Uniswap V4 Launches Continuous Clearing Auctions for Fair Token Price Discovery

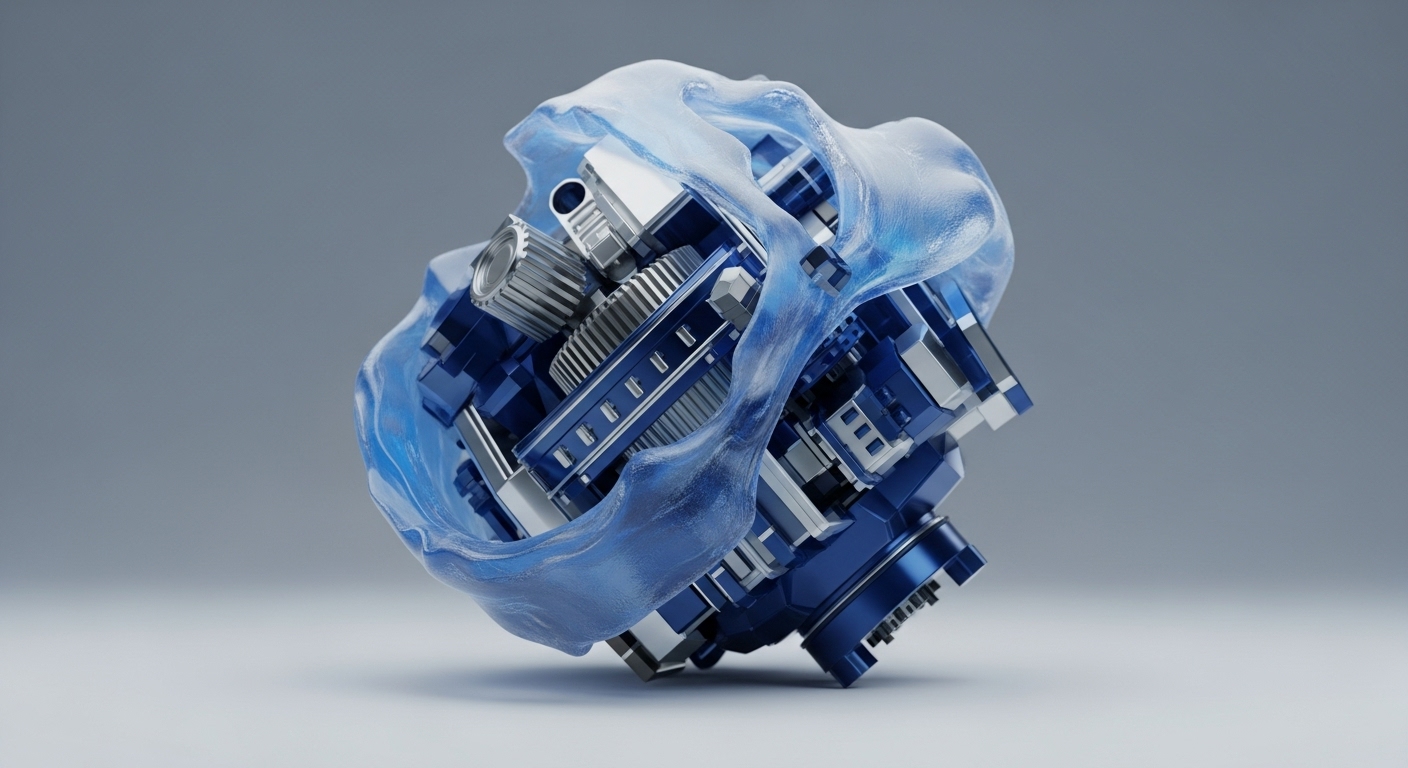

The Continuous Clearing Auction mechanism automates fair price discovery and liquidity provisioning, fundamentally re-architecting the capital formation flywheel for new DeFi assets.

Decentralized Exchange Vault Drained by Intentional Liquidity Manipulation Attack

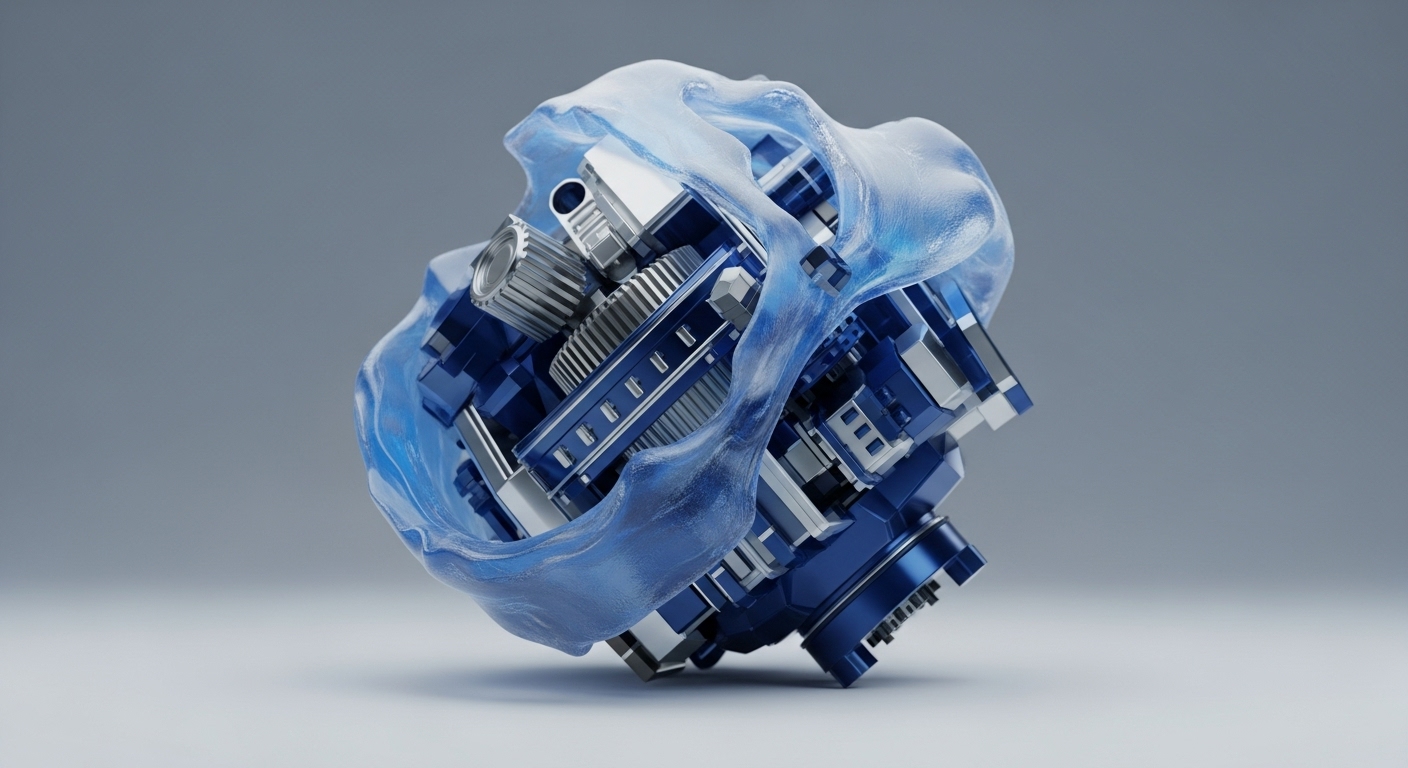

The HLP vault's automated liquidation logic was weaponized by a synthetic volatility event, exposing a critical design flaw in low-liquidity asset risk control.

Perpetual DEX Volume Surges past Trillion Dollar Mark, Redefining Derivatives Market

High-throughput perpetual DEXs surpassed $1.43T in monthly volume, validating specialized app-chain and Layer 2 architectures as the future of on-chain derivatives.

On-Chain Exchanges: Fair Trading Design over Speed Advantage

Many decentralized exchanges allow market makers to cancel trades last-second, creating an unfair advantage that costs users.