Next Technology Holding Expands Bitcoin Treasury with $500 Million Capital Raise

This strategic capital raise by Next Technology Holding underscores a critical shift in corporate treasury management, leveraging Bitcoin as a balance sheet staple to enhance long-term financial resilience and drive digital asset integration.

GAM3S.GG Unifies Web2 and Web3 Gaming Identities with Integrations

GAM3S.GG unifies Web2 and Web3 gaming identities via PlayStation achievements and OpenSea NFT trading, streamlining user onboarding and asset management.

Tokenized Assets Drive Bitget Onchain Volume past $100m Daily

Bitget Onchain's rapid volume surge to over $100 million daily highlights growing investor appetite for traditional assets on blockchain.

Apollo Diversified Credit Fund Tokenized with $50 Million Anchor Investment

This initiative tokenizes a diversified credit strategy, enabling on-chain access for institutional investors and enhancing transparency in private credit markets.

DBS, Franklin Templeton, Ripple Launch Tokenized Funds and Stablecoin Trading

This collaboration establishes a 24/7 on-chain framework for institutional investors to manage liquidity and rebalance portfolios with tokenized money market funds and stablecoins.

Ondo Finance Accelerates Institutional Asset Tokenization for Global Markets

Ondo Finance's platform enables financial institutions to tokenize diverse assets, enhancing capital markets efficiency and global accessibility.

Nasdaq Plans 24/7 Tokenized Securities Trading by 2026

Nasdaq's SEC filing to enable round-the-clock trading of tokenized securities signals a major shift towards integrating blockchain into traditional markets.

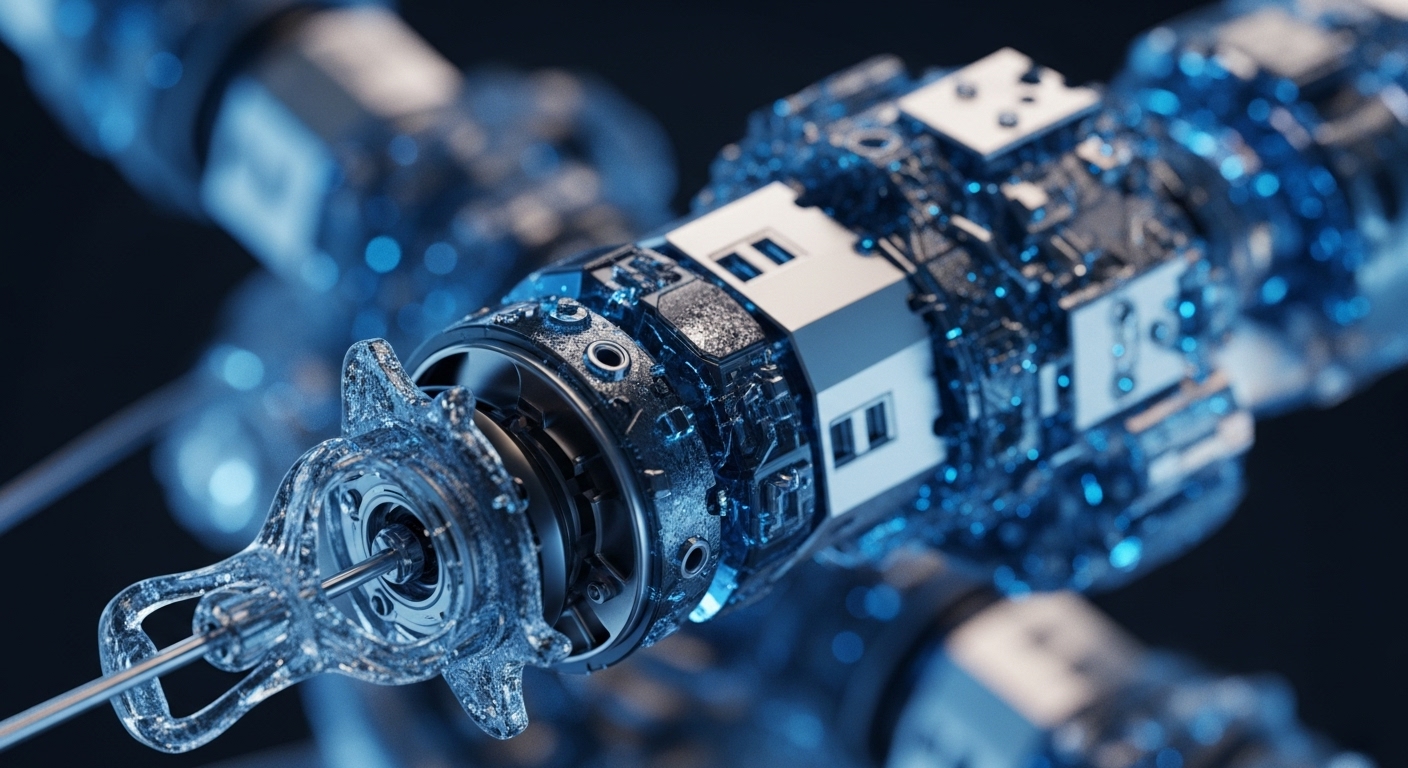

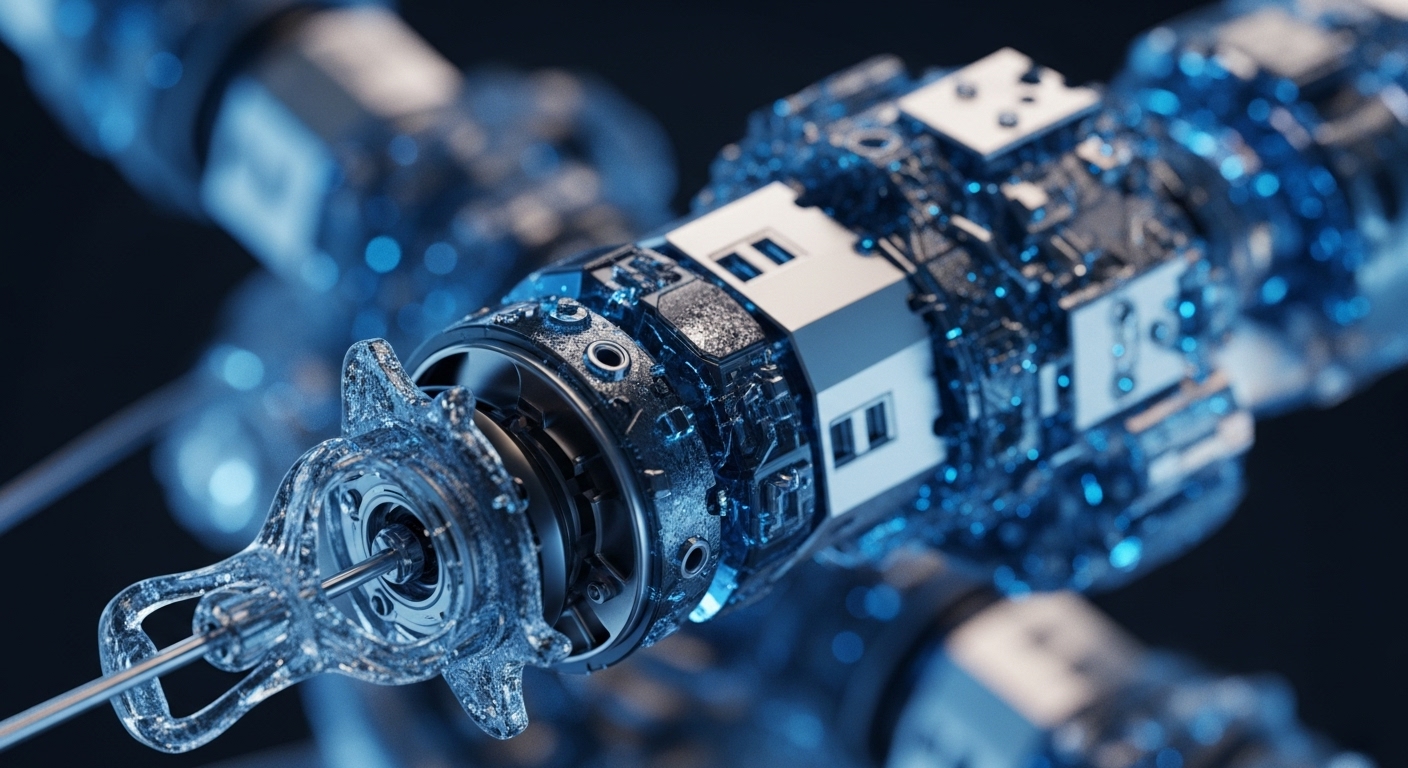

Eliza Labs Unveils No-Code Platform for Autonomous Web3 AI Agents

Eliza Labs' auto.fun platform democratizes AI agent deployment, enabling non-developers to automate complex DeFi and social media tasks on-chain.

Visa Integrates Stablecoins to Enhance Global Cross-Border Payments

Visa strategically integrates stablecoins into its global payment infrastructure, optimizing cross-border transactions and liquidity management for enterprise efficiency.