BlackRock’s BUIDL Fund Surpasses $2 Billion in Tokenized Assets

BlackRock's tokenized fund validates scalable RWA digitization, enhancing institutional liquidity and investor access for capital efficiency.

Corporations Integrate Bitcoin and Solana into Strategic Treasury Operations

Enterprises are leveraging Bitcoin and Solana to diversify treasury reserves and enhance capital efficiency, strategically integrating digital assets for balance sheet resilience.

B Strategy Launches $1 Billion BNB Treasury for Institutional Digital Asset Management

This initiative establishes a regulated $1 billion BNB treasury, enhancing institutional liquidity and streamlining DeFi access for traditional finance.

Institutions Drive $24 Billion Real-World Asset Tokenization Market

Strategic integration of tokenized real-world assets delivers enhanced capital efficiency and optimized yield for institutional portfolios, reshaping traditional finance.

Sui Blockchain Partners Google for AI-Driven Payments

Sui's new collaboration with Google's AI payment protocol signals potential for significant market growth and increased adoption.

OVERTAKE Token Bridges Web3 Gaming and DeFi with 237% Volume Surge

OVERTAKE's dual integration with Sui and BNB Chain, alongside its multisig escrow, establishes a capital-efficient bridge for gaming assets into DeFi, accelerating ecosystem liquidity and user engagement.

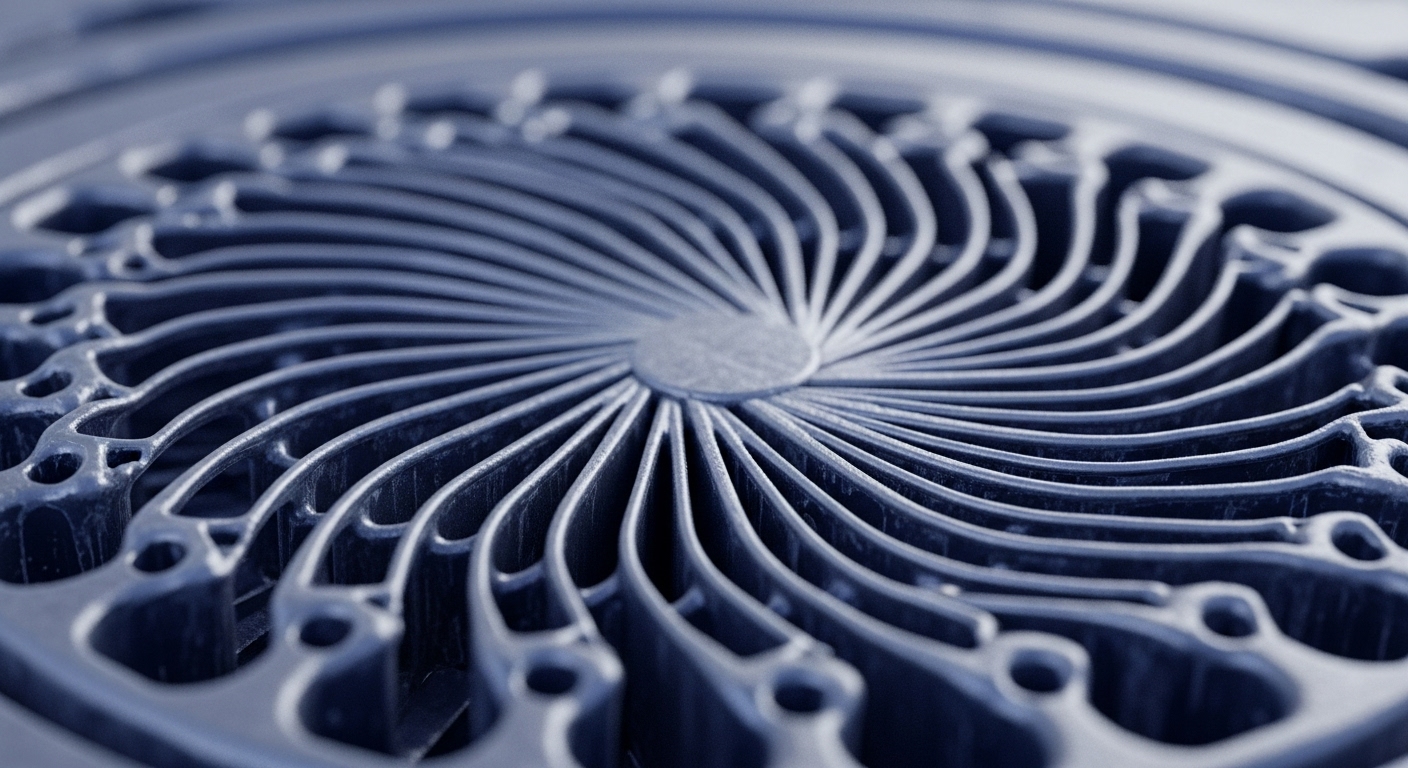

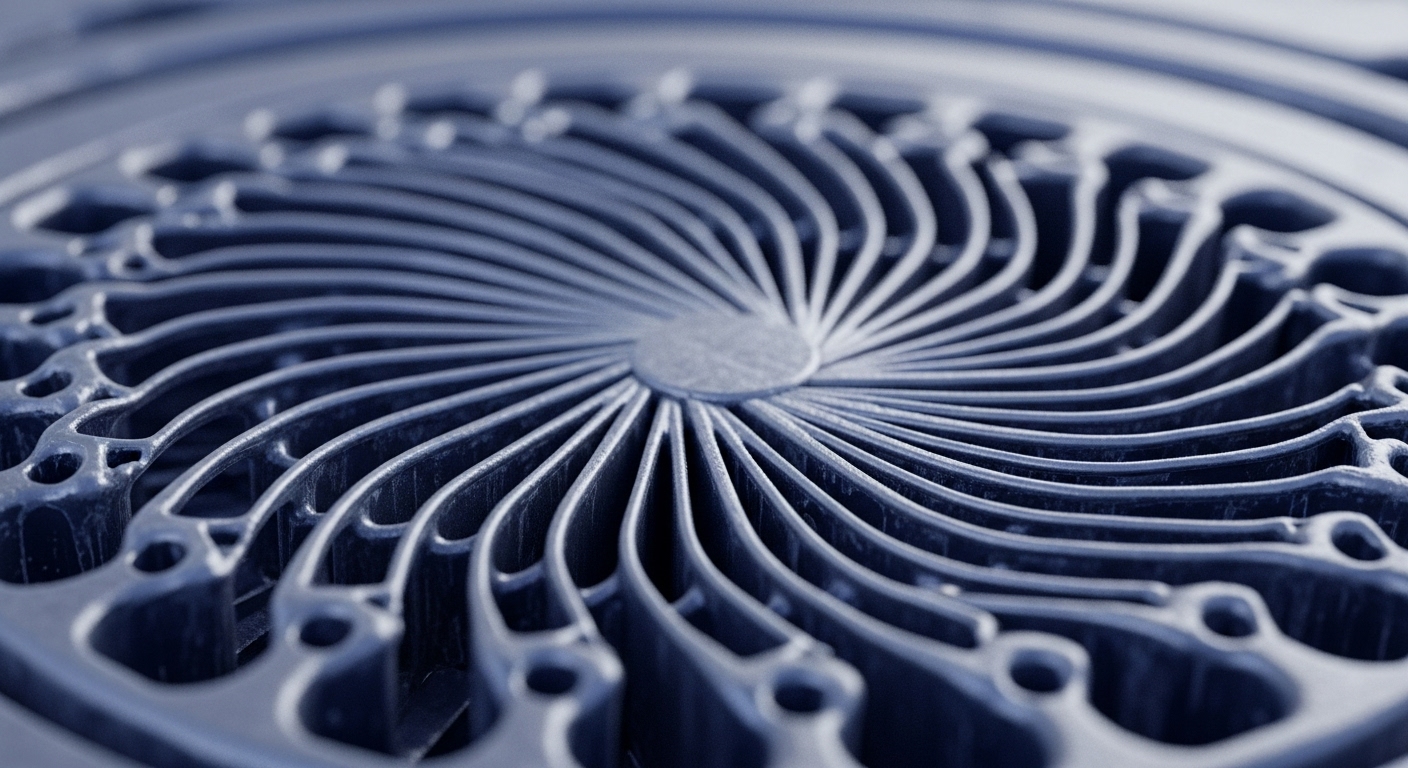

Incentivizing Federated Edge Learning via Game-Theoretic Blockchain Mechanisms

This research introduces a novel game-theoretic framework to incentivize participation and optimize resource pricing in blockchain-enabled federated edge learning, unlocking efficient decentralized AI.

QNB, Standard Chartered, DMZ Launch Dubai’s First Tokenized Money Market Fund

This initiative tokenizes U.S. Treasury bills and USD deposits, enhancing liquidity and accessibility for institutional clients within a regulated digital framework.

Ethena Surges, US Dollar Integrates Blockchain, Ethereum Eyes Breakout

Crypto markets see Ethena surge and US dollar blockchain integration, signaling potential Ethereum growth amid institutional interest.