Briefing

Michigan’s House recently advanced a bill allowing the state to allocate up to 10% of its funds into Bitcoin and other cryptocurrencies, a significant step that bolsters the narrative of digital assets as a legitimate reserve. This legislative action, providing a framework for secure custody and trading, suggests increasing government recognition and could position Bitcoin as a viable inflation hedge, despite a minor 0.49% dip in Bitcoin’s price over the last 24 hours to approximately $116,453.

Context

Before this news, many in the market wondered if institutional and governmental bodies would truly embrace cryptocurrencies beyond speculative interest. The common question was whether Bitcoin could transition from a volatile digital experiment to a recognized, long-term asset class, especially in the face of traditional economic uncertainties and the search for reliable inflation hedges.

Analysis

This development happened because state legislators are increasingly exploring innovative ways to manage public funds and diversify portfolios, acknowledging the growing digital economy. The market reacted by reinforcing the long-term bullish sentiment for Bitcoin, as government backing lends significant credibility. Think of it like a major pension fund announcing it will allocate a small portion to a new, promising technology; it legitimizes the asset and opens the door for broader acceptance. This move underscores Bitcoin’s fixed supply as a defense against currency devaluation, strengthening its appeal as a hedge.

Parameters

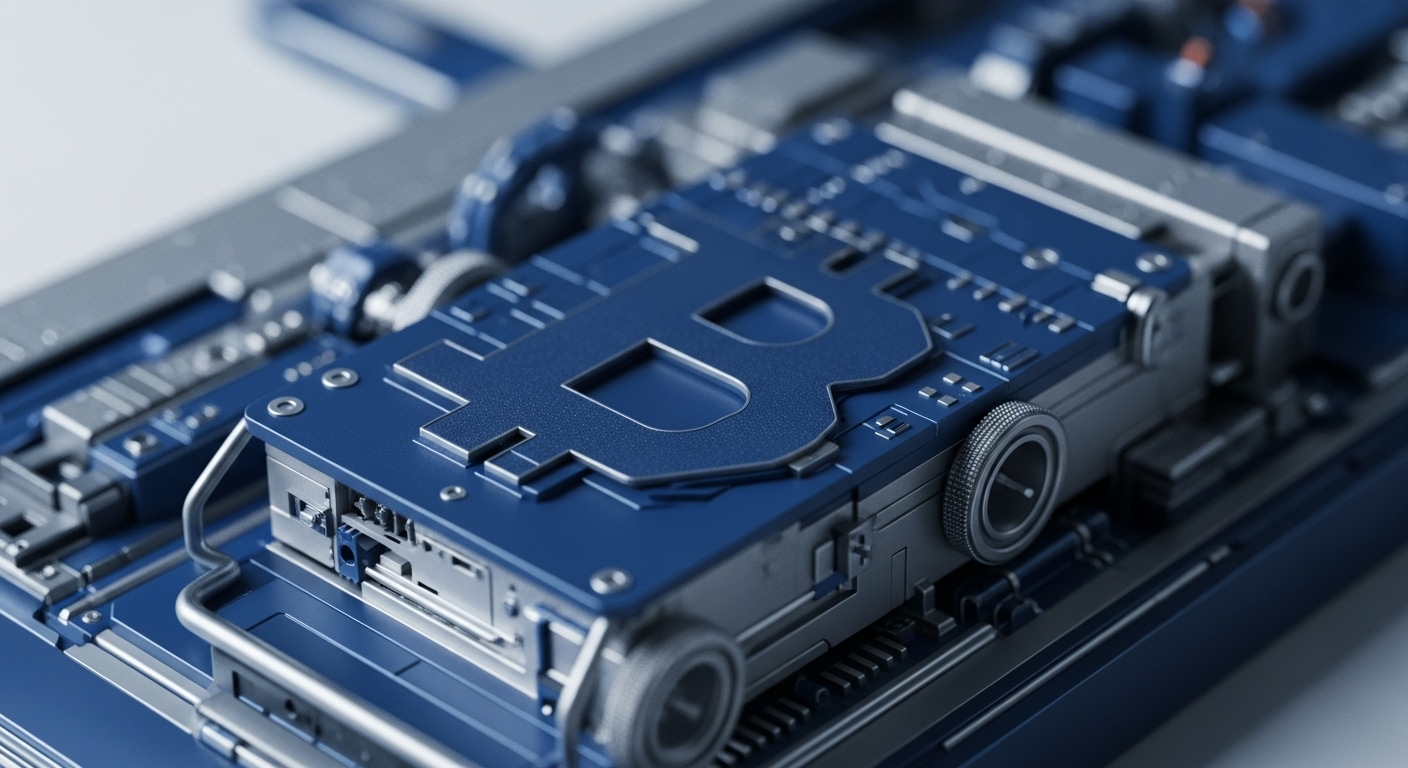

- State Fund Allocation → Michigan’s bill allows up to 10% of state funds to be invested in Bitcoin and other cryptocurrencies, indicating a notable institutional entry point.

- Bitcoin Price (24h) → Bitcoin saw a slight decline of 0.49% over the past 24 hours, trading around $116,453, showing that short-term market fluctuations persist even with positive news.

- Market Capitalization → Bitcoin’s market cap stands at approximately $2.31 trillion USD, highlighting its substantial presence and influence within the broader financial landscape.

Outlook

In the coming days and weeks, watch for other states or institutional entities to potentially follow Michigan’s lead, signaling a broader trend of government adoption. Keep an eye on legislative discussions and any further announcements regarding the implementation of this bill, as these will indicate the momentum behind integrating digital assets into traditional financial frameworks. Continued positive legislative developments could provide a sustained boost to market sentiment.

Signal Acquired from → TradingView