Nasdaq Signals Intent to Tokenize Equities for Onchain Capital Markets

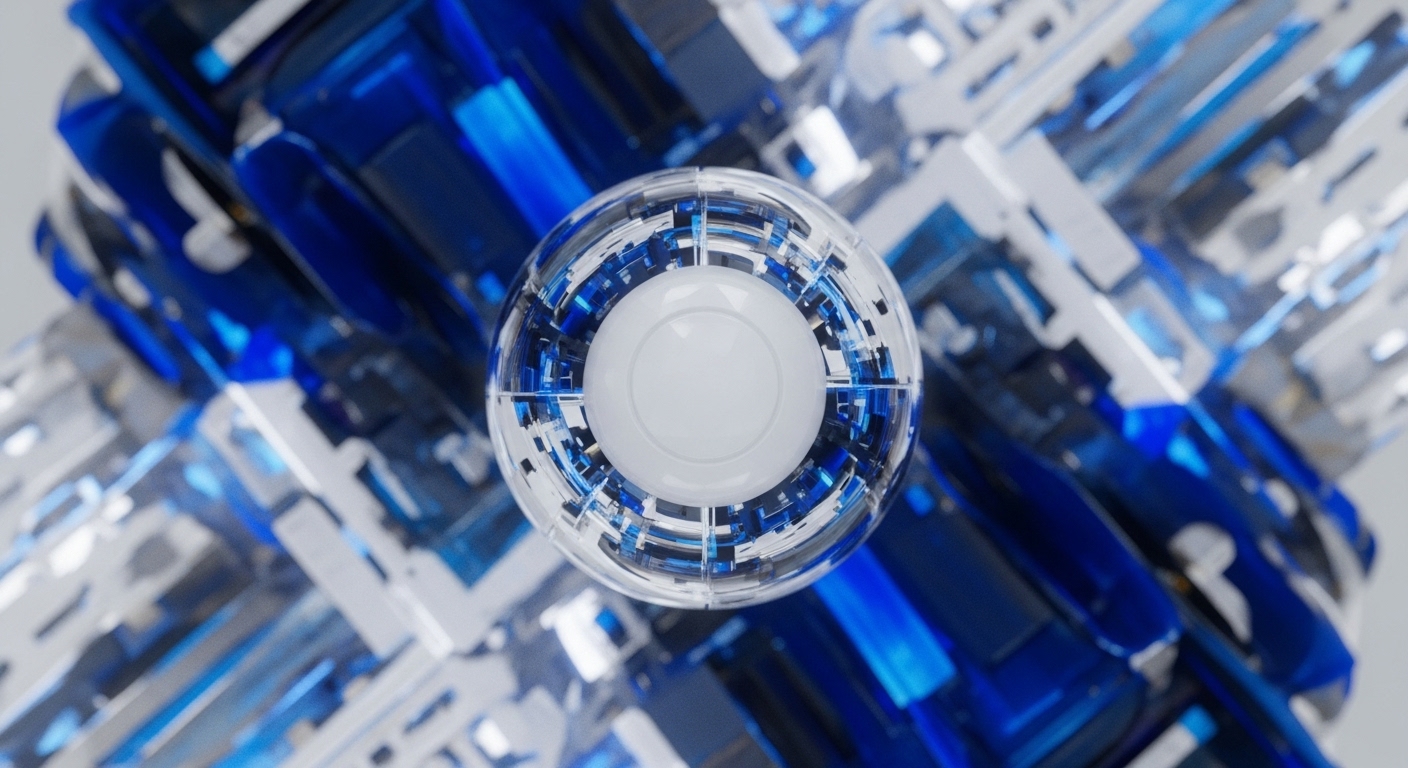

Nasdaq's strategic move to tokenize equities directly addresses legacy settlement inefficiencies, establishing a critical bridge between traditional finance and decentralized capital markets for enhanced liquidity and accessibility.