Sierra Protocol Launches Dynamically Rebalancing Liquid Yield Token on Avalanche

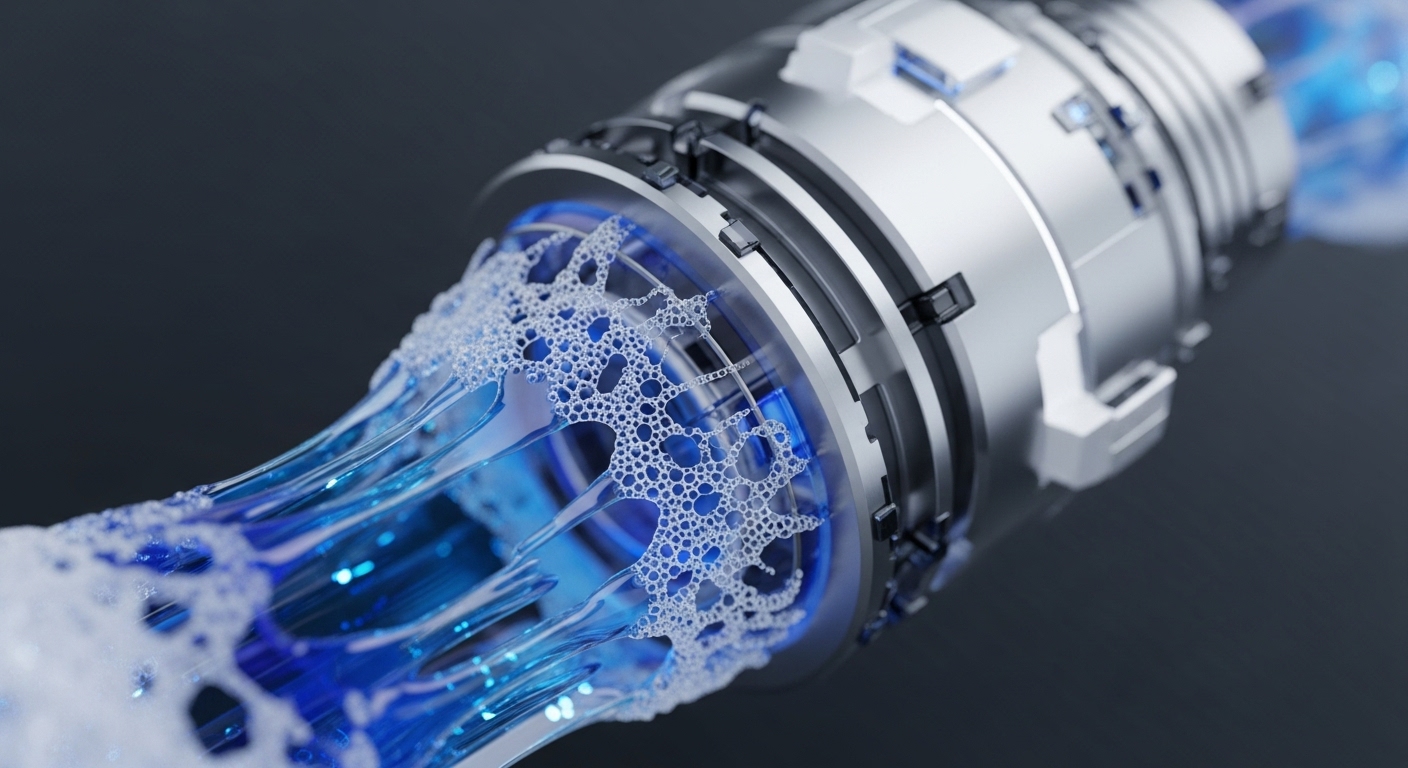

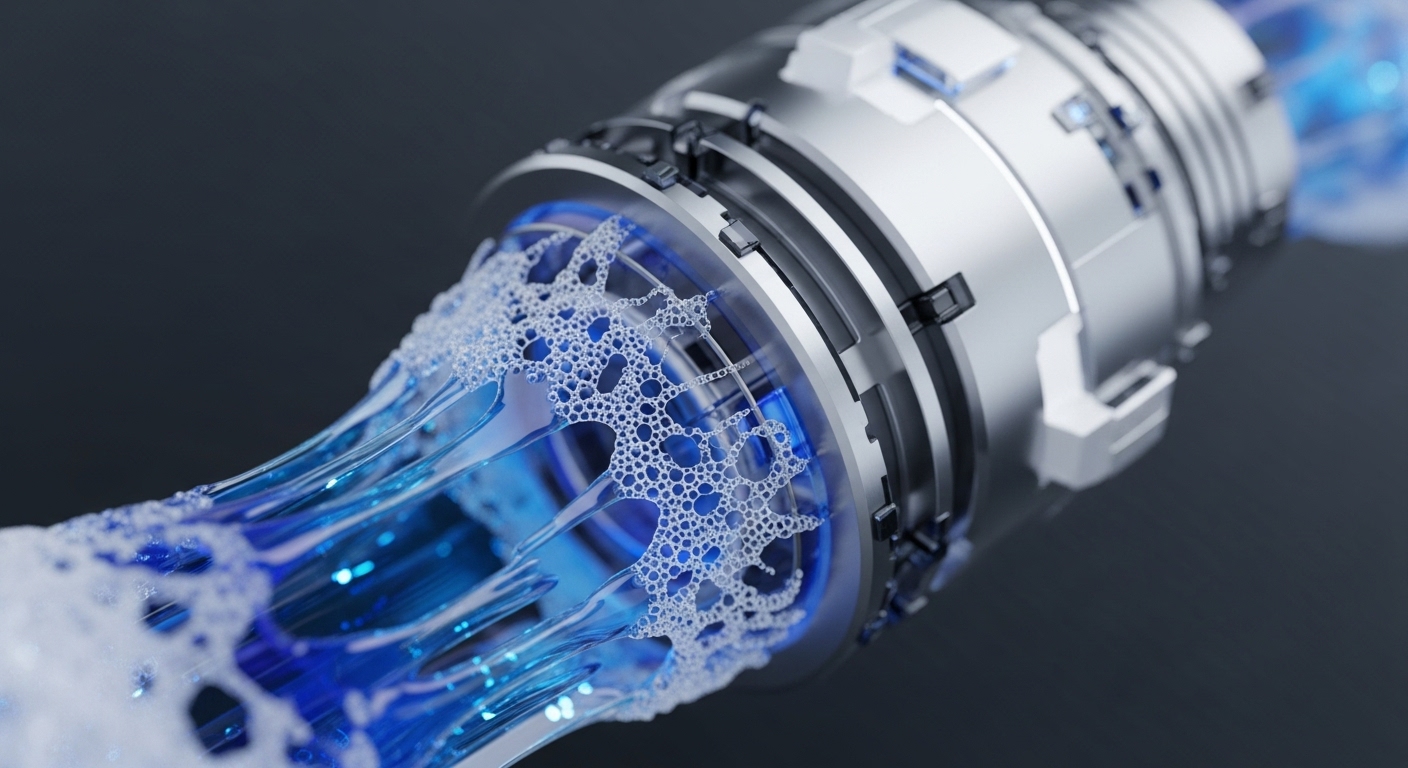

The new LYT architecture abstracts yield complexity, blending institutional RWA and DeFi primitives to create a capital-efficient, composable asset.

Sierra Protocol Launches Dynamically Rebalancing Liquid Yield Token on Avalanche Network

The new Liquid Yield Token architecture dynamically blends institutional RWA with DeFi yield, establishing a superior, capital-efficient primitive for permissionless stablecoin liquidity.

SEGG Media Launches $300 Million Corporate Treasury and Sports Tokenization Strategy

The $300M program establishes a dual-engine model: validator-based treasury yield provides capital efficiency for new tokenized IP revenue streams.