Deutsche Börse and Kraken Form Strategic Partnership to Unify Digital Markets

The collaboration creates a unified institutional access layer for tokenized assets, custody, and trading, significantly reducing market fragmentation and counterparty friction.

CME Launches Bitcoin Volatility Index for Enhanced Market Tools

CME Group introduced a new Bitcoin Volatility Index, providing institutional traders with a vital tool to measure market uncertainty and manage risk.

RWA Platform OpenEden Secures Funding to Scale Tokenized US Treasuries

This strategic capital infusion accelerates the integration of compliant, yield-bearing US Treasuries into decentralized finance, creating a critical on-chain liquidity bridge for institutional cash management.

Swiss Banks Achieve Near-Real-Time Fiat Settlement Using Google Cloud DLT

This DLT integration with core banking systems enables compliant, 24/7 near-instant settlement, dramatically reducing counterparty and liquidity risk.

HKMA Mandates Licensing and Strict Reserve Requirements for Stablecoin Issuers

The Hong Kong Monetary Authority established a high-bar licensing regime for fiat-referenced stablecoins, mandating robust capital and asset segregation to mitigate systemic risk.

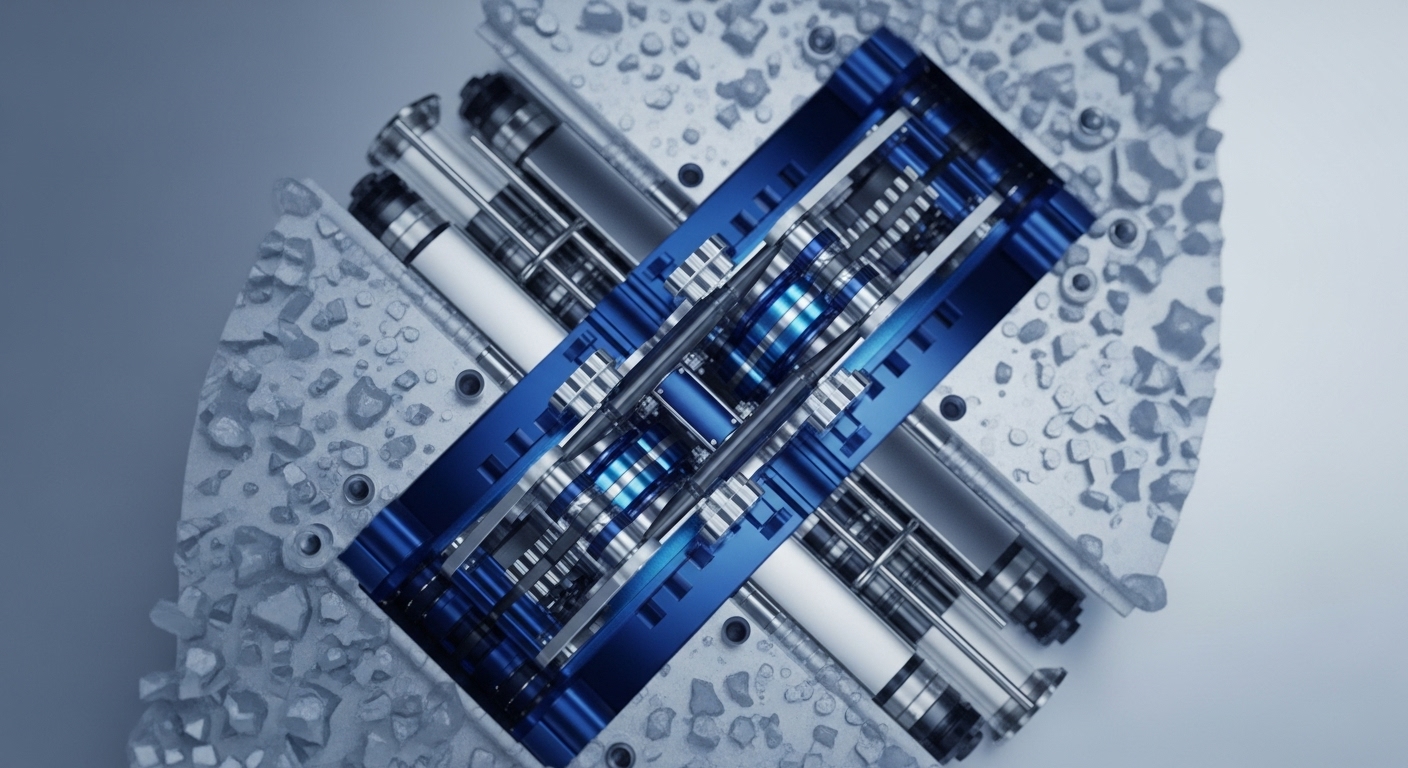

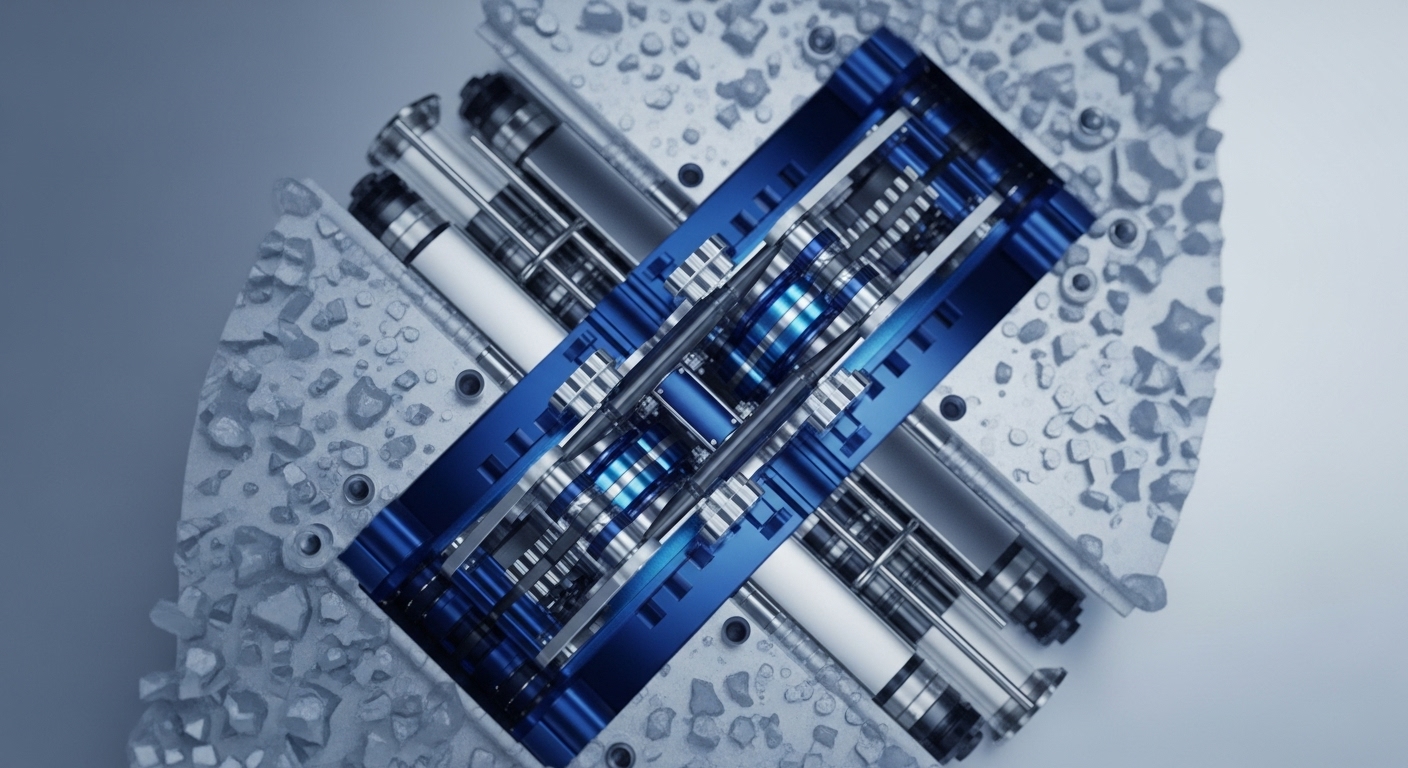

Broadridge DLT Platform Scales Institutional Repo Settlement to $385 Billion Daily

Integrating DLT for repurchase agreements dramatically enhances capital efficiency, reducing counterparty risk and optimizing liquidity management for institutional treasuries.

CNMV Authorizes First EU DLT Trading and Settlement System Operation

This landmark EU DLT Pilot Regime approval establishes the operational blueprint for tokenized securities, merging MTF and CSD functions into a single, regulated digital framework.

CME Halts Crypto Futures Trading amid System Failure

A technical malfunction at the CME Group's data center has suspended trading for major crypto futures, signaling potential market volatility.

CME Trading Halted Due to Data Center Failure, Impacting Crypto Futures

A critical technical issue at a major data center has unexpectedly suspended trading across CME Group markets, directly affecting Bitcoin, Ethereum, and Solana futures.