Solana Enhances Network Capacity, Explores Six-Second Block Times

The protocol architecturally scales transaction throughput via increased Compute Unit limits and evaluates a shift to six-second block times, optimizing execution layer efficiency.

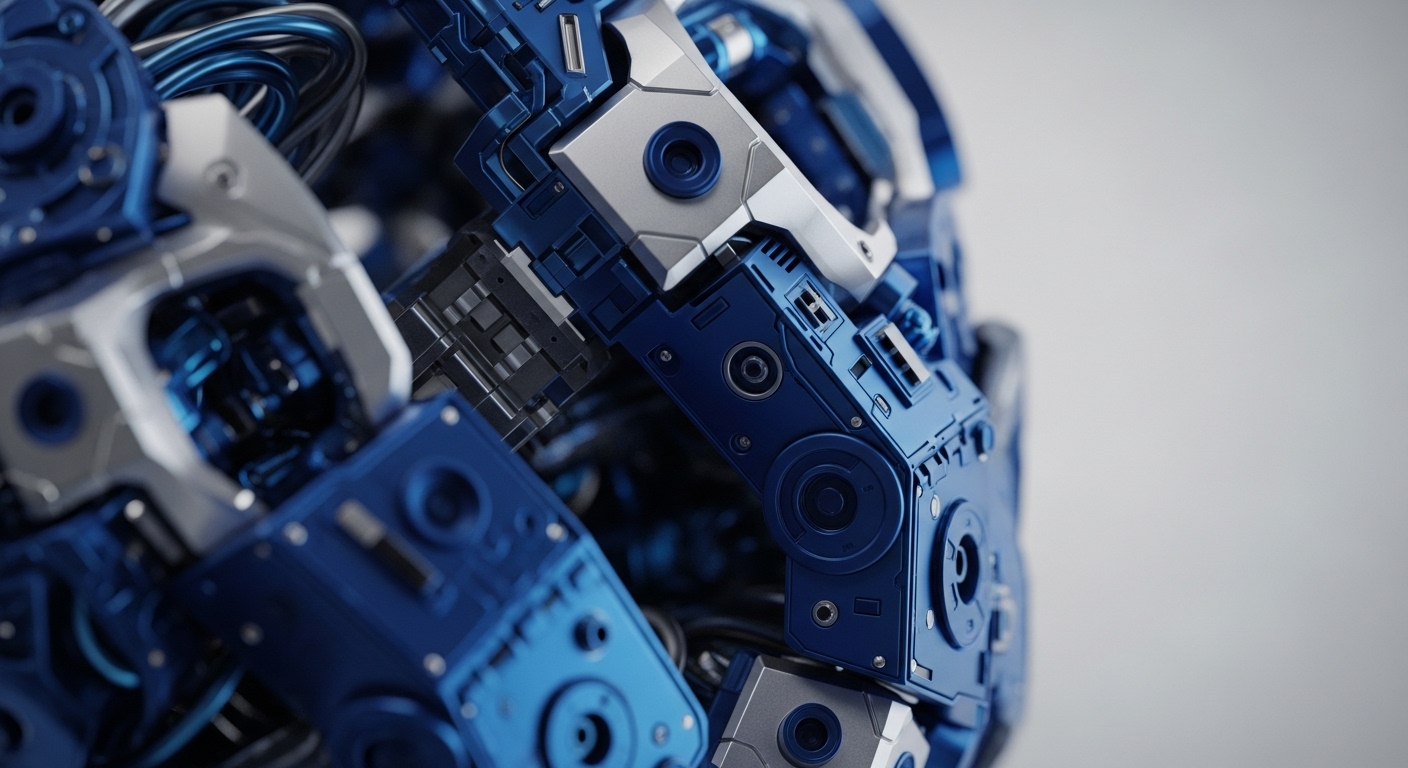

Decentralized Architecture Enables Blockchain Network and Asset Discovery

This novel architecture establishes a decentralized network discovery and cross-chain service resolution protocol, unlocking the full potential of the Internet of Blockchains.

Aave V4 Introduces Modular Lending Markets and Enhanced Risk Controls

Aave's V4 upgrade revolutionizes DeFi lending by enabling customized, isolated markets, optimizing capital efficiency and mitigating systemic risk across the ecosystem.

Congress Passes GENIUS Act Establishing Federal Stablecoin Regulatory Framework

The new federal stablecoin regime mandates 100% liquid reserves and BSA compliance, structurally redefining payment rails for all issuers.

Zero-Knowledge Proof of Training Secures Private Decentralized Federated Learning Consensus

ZKPoT introduces a zk-SNARK-based consensus mechanism that proves model accuracy without revealing private data, resolving the critical privacy-accuracy trade-off in decentralized AI.

SEC Chair Announces Innovation Exemption Framework to Modernize Digital Asset Rules

The SEC's pivot from enforcement to an innovation exemption fundamentally alters the U.S. market entry calculus for token issuers.

Sublinear Zero-Knowledge Proofs Democratize Verifiable Computation on Constrained Devices

A novel proof system reduces ZKP memory from linear to square-root scaling, fundamentally unlocking privacy-preserving computation for all mobile and edge devices.

Balancer V2 Pools Drained by Faulty Smart Contract Access Control

V2 vault access control logic failed to validate message senders, enabling unauthorized internal withdrawals and a $110 million multi-chain asset drain.

Balancer V2 Stable Pools Drained Exploiting Faulty Access Control Logic

Faulty access control in the core vault's manageUserBalance function allowed unauthorized internal withdrawal, compromising over $128 million in multi-chain liquidity.