DSCVR AI Launches Prediction Aggregation Layer Unifying Fragmented Global Forecasting Markets

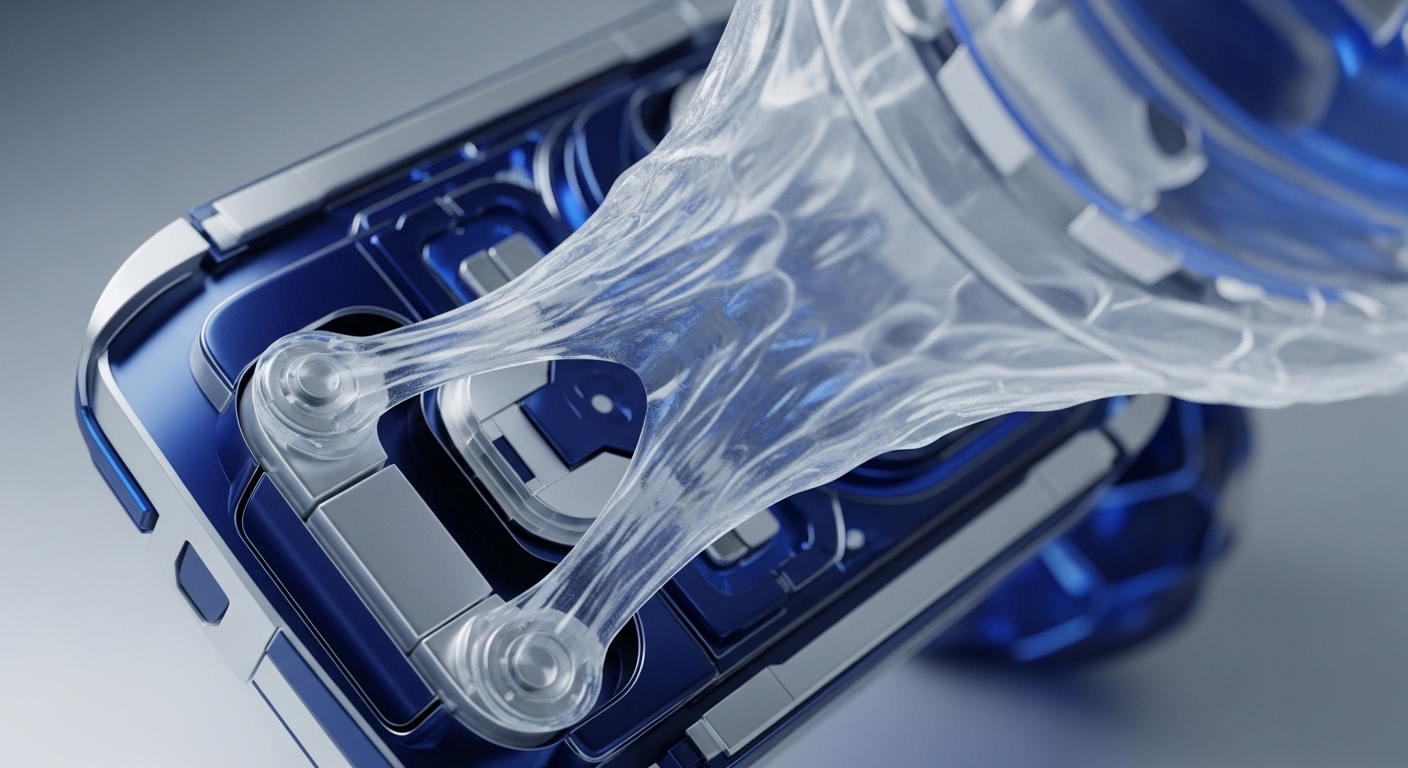

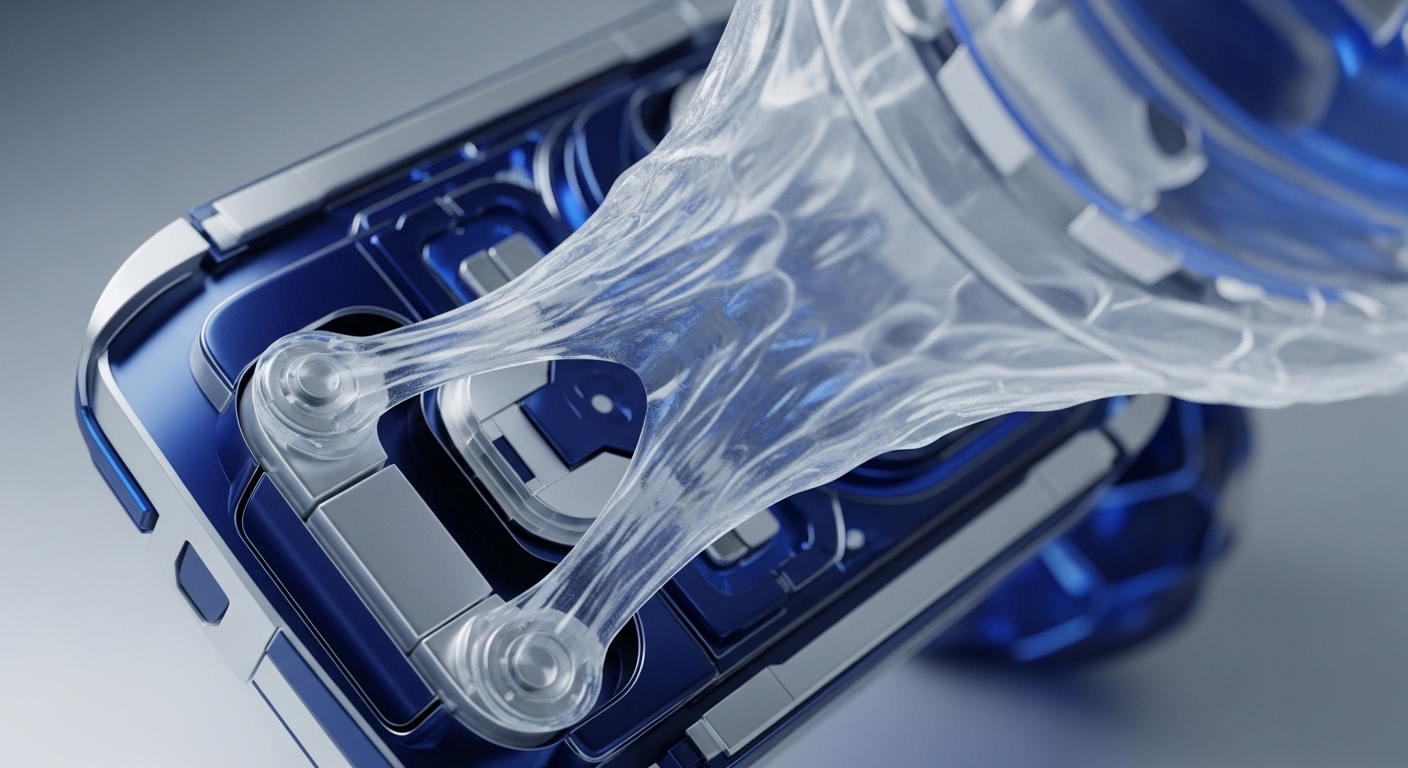

The new AI-driven aggregation layer abstracts multi-market data and liquidity, fundamentally improving capital efficiency and price discovery in the prediction market vertical.

Oracle Failure and Access Flaws Trigger $129 Million Multi-Chain DeFi Loss

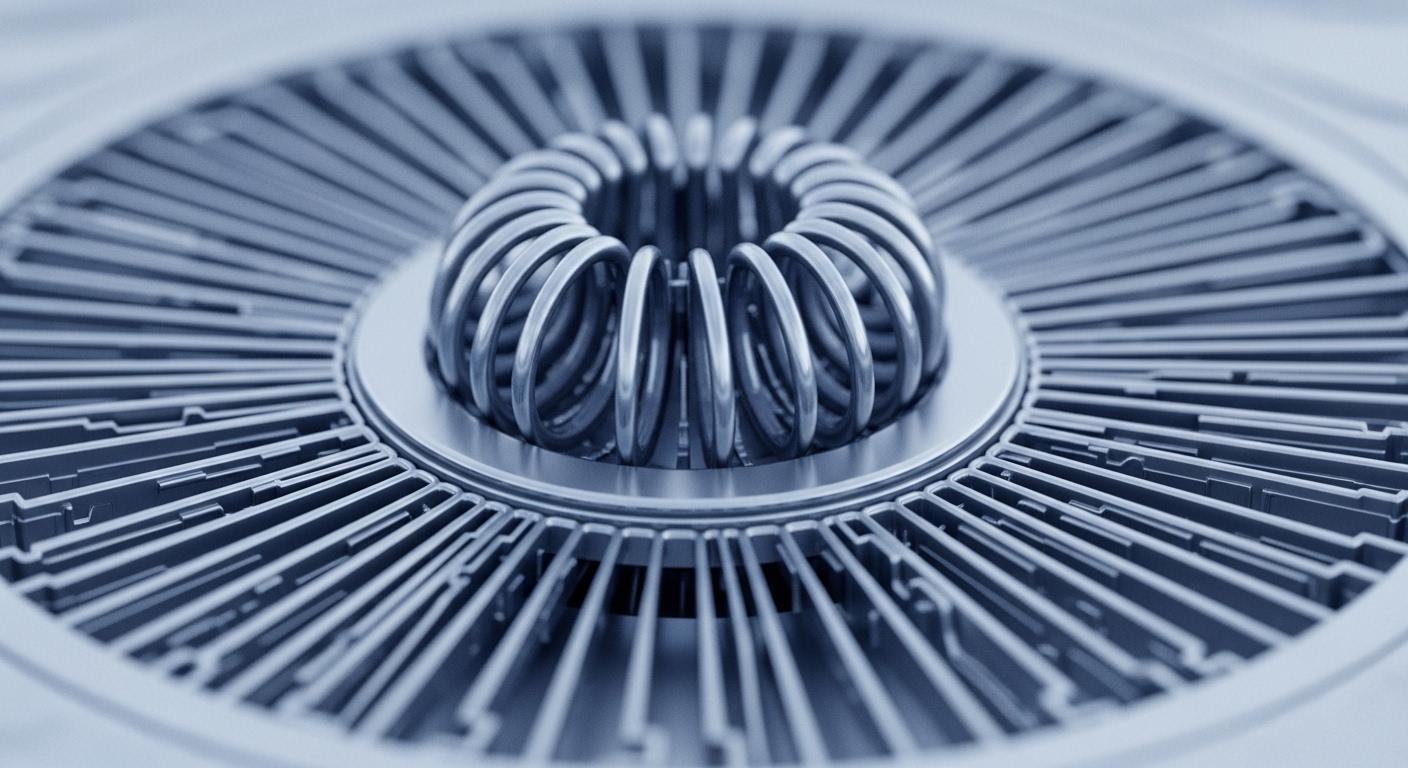

The $129M loss from oracle and access control exploits exposes critical systemic infrastructure risks, demanding a re-evaluation of multi-chain security primitives.

NYSE Owner ICE Partners with Polymarket to Distribute On-Chain Prediction Data

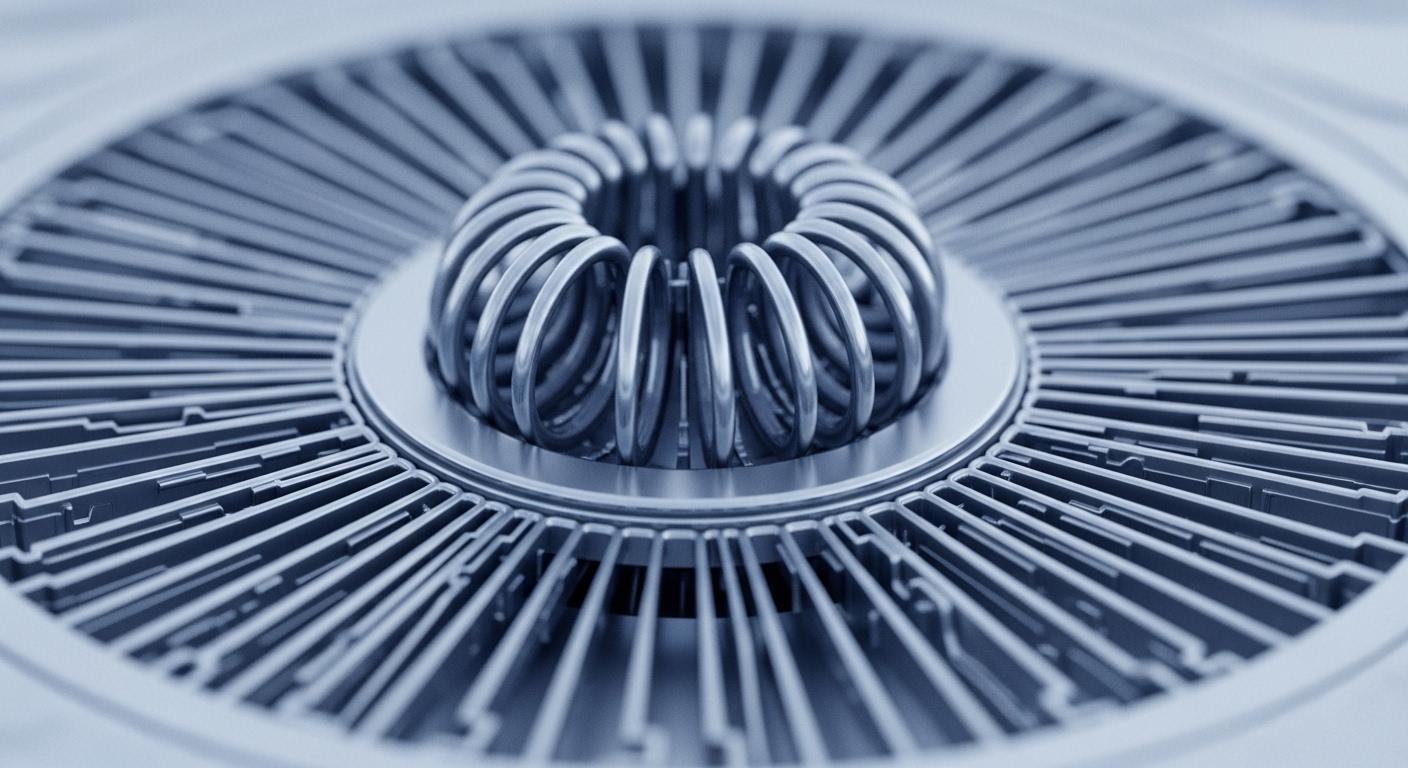

The ICE/Polymarket data partnership validates on-chain prediction markets as a new institutional-grade truth source for macro risk modeling.