibly closed across the crypto market in a single day.

- Bitcoin Price Drop → Below $112,000 → The level Bitcoin fell to during the liquidation event.

- Ethereum Price Drop → Below $4,150 → The level Ethereum fell to during the liquidation event.

- Traders Liquidated → Over 370,000 → The number of individual trading accounts that had their leveraged positions closed.

Outlook

In the coming days and weeks, watch for how Bitcoin reacts around the $105,000 to $100,000 support zone, which includes the 200-day moving average at $103,700. A stabilization or bounce from this area could signal that the “weaker hands” have been flushed out, potentially setting the stage for a recovery or a stronger run into the end of the year. Continued downward pressure, however, could indicate further technical corrections are still needed.