Regulated Bank Launches Multi-Chain Tokenized Deposit Pilot on Public Ledgers

This pilot leverages public chain infrastructure to create a compliant, FDIC-insured deposit token, optimizing liquidity management and reducing counterparty risk in wholesale payments.

Lawmakers Target Stablecoin Yield Loophole, Demanding Expanded Prohibition on Affiliates

The identified GENIUS Act loophole enabling stablecoin yield via affiliates mandates immediate risk mitigation for all interest-bearing product structuring.

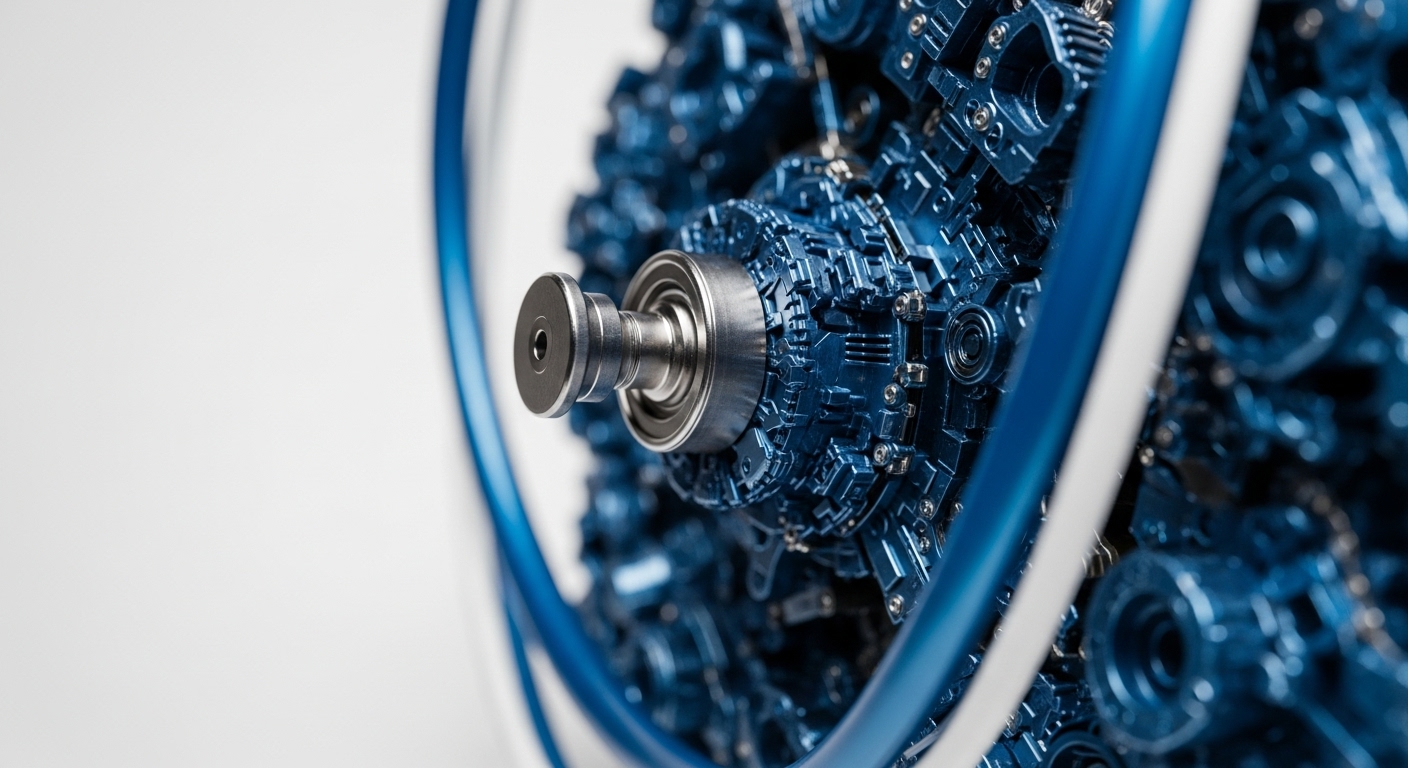

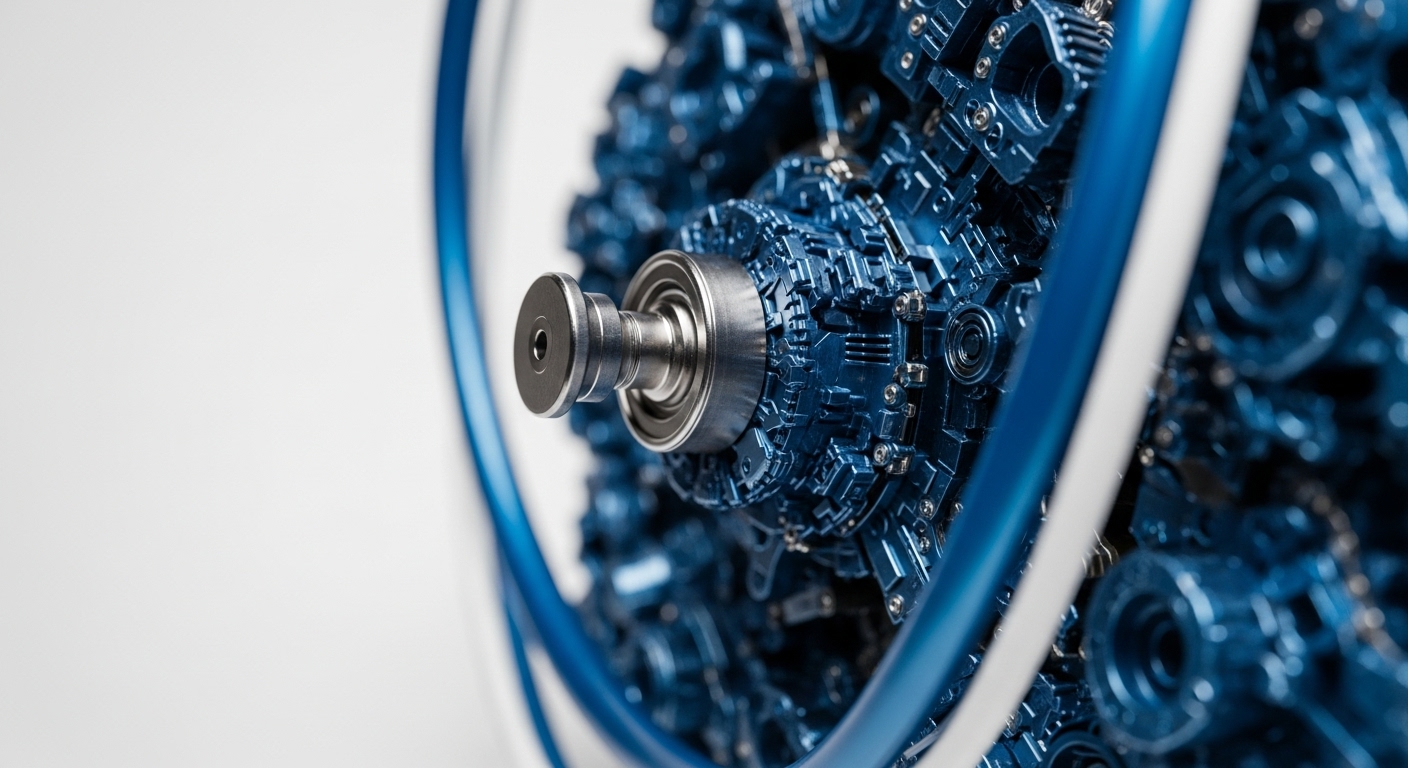

Mutuum Finance Launches Dual-Market Lending Protocol to Optimize DeFi Capital Efficiency

The blended P2C and P2P model creates isolated risk tranches, enhancing capital efficiency for blue-chip assets while enabling long-tail token flexibility.