Balancer Protocol Drained Exploiting Rounding Logic Flaw and Batch Swaps

A sophisticated BatchSwap and rounding error exploit in Stable Pools allowed for asset draining, underscoring systemic risk in complex DeFi logic.

Balancer V2 Pools Drained Exploiting Precision Rounding Arithmetic Flaw

The compounding of minor arithmetic rounding errors in `batchSwap` logic enabled systematic invariant manipulation, compromising over $120M in pool liquidity.

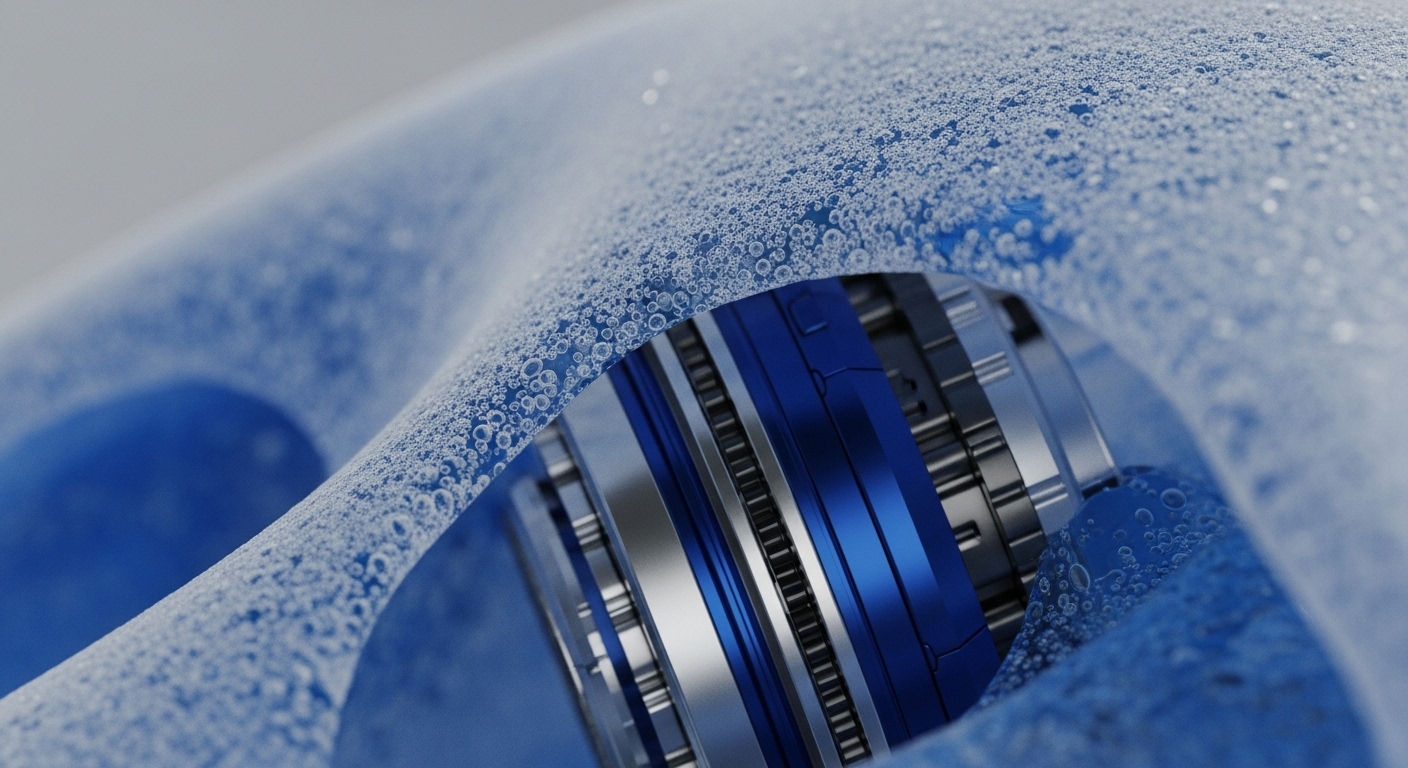

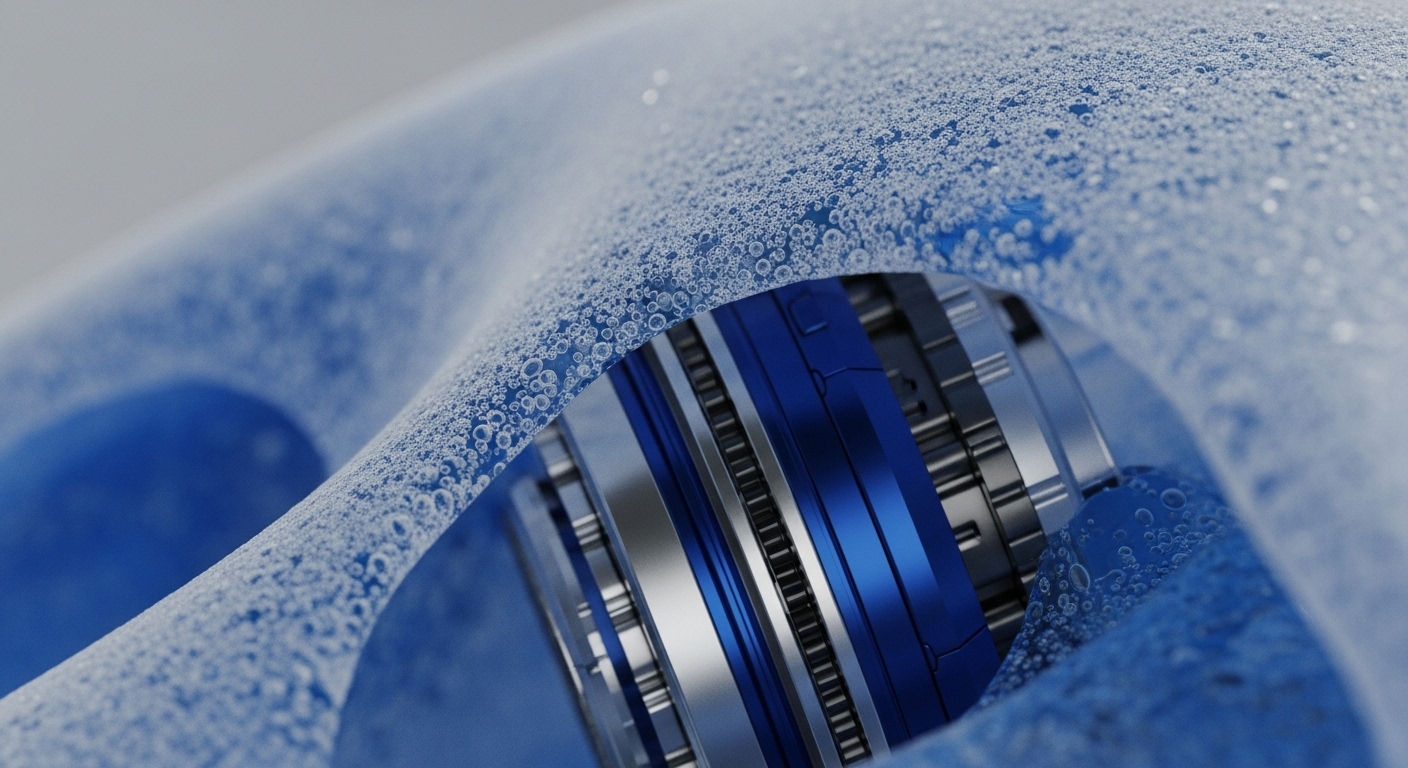

Decentralized Exchange Bunni Drained $8.4 Million Exploiting Custom Liquidity Logic

Custom liquidity distribution functions with subtle rounding errors create critical arithmetic vulnerabilities that enable catastrophic flash-loan exploits.

DeFi Protocol USPD Drained by Hidden Proxy Contract Admin Key Compromise

A compromised proxy initialization allowed a threat actor to plant a malicious implementation for a delayed, seven-figure asset drain.

Balancer V2 Stable Pools Drained Exploiting Compounded Precision Rounding Flaw

A catastrophic arithmetic precision flaw in ComposableStablePools allowed batch-swap manipulation, enabling the systematic draining of $128M in liquidity.

Legacy Yearn Pool Drained Exploiting Infinite Token Minting Flaw

A logic flaw in the legacy stableswap mint function enabled infinite token issuance, creating a systemic risk for all integrated liquidity pools.

Stablecoin Protocol Drained via Compromised Proxy Implementation Attack

A deployment-phase flaw allowed an attacker to seize proxy admin rights, enabling unauthorized token minting and a $1M liquidity drain.

DeFi Protocol UwU Lend Drained by Flash Loan Oracle Manipulation

The protocol's oracle design, which lacked price smoothing and relied on manipulable low-liquidity pools, enabled a $4 billion flash loan attack.

Cetus Protocol Drained $260 Million via Spoof Token Smart Contract Flaw

The DEX liquidity pool logic was exploited by a pricing vulnerability, allowing a spoof-token attack to drain assets and trigger a chain-wide crisis.