GTreasury Integrates Ripple for Real-Time Global Corporate Liquidity Activation

The integration transforms static corporate cash into instantly deployable global capital, optimizing liquidity and mitigating FX exposure in real-time.

Institutional Finance Shifts Stablecoin Integration from Pilot Phase to Execution

Enterprise readiness for stablecoin rails is at 86%, enabling deep ERP integration for T+0 cross-border B2B settlement and capital efficiency.

Oracle Launches Enterprise Platform for Institutional Digital Asset Tokenization and Settlement

The Nexus platform integrates multi-ledger tokenization and AI-powered governance, streamlining compliant digital asset issuance and optimizing cross-ledger settlement for financial institutions.

SharpLink Deploys $200 Million Ethereum to Generate Treasury Yield

The deployment of corporate ETH to an L2 network for yield generation transforms dormant treasury assets into an actively managed, productive capital layer, optimizing capital efficiency.

Citi and Coinbase Integrate to Streamline Institutional Fiat-Digital Asset Transfers

The collaboration links Citi's global payment network with Coinbase's digital rails, achieving T+0 liquidity management and reducing institutional fund transfer friction.

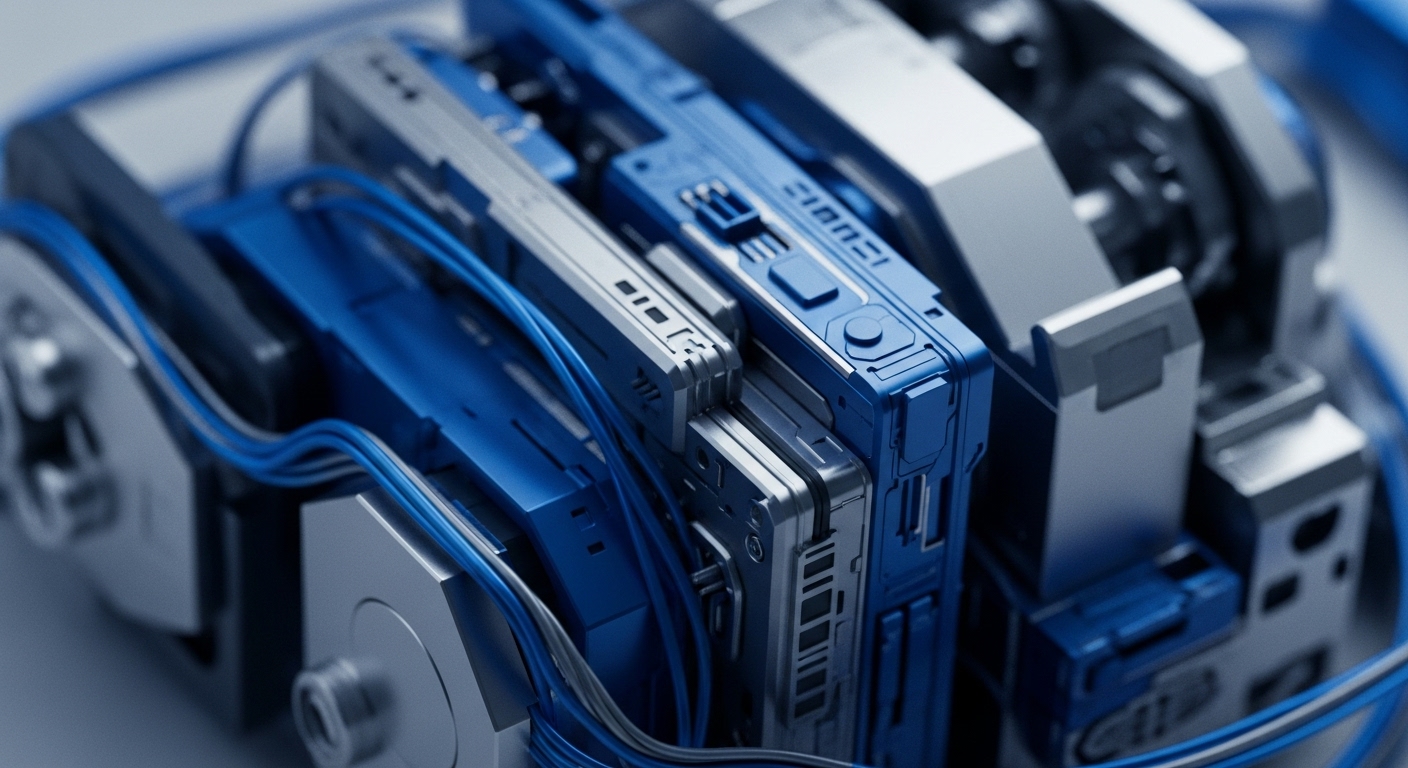

IBM Launches Multi-Chain Platform for Institutional Digital Asset Management and Settlement

The full-stack platform unifies digital asset operations across 40+ chains, accelerating institutional market entry while ensuring enterprise-grade compliance and security.

NU and Dream Launch Yield-Bearing Stablecoin Platform for Corporate Treasury

This partnership embeds programmable, yield-bearing stablecoins into enterprise resource planning systems, transforming idle cash into an active, 24/7 liquidity asset for global operations.

U.S. Bancorp Establishes Dedicated Digital Assets Division for Tokenization and Settlement

The new organization centralizes DLT-enabled payment rails and tokenization capabilities, accelerating T+0 settlement and enhancing institutional liquidity management.

Modern Treasury Integrates Stablecoins for 24/7 Corporate Cross-Border Payments

Integrating stablecoin rails via Brale enables corporate treasurers to eliminate pre-funding requirements and achieve instant, continuous global liquidity management.