Yearn Finance yETH Pool Drained Exploiting Custom Stableswap Minting Flaw

A critical logic flaw in a custom stableswap implementation enabled an attacker to mint near-infinite yETH, creating an immediate, catastrophic liquidity drain.

High-Profile Web3 Social Accounts Compromised, Leading to User Wallet Drains

Supply chain failure via compromised employee accounts weaponizes trusted social channels, tricking users into malicious token approvals.

UK Parliament Formally Establishes Digital Assets as Third Property Category

The Act codifies digital assets as a distinct personal property class, fundamentally strengthening legal recourse and clarifying insolvency frameworks for all regulated entities.

Force Bridge Compromised: Cross-Chain Exploit Drains Millions in Assets

Bridge logic failure enabled unauthorized asset withdrawal, exposing systemic interoperability risk to users.

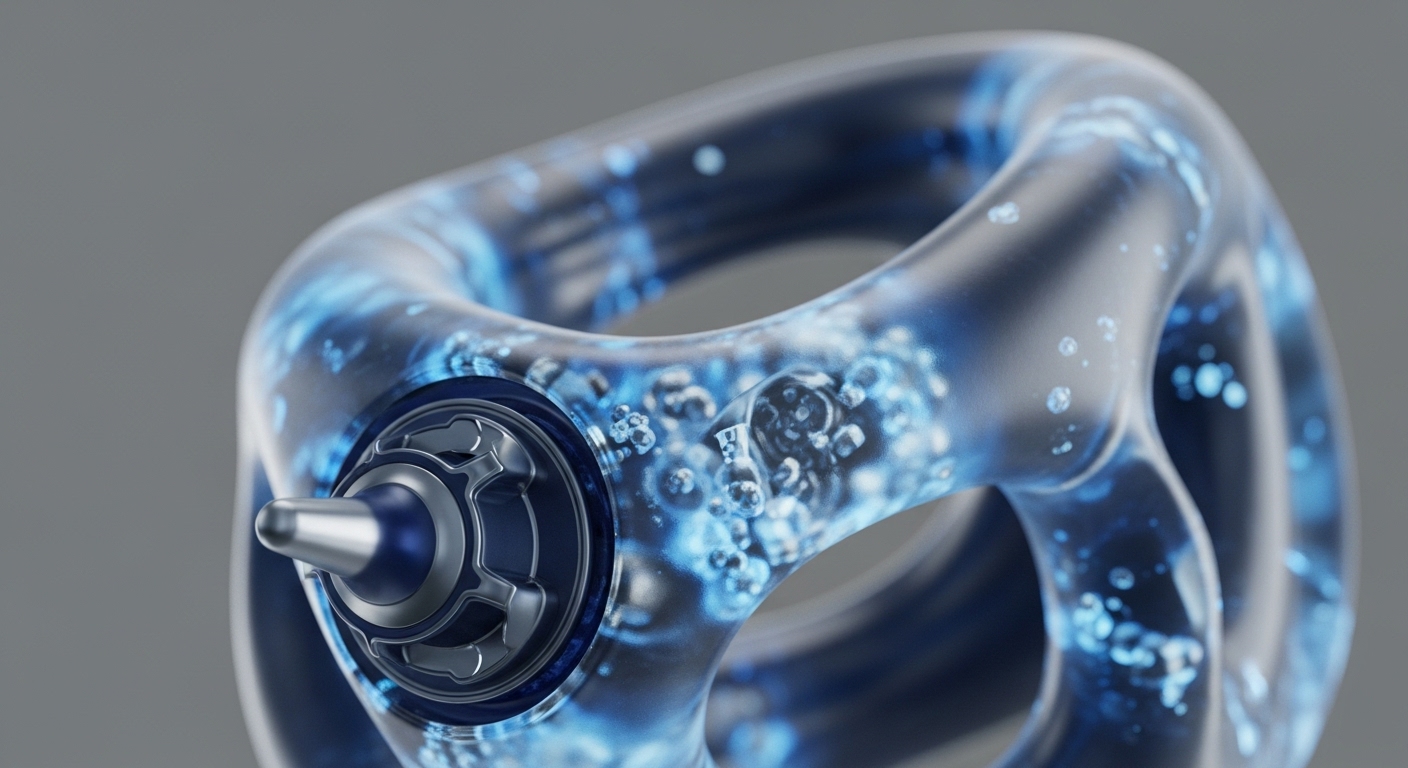

Cetus Protocol Drained $260 Million via Spoof Token Smart Contract Flaw

The DEX liquidity pool logic was exploited by a pricing vulnerability, allowing a spoof-token attack to drain assets and trigger a chain-wide crisis.

Legacy DeFi Pool Drained Exploiting Infinite Token Minting Flaw

A critical flaw in a custom stable-swap contract allowed an attacker to mint near-infinite yETH, bypassing core pool solvency checks.