European Commission Proposes DLT Pilot Regime Expansion to €100 Billion Limit

The €100 billion DLT Pilot Regime expansion fundamentally re-architects the EU's tokenization framework, unlocking institutional RWA scale.

ESMA Urges European Commission to Extend and Permanently Adopt DLT Pilot Regime

The European DLT Pilot Regime's potential extension beyond 2026 provides critical regulatory certainty for tokenized securities market infrastructure development.

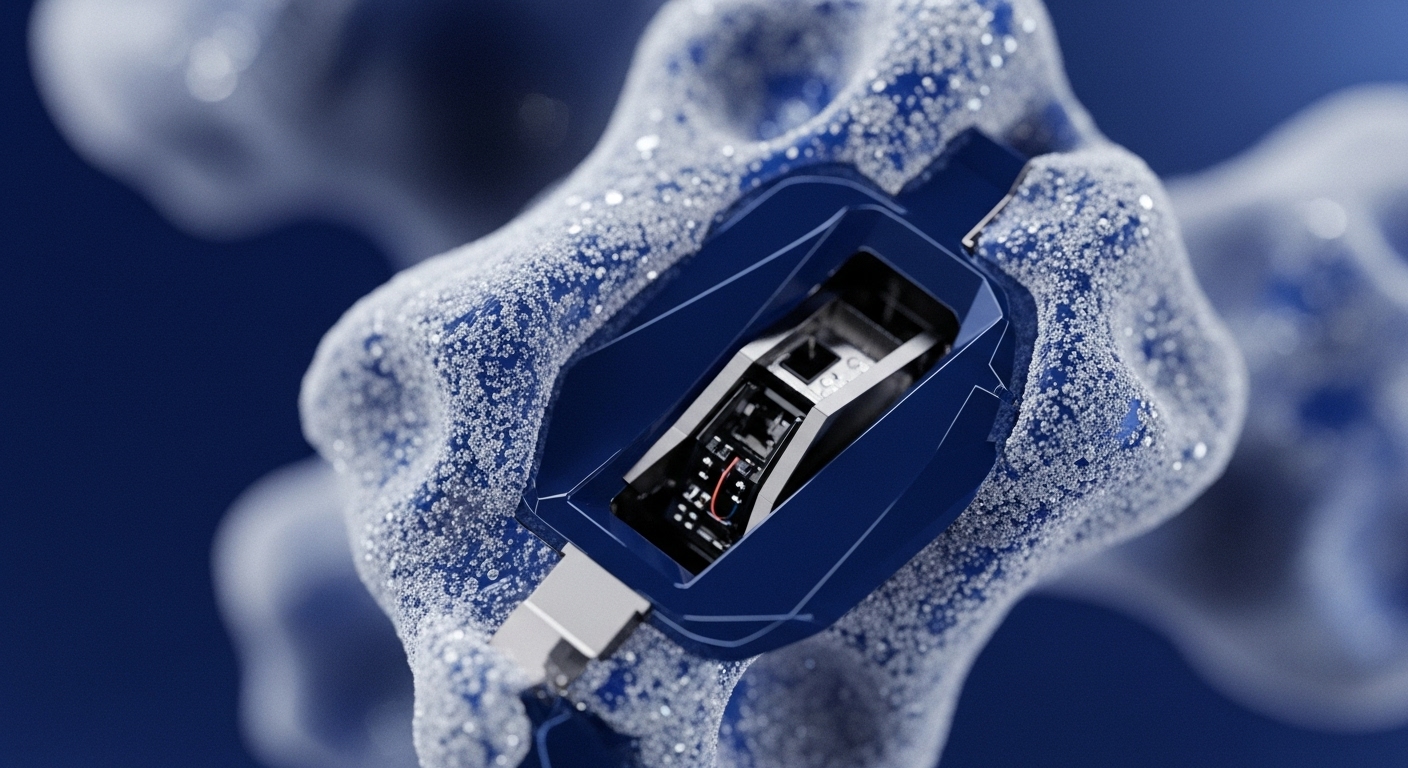

Datavault AI and Max International Launch Swiss Digital RWA Exchange

The new exchange utilizes Swiss DLT regulation to tokenize commodities, resolving institutional barriers around compliance, trust, and scalability.

Six Major UK Banks Pilot Tokenized Sterling Deposits for Settlement Efficiency

The consortium pilot of tokenized commercial bank deposits leverages DLT to enable programmable sterling, reducing settlement friction and counterparty risk.

CFTC Explores Equivalence for EU MiCA-Authorized Digital Asset Platforms

Transatlantic regulatory arbitrage risk diminishes as CFTC considers MiCA equivalence, mandating a pivot to integrated, global compliance architectures.