Balancer V2 Stable Pools Drained Exploiting Compounded Precision Rounding Flaw

A catastrophic arithmetic precision flaw in ComposableStablePools allowed batch-swap manipulation, enabling the systematic draining of $128M in liquidity.

Legacy DeFi Pool Drained Exploiting Infinite Token Minting Flaw

A critical flaw in a custom stable-swap contract allowed an attacker to mint near-infinite yETH, bypassing core pool solvency checks.

Legacy Staking Pool Exploited via Synthetic Token Inflation Logic

A flaw in the custom stableswap pool's token accounting allowed the attacker to mint unlimited synthetic assets, draining $9M in liquid staking collateral.

Decentralized Clock Network Decouples Ordering from Consensus for Fair Transactions

A Decentralized Clock Network assigns provably fair timestamps to transactions, fundamentally eliminating front-running and MEV-driven order manipulation.

Application-Layer Mechanism Design Achieves Provable MEV Resilience for DeFi

Foundational impossibility results mandate shifting MEV mitigation from consensus to application-layer smart contracts, achieving provable strategy proofness.

DeFi Protocol Typus Drained $3.4 Million via Oracle Price Manipulation

A critical missing authorization check in the oracle contract's `update_v2()` function allowed unauthorized price manipulation, directly compromising the TLP and draining $3.44M in assets.

KernelDAO Liquid Restaking Protocol Captures $1.34 Billion TVL and Stablecoin Collateral

Kelp's $1.34B TVL and USD1 stablecoin integration unlocks a new primitive for capital-efficient, risk-adjusted DeFi security provisioning.

Yearn yUSND Vault Suffers Economic Exploit via Liquidity Slippage Flaw

Insufficient liquidity during liquidation reward swaps created an economic vector, allowing a 5.2% capital drawdown on the yUSND vault through severe slippage manipulation.

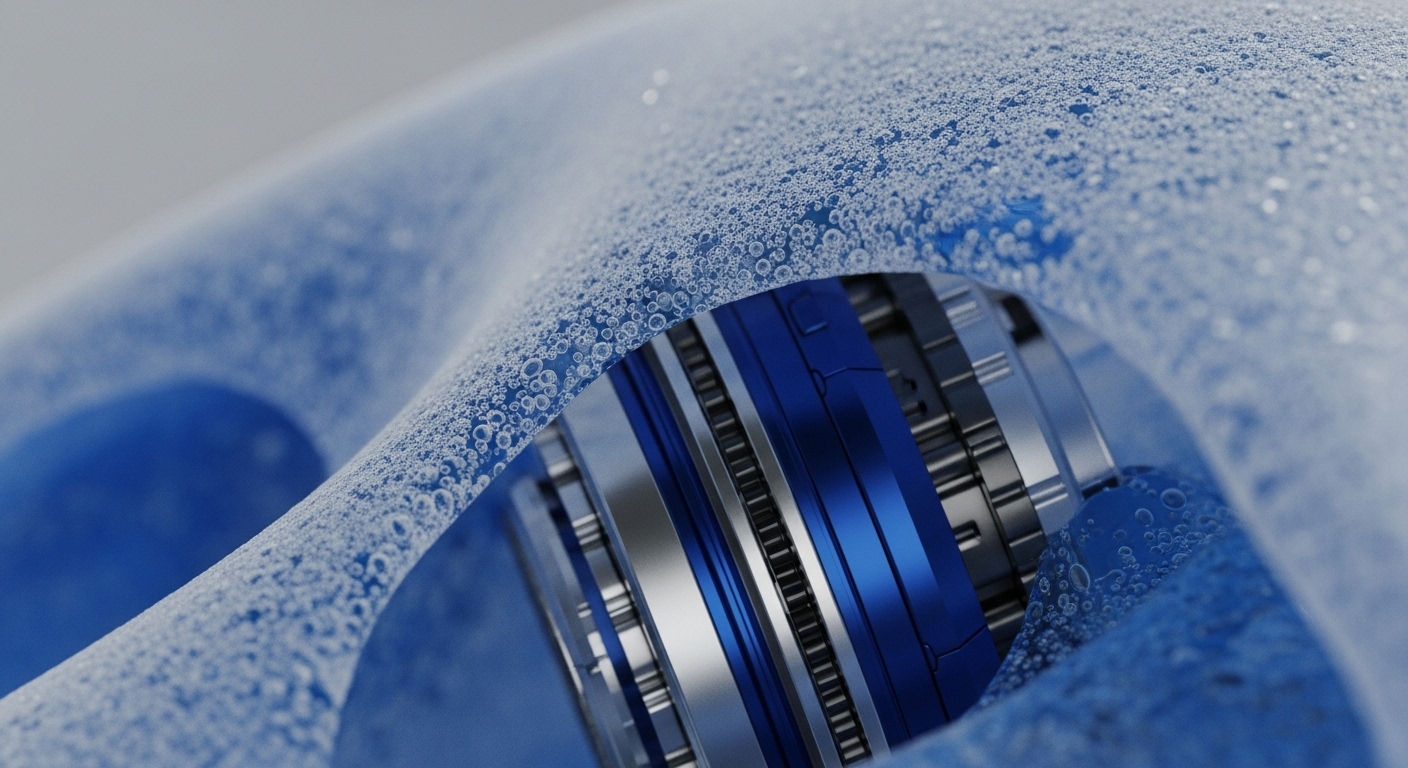

Multi-Chain Pool Exploit Drains $128 Million Leveraging Smart Contract Logic Flaw

Precision rounding flaws in multi-chain pools allowed unauthorized fund withdrawal, creating systemic contagion risk across all connected DeFi assets.